The institutional crazies, village idiots and knee-jerk opportunists who bought shares yesterday following a Fed announcement of yet more monetization seem not to have been paying attention, at least initially, to the nasty sell-off in T-Bonds. Well before yesterday, any sentient being would have surmised that easing’s impact on the economy had reached the point of diminishing returns. With administered rates pegged at zero and mortgage loans near historical lows, how much more boost are we to expect from yet another gaseous effusion of bank-system credit? Most of it is going unused anyway, other than by banks for the purpose of “buying” – you got it! – Treasury paper.

Contemplating this stupid shell game probably gets a faux Keynesian like Krugman hard, but sage T-Bond traders evidently were having none of it. As a backdrop, the Fed has been buying $45 billion of T-bonds each month, but offsetting it by selling a like amount of short-term Treasurys. With yesterday’s announcement, the central bank ditched the offset, clearing the way for an increase in the Fed’s portfolio of “assets” above the current level of $2.861 trillion. This latest twist in the soon-to-expire, dumber-than-dumb Operation Twist got a big thumbs-down from the bond traders, who drove futures prices sharply lower. Stocks, for their part, relapsed after the obligatory, news-driven short-squeeze, demonstrating that although the Fed may be capable of managing inflation expectations, its ability do so is no longer to be reckoned in months or weeks, but in minutes.

Bullish on T-Bonds

Despite the long bond’s plunge, we remain bullish on it down to 2% — but not because of the Fed’s insatiable appetite for auction paper. As we saw yesterday, the promise of more easing has become a short-term negative for bonds. However, we expect the effect to be overshadowed, at least for the foreseeable future, by the deflationary force of an imploding U.S. economy, and by the flight of capital to “safety” from Europe and other redoubts of economic folly that are a step closer to economic Armageddon than the U.S. (mainly because their respective currencies, unlike the dollar, are not held as a global reserve).

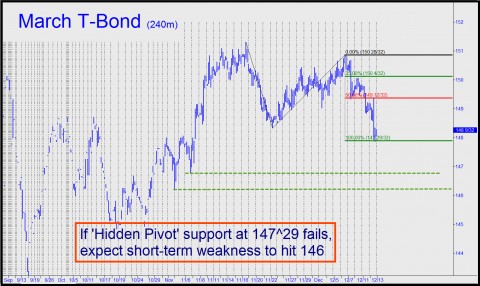

From a technical standpoint, T-Bond futures will be signaling more weakness, at least for the near term, if they are unable to rally from yesterday’s low. It coincided very precisely with a Hidden Pivot target at 147^29 (see chart above), and although that number could have been bought speculatively, a breach by more than three or four ticks would augur a test of November lows at either 146^25, or if any lower, 146^08.

***

[Click here for a free trial subscription to Rick’s Picks that includes access to a 24/7 chat room and timely trading touts.]

Hey folks,

Don’t forget heirloom seeds ,compost ,peat moss + vermiculite .