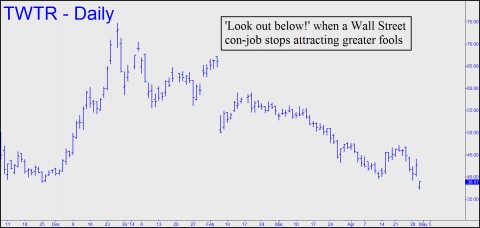

Twitter shares plunged to new lows yesterday, dumped by the same halfwits who earlier had bid the stock into the ionosphere, even though the company had no revenues nor even a proven way to make money. At the time, back in early November, I wrote that the flood of dollars into Twitter shares was ludicrous. Granted, it was mostly Other People’s Money, mishandled in the usual devil-may-care, malfeasant way by Wall Street’s tightly knit community of thieves and mountebanks. But $50 a share?? At that price, I noted, Twitter’s capitalization amounted to $35 billion, “putting it in the same league as John Deere, News Corp., Halliburton, Biogen and Prudential Financial. This, despite the fact that the Internet messaging service, with hundreds of millions of followers, has yet to earn a dime of profit — or even to figure out how to earn one. ‘Investors’ seemed not to care, however. In the opening minutes of Thursday’s session, their orgiastic buying spree pumped the stock to an intraday high of $50 that was nearly double the $26 offering price.”

The rest of my commentary bears repeating, since the lessons of Twitter’s fall from grace have yet to sink into the tiny brains of investors who still hold grossly inflated shares in web-based companies that are more “idea” than actual product. “For those of you not familiar with Twitter,” the November commentary continued, “it is an online social networking and microblogging service that enables users to send and read text messages limited to 140 characters called ‘tweets’. Although tweets undoubtedly have theoretical value as a marketing tool, they have been used mainly by celebrities to share their personal thoughts and reflections with millions of fans at all hours of the day and night. The tweet-happy Justin Bieber, for one, probably has more online followers than Coca-Cola, Doritos, Ralph Lauren et al. could attract in a lifetime. If you’re wondering, then, who can benefit from Twitter, let alone get rich from it, you’re not alone, especially since the service has yet to come up with a viable business model. One answer soon to be tried involves adding graphic marketing images to tweets. However, this would force Twitter to compete more directly with Facebook. It would also risk driving away users who were attracted to the service in the first place because of its simplicity and ad-free format.

Street’s ‘Community of Thieves’

“In the meantime, Twitter, having become one of America’s 100 most valuable companies literally overnight, will presumably continue to add nothing, zilch, zero to the economy. At best – and this is only in theory – it could help a company raise its market share at the expense of competitors. So where’s the money? Even bank robber Willy Sutton would have trouble figuring that one out. One need look no further than Wall Street, however. The Street is by far the biggest winner every time its insider gang of thieves has an opportunity to hype the IPO of some company whose business is inscrutable to most of us — inscrutable, no doubt, to most of the fools who were clamoring for IPO shares last week at $50 per. If they wind up making any money at all, it will only be because even greater fools have come along to bail them out.

“Our hunch is that the epic stupidity, hubris and greed that made Twitter’s IPO such a success will mark the top of the second, and presumably last, dot-com boom. Readers?”

Late-breaking note: From a technical standpoint, the stock looks like it could find at least temporary traction at 36.48, exactly 76 cents below Wednesday’s bombed-out bottom. But I’ll be looking for an opportunity to short any rally, since the all-time low the stock recorded yesterday is unlikely to go untested. This will remain so unless the company suddenly figures out a way to monetize its vast audience without driving it away. _______ UPDATE (May 6, 4:12 p.m. ET): The stock’s last-gasp rally to 43.97 was indeed a great opportunity to get short, as some subscribers evidently did. Now, with today’s collapse and the obliteration of the 36.48 ‘hidden’ support, the stock should fall to at least 30.92, exactly 80 cents beneath the intraday low, before it can find traction. If it doesn’t turn from there, however, a Hidden Pivot at 27.82 would become my worst-case projection for this bear market. _______ UPDATE (May 13): Bulls have their work cut out for them if they want to achieve a bear rally worthy of the name. Specifically, they’ll need to push this brick above 39.60 to generate a pulse on the hourly chart.