Can anyone remember when Apple shares were trading for around four bucks? We can, because at the time, in 1997, we were so certain the company was headed for oblivion that we made it the subject of the weekly column we wrote for the Sunday San Francisco Examiner. Back then, it looked as though Apple had finally lost the battle for market share to Microsoft. This, despite the fact that Macs were superior to PCs in nearly every way save cost and, almost fatally, software development. Even though Macs were the computer of choice outside of the workplace, and although students and users in creative fields were particularly loyal to the brand, by late 1997 Apple’s market share had slipped below 4 percent, down from 7 percent a year earlier. This placed the company eighth among U.S. computer manufacturers. “Think Different” was the company’s slogan then, but unless they did some out-of-the-box thinking themselves, there would be no future.

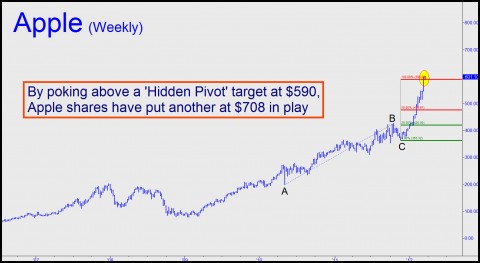

Fast forward to today. Amid a swell of hubris on the announcement of a $2.65 quarterly dividend and a $10 billion stock buy-back plan, Apple shares finally cracked $600. A $5,000 investment in 1997 would be worth $750,000 today. We should have realized the company was bottoming when we were deluged with hate mail in the days after the Examiner column ran. Hell hath no fury, evidently, like a Mac user scorned. While our essays ordinarily elicited no more than three or four dozen responses, this time hundreds of letters and e-mails poured in. The milder ones merely assailed us for being blind to the Mac’s many virtues. But quite a few implied that we’d burn in hell, or worse, for merely doubting that Apple would survive. Who could doubt they would with so many hard-core fans ready to come to the company’s defense?

Bucking Mediocrity

It wasn’t just computer users who were willing to fight to keep the Sunnyvale firm alive. Software developers gave their all as well. We came to know one of them personally in our quest to find a trading platform that had all of the right features. This developer, with just a few employees, managed to keep Apple in the game until he was eventually outgunned by big companies with, collectively, thousands of employees. But the fact that he was able to offer a product that could compete in the major leagues of trading software, and to hang in there for several years, attested to the passion and dedication of all who have kept Apple’s flame burning. The company’s market share now stands at around 11 percent but is likely to grow significantly as more software applications move into the cloud and away from the Windows operating system. Even at $600 a share, our advice would be to buy Apple and short the perennially clueless Microsoft. We should all wish Apple well, since the company has succeeded, and will likely continue to do so, by bucking a tide of mediocrity.

***

(If you’d like to have these commentaries delivered free each day to your e-mail box, click here.)

So, E.M., what are you liking these days?