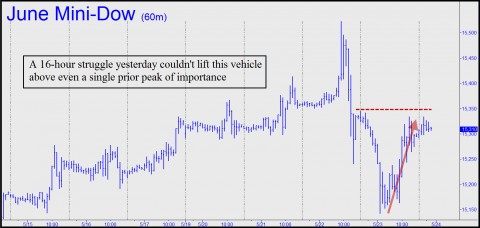

Yesterday’s rally recouped a 200-point overnight selloff in the Dow, but because it was unpersuasive from a technical standpoint, we expect the week to end on a whimper at best. At worst, the selling could carry into next week, and if it persist so that shares fall on a Tuesday – something that has not occurred in more than four months – then we would view that as further evidence that Wednesday’s high was an important one. Regarding “weak technicals,” notice in the chart below how buyers of DJIA index futures failed to surpass even a single important peak on the hourly chart after devoting an entire night and day to the task. From our perspective this is telling, since, according to our Hidden Pivot Method of analysis, rallies destined for greatness, or even just goodness, must exceed a new peak on the hourly chart with each new thrust. Not this time, though, and that’s why we would classify yesterday’s rebound – all 200 points of it – as a bust.

Wednesday night, index futures had gotten pounded into a deep hole after bulls got trapped celebrating Bernanke’s latest appearance on Capitol Hill. The man had said absolutely nothing of importance, as usual, and although that has rarely troubled investors in the past, this time it evidently did. The result was that U.S. markets appeared to be in avalanche mode in the wee hours, gaining momentum following the previous day’s bull-trap reversal. Although, as we have noted above, yesterday’s ascent from the depths was not impressive by itself, the ability of DaBoyz to arrest a slide that should have carried strongly into the opening was a pretty good trick. We doubt the Plunge Protection Team was involved, although it would have been a cheap trick for them to turn the tide at 3 a.m., when stocks finally got traction, with some judicious buying of S&P futures or perhaps mini contracts.

Time to Straddle

From a trading standpoint, Rick’s Picks has recommended that subscribers straddle the fence. Although our target for the Dow Industrials is 1500 points higher, Wednesday’s highs coincided with some middling rally targets that had the potential to end the party, at least for a while. Subscribers reported buying – as instructed – Johnson & Johnson May 87.50 weekly puts for 0.11 that traded as high as 0.60 yesterday; and DIA June 152 puts for 1.00 that hit 2.32. Click here if you’ve never made a profitable options trade and would like to change your luck.

JJ, very shrewd analysis. You’re looking much further ahead than me. Best wishes for a recreative holiday. I’m sure you won’t spend it in motionless traffic on Cal’s noways.