And now we learn that Standard & Poor’s, the same unprincipled hacks whose grossly inflated triple-A ratings made America’s real estate boom and still-busting bust possible, has downgraded the USA itself. Or to be more precise, their long-term outlook fell from “stable” to “negative” – a Kremlinesque way of hinting that an actual downgrade from AAA is possible if the U.S. doesn’t get its fiscal house in order (as though that were even possible, given that the Federal debt is $14.3 trillion and climbing, and that the economy is on a permanent respirator). And whose payroll is S&P on, we wonder? Until yesterday, we thought they were so busy putting the screws to Europe’s financial cripples that there wasn’t time or manpower enough to pore over America’s books. Now, it would appear, they’ve found actual fiscal problems to worry about even if the real worries eupted like Vesuvius three years ago. And another thing: Whenever they slam the PIIGS by taking their credit ratings down a peg or two, it is usually to buoy the U.S. dollar that day so that Little Timmy Geithner’s pep talk at some Rotary Club luncheon gets good press. Whatever the reason for yesterday’s downgrade – about as shocking to millions of Americans as the revelation that Liberace was gay – it was fun to watch the bond market react.

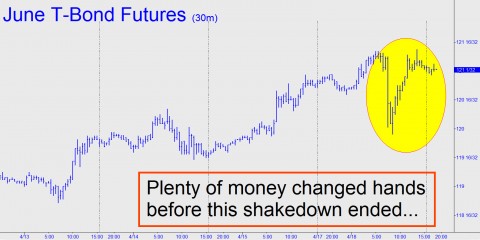

Or rather, to not react. T-Bond futures ended the day down a few measly ticks, although the obligatory swoon on the “news” allowed predators who live off such volatility to shake down the rubes. The June contract plummeted more than a point-and-a-quarter on the opening bar, then spent the rest of the day making fools of those who had bailed out at the lows. Nice to see the bonds acting conflicted for a change. On the one hand, USA Inc. took one small step toward its inevitable bankruptcy. On the other, the weak economic outlook prevented bonds from sinking on inversely rising yields. Doubtless, those who bought did so with a quick-exit strategy in mind.

Gold, Silver Swoon Too

The quasi-criminal shakedown wasn’t limited to the Bond pits either. Gold and Silver both took a flying dive for no particular reason – other, perhaps, than a fleeting lack of demand as traders tried to figure out what it all meant. The answer to that question being “nothing,” bullion quotes soon recovered even more sharply than Treasury debt when it was realized that Standard & Poor’s tasteless publicity stunt had laid an egg. For our part, we held an existing position in Silver Wheaton over the four hours that it took for the hysteria to run its course. Although the stock swung more than $4 yesterday to close down $1, we’re not convinced that silver bulls are out of the woods. Actually, we’d been looking to short silver ETFs on the opening, and although the rally spike on the opening bar missed our offer by pennies, we might be tempted to try again on Tuesday. On the bullish side, June Gold still has a ways to go before it bumps into any Hidden Pivots that look capable of briefly reversing the tide. If you’re interested in our precise targets for Comex Gold (and Silver) but don’t subscribe to Rick’s Picks, try a risk-free seven-day trial by clicking here.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Terry, don’t feel discouraged by what I wrote or read too much into the comments from the wrong perspective. I still firmly believe we are in a long-run commodity super-cycle that will go on for many years longer.

I also anticipate gold to reach newer highs eventually too and have long predicted a minimum price of 2500 dollars although that may be a conservative estimate these days.

My comments were related to what I see as a medium term trend change and I apologize for not having stated that unequivocally. I just have to know when to draw the line when writing and not take too much space and I make assumptions that others already understand that what we are discussing is an event that veers from the anticipated course and is something we need to acknowledge in order to avoid losing money while that trend is in progress.

The bare idea that the dollar might appreciate on Euro weakness is not really all that radical and it has in fact happened many times before. We should always expect that market changes will not flow evenly in one single direction until an end arrives. Indeed, they rarely do.

So don’t worry too much. I have not become a recovery(ist) exactly and I still share the concerns of most that debt levels are really excessive and climbing while monetization is a significant concern we need to keep our eye on.

Background overseas events will keep us very busy trying to stay focussed though. That is what we are now seeing as the advent of an electoral backlash against the bailout of failed nations comes to the surface. This is a major concern if you speculate in currencies.

It is, in fact, a game changer for the moment.