[Buyers on Wednesday made short work of the 1647 target noted below, pushing the futures as high as 1660. This implies that a further rally of 130 points — equivalent to more than 1000 Dow points — is likely gestating. RA]

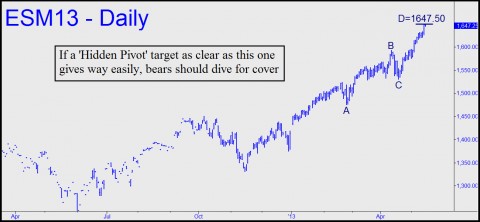

The 1647.50 rally target shown in the chart below looked until recently like a good bet to contain the bullish stampede, at least for a while. As of early Wednesday morning, however, it seemed to be giving way. Even though it has been exceeded so far by just 2.50 points, that’s enough to imply that the resistance has been fatally compromised, given the clarity of the technical pattern that produced it. If this “Hidden Pivot” is in fact easily brushed aside, it would be yet one more casualty of a bull market that in its fifth year is growing more relentless by the day.

And freakish. Yesterday’s rally marked the 18th straight week that the Dow has closed higher on a Tuesday. Market watchers have been trying to make sense of this, since nothing remotely like it has ever happened before. But they might as well be trying to explain Stonehenge. The mere fact that betting that stocks will finish higher on a Tuesday has become all but a sure thing is reason enough for it not to happen again. That’s because “knowing” what the Dow will do on a given Tuesday would make it possible for “everyone” to make money on the same side of the market. That cannot be, of course. And yet, who would dare fade next Tuesday’s action, assuming it’s a rally?

Another 1000-Pointer?

And now, what if buyers simply blow past the 1647.50 target shown above? According to our technical runes, that would put in play a 1779.75 target of higher degree whose attainment would be equivalent to a 1000-point rally in the Dow. For a graphical explanation, check out the “touts” section of Rick’s Picks today. If you don’t subscribe but would like to try a risk-free trial for a week, click here. You’ll get access to all of our features and services, including a 24/7 chat room that draws veteran traders from around the world.

Not freakish, nauseaus. What market anyways. It is all bull****. Crooked, criminal casino run by terrorist tyrannical mass murdering psychopathic banksters. That is your market.