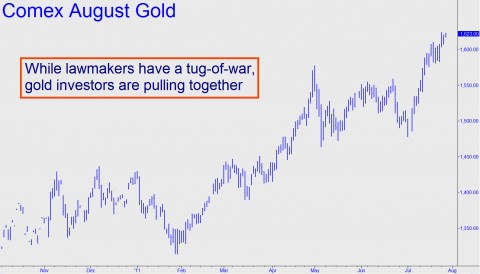

Our elected leaders need only look at the chart below to see how the budget stalemate will turn out. Gold has been rising at an exceedingly steep pitch since early July, implying that whatever deal emerges from the sausage factory on Capitol Hill, it will not much affect the ongoing destruction of the dollar that began in earnest in 1913 with the creation of the Federal Reserve System. The Fed, as we know, was charged with conducting monetary policy and supervising the banking system. However, events of the last few years have allowed the central bank’s directors to expand its mandate to….as Buzz Lightyear would put it, infinity and beyond. The dire implications of this for the U.S. dollar have not been lost on bullion investors and traders, even if conventional thinking would deign to suggest that precious-metal prices have come too far, too fast. But compared to what? Over the last decade, bullion has outperformed just about every asset class you can name. The fact that it is now moving away from the pack of investment also-rans suggests not that buyers have run amok, but that the destruction of the dollar has entered a new and perhaps cataclysmic phase. What will replace the dollar when it utterly fails, as it must? Although gold may not pass political muster right now as America’s and the world’s next choice for money, no one can be certain that it won’t be drafted into the role. After all, how many tried and true alternatives are there?

In the meantime, we think the bull market has barely gotten started and that penny stocks that have languished for years will trade at ten or perhaps even a hundred times their current values before the bull has run its course. We’re so confident about this that we touted a junior mining stock to our 91-year-old mother the other day. (Click here for a free trial subscription to Rick’s Picks if you want to know the name of this stock and why we like it. It sells for under $2, by the way.) She had tuned out our investment counsel 30 years ago after a covered write we’d advised caused her Loew’s Corp. shares to be called away. Then, two years ago this August, when she mentioned in a phone conversation that she had a few investment dollars to spare for something more speculative than the usual blue chip stocks, we leaped at the chance to put her into some promising mining stocks. Our picks were Goldcorp (NYSE Symbol: GG) and Detour Gold (OTC Symbol: DRGDF). The latter was a favorite of gold consultant Chuck Cohen, whose wisdom has been featured here many times. When we asked him for ideas, we made clear that this particular selection had to be a sure thing. Of course, there are no sure things in the investment world, but as anyone who has followed either of those stocks will know, things worked out great for Mom nonetheless. We got her out of the stocks near the May top, and so she’ll be playing with the house’s money, so to speak, if she decides to take another plunge.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Rick, whats your basis for more bull run? Is it more QE and inflation as your reasoning. Without those factors, the DOW seems overvalued.