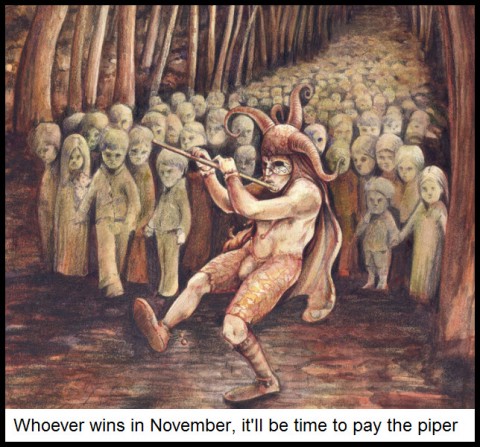

[In his latest report to clients, below, Boulder-based financial adviser Doug Behnfield sees a tough economy ahead no matter how the election turns out. Doug is optimistic that the new Congress will finally move toward resolving a debt crisis that has held the economy in stays since the Great Financial Crash of 2007-08. The bad news is that this will induce an economic coma from which it will be difficult and painful to emerge. RA]

Here comes the 4th Quarter! I suspect it will be action-packed. With one month to go before the election, it is a tight race and much of the investment commentary is focused on how the possible outcomes will affect the markets. Perhaps it all comes down to fate (n. 1. the power or agency supposed to determine the outcome of events before they occur; destiny). We should have a better idea whether gridlock will continue or legislative progress will be made in the effort to get the federal budget under control. The two movie scenes that come to mind are Thelma and Louise and Indiana Jones and the Last Crusade. I am pinning my hopes on Harrison Ford. The outcome will probably be more a function of how the congressional elections wind up than who wins the

presidency. I am optimistic that, through a combination of “political capital” in the Oval Office and a Congress that can legislate, the country will move forward in the battle against the fiscal crisis. However, if investors perceive the likelihood of progress, the response in the markets could be negative. That is because whatever the combination of tax increases and spending cuts, the impact on the economy is likely to be depressing.

presidency. I am optimistic that, through a combination of “political capital” in the Oval Office and a Congress that can legislate, the country will move forward in the battle against the fiscal crisis. However, if investors perceive the likelihood of progress, the response in the markets could be negative. That is because whatever the combination of tax increases and spending cuts, the impact on the economy is likely to be depressing.

Baby Boomer Demographics

Nobody ever said paying the piper would be easy. The sacrifices that will be required to bring down the deficit will be substantial because the natural rate of economic growth has been brought to a crawl. The combination of the credit bubble bursting and Baby Boomer demographics are mostly to blame. Because of democracy, government is a reflection of the voting households, so both balance sheets hit the wall at about the same time. The problems in Europe are similar. Fiscal stimulus seems to have reached its limit too. The outcome of this election will have an impact on where the sacrifices are inflicted, but the economic drag will be severe in any case if progress is to be made on budget deficits exceeding one trillion dollars. Research on the part of UBS, Goldman Sachs and the Congressional Budget Office suggest a range of outcomes that will reduce GDP growth between 1% and 6% in 2013. This is referred to as the Fiscal Cliff.

There is a fairly large contingent of economists who are either calling for recession or believe we have already entered one. Under normal circumstances, the vast majority of economists never use the “R” word until it is official because they are afraid of being perceived as pessimistic. Typically, recessions are declared six to nine months after they begin. Positive economic growth that is initially reported during the first quarter or two of a recession typically gets revised down into negative territory as part of that determination. The reason that this occurs is that real-time economic reporting for GDP contains an enormous amount of estimates that subsequently get replaced by actual data. This year’s 2nd Quarter growth was just revised down to 1.3% and the 3rd Quarter is expected to be below 2%. The concern among the bearish economists is that this meager rate of growth is within the margin of error and any amount of tax increases or spending cuts will be enough to push the economy over. That would most likely result in lower stock prices and higher Treasury and municipal bond prices.

O% Money Has Failed

Short-term borrowing rates have been near 0% for years without sparking a new credit cycle, and that should have been expected. The Fed and central bankers in the rest of the developed world have been “pushing on a string” for the most part and there is very little monetary stimulus left in the tool box to stave off the business cycle. Ben Bernanke has repeatedly stated that the Fed cannot create economic growth on its own and that the federal government needs to enact fiscal policy that helps. The problem is that growth ultimately is dependent on consumers, investors and businesses in a capitalistic society. Even brilliant political action and an accommodative Fed will be limited in its effectiveness by the pace of recovery dictated by the private sector.

The stock market disagrees so far, however. When it looked like a recession was beginning in 2010, the Fed implemented QEII, a $600 billion injection of liquidity, and in doing so, juiced consumer confidence enough to avoid it. Coordinated central bank easing in 2011 had a similar effect. Last month the Fed announced QEIII on the back of a bold promise by the European central bank to “do whatever it takes.” Perhaps recession will be avoided once again. But even if that proves to be the case, the stock market has priced it in by rallying 14% since the beginning of June. (The S&P500 was up 16.44% through September.) It remains below the levels reached on the day of the Fed’s announcement. Sentiment has turned extremely bullish as it usually does at tops, and earnings estimates are being cut. Time will tell.

In the meantime, the bond market continues to refuse to go along for the ride. Closed end municipal bond fund returns remain close to their highs for the year as rates have dropped. Treasury bond rates have basically treaded water so far in 2012. Sentiment there remains solidly negative, even as core inflation remains low and the Fed has extended its promise to keep rates at 0% into mid-2015.

For an example of an economist who believes that we have entered a recession (and who runs an equity mutual fund), I refer you to John Hussman. Click here to access his current comments.

***

[Click here for a free trial subscription to Rick’s Picks that includes access to a 24/7 chat room and the just-launched ‘Harry’s Place’.]

Several factors will ‘save’ h US economy from sure disaster. Eliminate the Fed and use the interest on the national debt citizens pay ($502 BILLION) to fund universal healthcare thereby removing a major business cost limiting US business success, competitiveness and profitability. Regulate Insurance Companies as they’re largely unnecessary and a ‘piggybank’ for the Wealthy.

Include Capital Gains a part of a person’s wages and hen tax accordingly. Audit the Fed & US goal held. epublish the M3 money supply number each month in all newspapers. Abbrogate and default on all Credit Default Swap Derivatives then implement a comprehensive regulatory system for them run by major US economists.

Reinstall the Glass-Steagall like yesterday. Indict, rmeove and imprison Wall Street Banking executives clearly committing multiple Felonies – including Prince, Bernanke, Geithner, Summers, Rubin, Greenspan Paulson, Blankfein, all major AIG execuitives and Freidman. The ‘roaches will scurry one h first one goes o jail. America’s on the brink but is citizens are too stupid, ignorant, cowardly, passive and oblivious to act. As a result, the U.S. pseudo-democracy is near death.