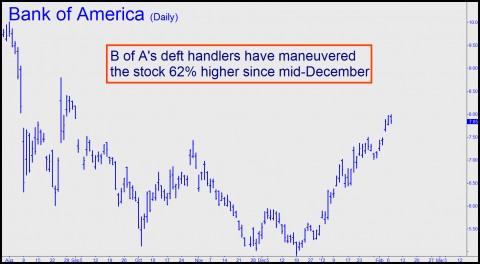

The stock market hasn’t been much fun to trade in a while, but that could change today as the broad averages approach some potentially important rally targets of ours. Want to know exactly where these targets lie but don’t subscribe? Click here for a free trial subscription that will give you access to our proprietary numbers. One of them foresaw a 600-point rally in the Dow that is nearly complete. The other is a bullish target for the E-Mini S&Ps that smacked us in the eye yesterday with its clarity. There are also two bank stocks whose deft handlers appear to be setting up suckers for the kill. These financial biggies are household names, but because they are in the thick of Europe’s bailout hoax, they are destined to go down with the ship. Under the circumstances, the hysterical, short-squeeze rallies that have driven their shares steeply higher may be ready to seven-out.

We’ve been itching for months to find a good place to short this market. As many of you who trade will already know, except for a delightful, breath-of-spring plunge in late October/early November, it’s been a tiresome, uphill slog for patient bears. Now, although we can’t guarantee that the Hidden Pivot targets about to be hit are going to stop the bull dead in its tracks, we’re optimistic that they will provide an exceptional opportunity to get short. There are umpteen ways to do this, but we’ll probably concentrate on index futures and put options on certain equity trading vehicles. If you’re not familiar with the “camouflage” technique we use to help alleviate the stress of initiating a trade, you may be surprised at how easy it is.

‘Unmained’

This won’t be the first time we’ve laid out shorts in a market that was steaming relentlessly higher. Although the odds will always be against trying to catch the Mother of All Tops exactly, Rick’s Picks subscribers know that it’s possible to at least attempt it without getting maimed. Or even dinged. However, because we are wary of the watched-pot phenomenon, we will not divulge our specific rally targets in this commentary. We also don’t want to jinx the numbers by drum-rolling them too loudly. But if you’re interested in seeing how close we actually get to calling a/the top, simply click on the link above for a no-risk trial to Rick’s Picks. You’ll have access to all of our services and features, including a 24/7 chat room that draws traders from around the world.

***

(If you’d like to have these commentaries delivered free each day to your e-mail box, click here.)

I think your right Rick … if an agreement can’t be reached with private fund managers that hold a substantial amount of “insured” Greek debt … and Greece defaults … the five biggest banks in America who must pay out on a Greek default will be bankrupted … bank stocks will likely fall until Bernanke steps in and again bails out the banks.

One can play this by selling bank stocks short until Bernanke comes to the rescue … and additionally by buying gold as Bernanke responds with massive fiat money creation to help his bankster buddies once again.