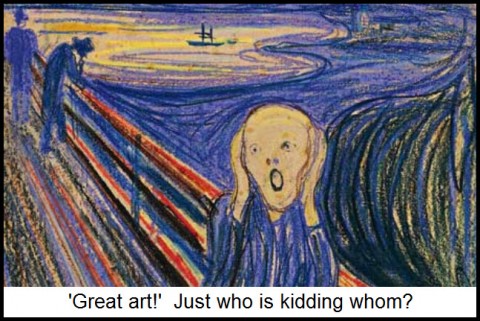

We now know that financier Leon Black was the anonymous bidder who acquired “The Scream” for $120 million at Sotheby’s in May. Although Black is known in art circles as a discerning connoisseur and collector mainly of drawings, in this case his supposed good taste seems to have suffered a lapse. Only a billionaire art collector with an outlandish ego would pay so much for such an atrocious work – one that neither you nor I would hang on a basement wall let alone display where everyone might see it. Black bought Norwegian painter Edvard Munch’s 1893 work simply because it is one of the most recognizable paintings in the world. But if it had been undiscovered and unknown until yesterday, only someone with very peculiar taste or a bizarre sense of humor might have given it a second look at a flea market. If we had bought it ourselves, it would be to give away as a gag gift, or to hang in a bathroom.

This is nothing against Munch, who clearly had “issues.” As we know, more than a few great artists were borderline nuts (although we would not classify Van Gogh as such. The guy had every right to be crazy-angry when his paintings failed to attract even a single buyer). Far be it from us to begrudge the tortured artist the right to exorcise his demons on a canvas. But we – pardon the pun – draw the line at paying good money for the result. We’d rather spend our art dollars on objects of beauty – as why not, since beauty is arguably the only sensual path we have to things spiritual. Black, by paying a fortune for The Scream, seems intent on finding a path to something else. Notoriety, perhaps? Not in the art world. He’s a hero at Sotheby’s, and his friends are probably telling him what a great bargain he got. You and I can do a lot better, though. In all likelihood, many of us know an artist or two far more talented than Munch. Two friends of ours spring to mind, both of them gifted artists who paint beautiful pictures: Debra Oropallo and Geoffrey Leckie. Although neither is undiscovered, their best works can be had for far less than artists collected by the likes of Leon Black.

If you’re interested in art mainly as an investment, though, we’d suggest plowing every penny you can beg, steal or borrow into a Warhol. His art is so closely identified with the visual iconography of this age that it seems assured that it will continue to appreciate for the next thousand years (assuming mankind is still around). But don’t be afraid to buy something else – particularly something beautiful — if it strikes your fancy. Beauty is about as popular in the art world these days as rhyming poetry is in academia. That’s why there are some great bargains to be had. As for Leon Black, if he professes to find something new in The Scream each time he looks at it, that’s just buyer’s remorse living large.

***

Making money in such treacherous markets is going to call for great patience and skill. Click here if you’d like to see how Rick’s Picks approaches this challenge.

HI Rick

I agree with you that this type of art is mainly interesting to investors following investment advice from art dealers. This is really about money, investments and not about good (or relevant) art.

Thanks for the links to your artist friends. Here’s a link to a socially critical exhibition in London (UK): http://www.furtherfield.org/programmes/exhibition/invisible-forces.

The exhibition is full of art pieces that comment and reflect on our lives and frustrations right now – it covers lots of issues that you regularly talk about here. The show is running until mid August, so if you want to invest in Art, I recommend taking a look at this.

thanks, dave