Our colleague Mish Shedlock did quite a hatchet job on hyperinflationist Peter Schiff the other day – much of it deserved, if the evidence that Mish presented is to be believed. The two have never seen eye to eye, since Mish, like us, is an unreconstructed deflationist. But his indictments against Schiff have less to do with the Inflation vs. Hyperinflation argument than with allegations that Schiff’s actual performance as an investment advisor has not been so stellar as one might have inferred from his high-profile exposure as a doomsdayer. Mish says that while Schiff has been essentially correct about doomsday, his actual investment portfolio got the details completely wrong, especially in its short-dollar orientation. (The same could probably be said of another world-class self-promoter, Jimmy Rogers.)

Our colleague Mish Shedlock did quite a hatchet job on hyperinflationist Peter Schiff the other day – much of it deserved, if the evidence that Mish presented is to be believed. The two have never seen eye to eye, since Mish, like us, is an unreconstructed deflationist. But his indictments against Schiff have less to do with the Inflation vs. Hyperinflation argument than with allegations that Schiff’s actual performance as an investment advisor has not been so stellar as one might have inferred from his high-profile exposure as a doomsdayer. Mish says that while Schiff has been essentially correct about doomsday, his actual investment portfolio got the details completely wrong, especially in its short-dollar orientation. (The same could probably be said of another world-class self-promoter, Jimmy Rogers.)

We won’t go into Mish’s case against Schiff, since it is quite detailed and can speak for itself. (You can access it at your leisure by clicking on the link at the bottom of this commentary.) However, we would like to say a few things about hyperinflation, since, on this score, we think Schiff got it right. He believes that the Fed, having explicitly committed itself to holding interest rates down by purchasing unlimited quantities of Treasury debt, has put the U.S. on a hyperinflationary course. We agree. In fact, and as we noted in an earlier commentary here, Schiff has laid out such a strong case that it is hard to see how he could be wrong. That said, however, we stand solidly with Mish, who notes: “I called for deflation and it is here right now. I do not have to wait for it. The only debate is how long it lasts.”

Hey, Bozo!

We have been calling for deflation ourselves since the early 1990s – in fact had the topic entirely to ourselves for many years in writing about it for Barron’s, The San Francisco Examiner and other mainstream publications. During that time, we had just one question for inflationists: “What the heck are you smoking, bozo?” We even stopped responding to one well-known inflationist’s calls for debate, since we believed that anyone who took that side of the argument did not know his ass from his elbow. But there came a time when we had to acknowledge that any issue that could fool the World’s Smartest Economist, Gary North, was trickier than it seemed on the surface.

As indeed it was. For here were the world’s central banks, pumping like crazy; and yet, none of the asset inflation they had hoped to catalyze occurred. In fact, the opposite obtains: real estate values continue to sink, and financial assets remain on life support. We believe, as Mish evidently does, that this will continue for at least a few more years. One reason we see deflation dragging on for so long is that Obama, in his approach to “saving” the economy, is using fiscal, rather than monetary, stimulus. That is like using gunpowder instead of fissionable uranium. Not that uranium would have worked anyway, since money velocity is too, too dead – and will remain so for at least another 30 years — to bring banking reserves to an inflationary boil. In the end, we have no serious disagreements with Mish, although we do think that Schiff’s hyperinflationary scenario absolutely must play out at some point.

Obama’s Non-Choice

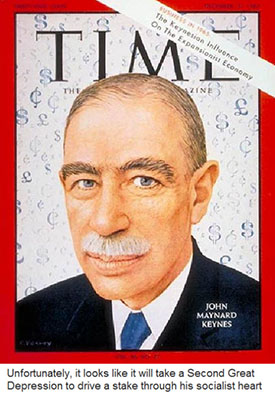

Meanwhile, for reasons that we have spelled out here before, Obama’s nostrums do not have even the remotest chance of success. Perhaps in a decade, when they are seen to have failed conclusively, Keynes will finally be buried forever, a stake through his heart. We would have thought the experience of the 1930s was clear enough to refute Keynesian quackery forever. In any case, urgency and expediency have impelled Obama’s WPA plan forward, and it is politically understandable why neither he nor his advisors has taken the only possible route that would guarantee success – i.e., letting the banks fail (and doing away with the Federal Reserve while this golden opportunity presents itself).

