We could not have improved on Bernanke’s speech yesterday, although investors appear to have found it more than a little unsettling. Don’t worry, they’ll soon be back in droves, snapping up stocks as always, without so much as a moment’s pause as to why. Meanwhile, everyone knew beforehand that even the vaguest hint about cutting back on the Fed’s monthly purchases of Treasury debt and mortgage securities would be enough to send global markets spasming. Look at the damage that’s been done already. In the case of so-called emerging markets, they have gotten crushed in recent weeks as hot money has fled for safer venues. And China’s financial system has begun to totter on fears that domestic credit speculation will not easily abide even a slight U.S. shift from easing.

Under the circumstances, Bernanke talked his book about as well as he might have, suggesting that the U.S. economic recovery is proceeding well enough that it may be possible to end QE sometime next year. Yeah, sure. The official line has been that unemployment could be at 7% or lower within a year and that the real estate market will continue to firm. As Goebbels famously said, if you tell a lie big enough and keep repeating it, people will eventually come to believe it. So it is with a U.S. economic “recovery” that has rested solely on inflated home prices and shares driven by untold $$ trillions of funny money.

Gold’s Usual Reaction

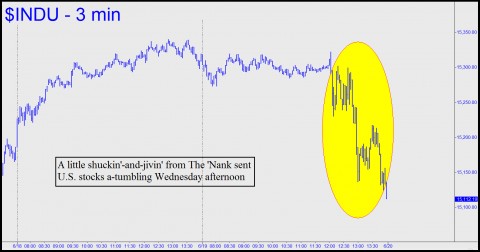

Wall Street’s conniptions in response to Bernanke’s latest variation on a theme was at least amusing, with traders slipping and sliding in their own excrement, so to speak. The chart above shows this. The initial feint was higher, but it proved to have been a bull trap when DaBoyz pulled the plug, sending the Indoos into a 200-point plunge. It was punctuated along the way by intricate seizures, tremors and twinges, each perhaps signifying that Wall Street is not so completely bereft of buyer’s remorse as we might have imagined.

For its part, gold did not miss an opportunity to head lower, even if there was nothing in the news that should have caused this. Actually, there was a story that in olden days might have lifted the price of gold. It seems that Russia, evidently in need of economic stimulus, has joined the world’s devaluation Olympiad. We should welcome them to the club and wish them luck, since it’s going to take a pile of devalued rubles to keep energy sales firm with demand from China softening.

I don’t think Ben will actually taper in Sept. like 40% of economists think he will, UNLESS the economy and the stock market look like they can stand on their own even if he tapers. He wants to go out in a blaze of glory I expect, in Jan. 2014. I’m sure he doesn’t mind if the stock market goes through its usual summer correction though.

My own guess, FWIW, is for a summer pullback and then a ramp up in the Fall, to usher Ben out in his blaze of glory in Jan.