With the economy certain to keep sinking, those who have been hoarding gold have less to fear than investors who have diversified, since clarity has finally come to the Inflation/Deflation question. Whichever side of the debate one took, there was broad agreement about the end result: a Second Great Depression. We are very nearly there now, and nothing can stop it. But there is no longer uncertainty about how well gold might perform, since, as anyone can see, gold has done brilliantly in the midst of a global asset collapse. If the tide should turn, and hyperinflation plays out, it seems highly unlikely that gold would fare any worse, relatively speaking, than it has in these deflationary times. (If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.) And here’s the link to Mish’s exposé.

>> See what you’ve been missing: Get a free one week trial of Rick’s Picks.

Rick

You have not really read my post. Or you have deliberately, for your own motives, ignored the main point.

Obama, is no different in position than any other president – and I mean any other.

He was not put there to be his own man. He was not put there by the American people. It was a set up, as they all are.

Now I can understand that in your position you are not able to agree ‘openly’, but if you do not really see, then there is little further to be said.

It really is no secret. In fact they even want us to know – they have told us time and again, and shown us. You see, they know we can do nothing about it.

Forget Ron Paul, he hasn;t a cat in hell’s chance. He would not get to first base.

The only man who could have changed things, if there had ever been the remotest possibility, was Kennedy, along with his brother.

Kennedy should have known better. He was a true blue 100 percent American, but with that bull headed fighting Irish devil may care attitude which is a trait

of the Irish, and Scots. Remember ‘Brave Heart’ the story of William Wallace.

Kennedy played along with the dark forces when he was in the running. He led them to believe he was their man. That is, until he got in with their help, or at least without their hindersance. Then, once installed, he failed to read and act from the script. He was hell bent on kicking them all where it hurts.

Why did he ride around in an open car, and in Dallas.? When asked, he said that if the only force who could assassinate a president, wanted to get him, an armoured car would not protect him. He knew the score, but had banked on the working with his brother to expose the corruption, and the evil, working beneath before they got to him. He had that Gaelic blood he shared with so many warriors of lost causes.

They assassinated the two brothers, killed his son, and ensured the other brother became a vegetable brain. Or, perhaps it was all coincidence. There are more coincidence theorists, than conspiracy ones – many, many, more, a world full.

This is nothing new. You play by their rules, or you don’t play at all. There are many ways, not always assassination that they get you out of their way if you cross them.

Don’t take just my word for it. Benjamin Disraeli the Prime Minister of Great Britain at the height of her power, when her navy literally ruled the waves and she built the largest Empire the world had known. The British pound was the reserve currency, and her army was straddling the globe assisted by no one, he wrote in clear, concise terms – This world is governed by far different personages than is imagined by those not on the inside (‘Conningsby’ published in 1842)

He was a highly educated man from a powerful Jewish background. But what he was saying was, that in spite of his position of power in the most powerful nation in the world at that time – there was another power behind the scenes. He could afford to say it. few would understand, and those who did could do nothing about it.

Now, you believe what you want, Rick. I listen to the people who know when they try to open my eyes to see the light.

What they have told me, and there have been others – all fits.

Your ideas of Obama et al do NOT fit. Their actions confound you because you fail to see.

Take your pot shots at me. I will not back down. The evidence is far too well stacked.

The most wonderful thing about this is that nothing baffles you anymore. You can see the picture and where all the pieces fit. And you can use it to advantage.

There are now, and there are going to be many more fantastic opportunities to make serious money. But most will not as they are kept in fear, and they are confounded because nothing, to them, seems to fit with the perceptions to which they have been mind conditioned.

Have fun, we are living in a wonderful age.