Bears found themselves trapped on the opening yesterday for the umpteenth time since the bull market began, setting up a short-covering panic that turned what began as natural weakness in the broad averages into steroid-powered strength. DaBoyz simply pulled their bids at the bell, allowing the relative smattering of market orders that had built up over the weekend to have an inordinate effect. Into a bid-less vacuum, stocks dove the equivalent of 120 Dow points, exhausting pent-up orders in about 45 minutes. Once sellers were spent, it was child’s play for the smart money to effortlessly squeeze the futures back up to where they had begun the day — plus a little. Moreover, since there was but a shallow correction from the end-of-day highs, bears remained tactically on the ropes at the close.

Bears found themselves trapped on the opening yesterday for the umpteenth time since the bull market began, setting up a short-covering panic that turned what began as natural weakness in the broad averages into steroid-powered strength. DaBoyz simply pulled their bids at the bell, allowing the relative smattering of market orders that had built up over the weekend to have an inordinate effect. Into a bid-less vacuum, stocks dove the equivalent of 120 Dow points, exhausting pent-up orders in about 45 minutes. Once sellers were spent, it was child’s play for the smart money to effortlessly squeeze the futures back up to where they had begun the day — plus a little. Moreover, since there was but a shallow correction from the end-of-day highs, bears remained tactically on the ropes at the close.

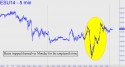

For our part, since subscribers could have gotten short from as high as 1984.25 based on a Hidden Pivot rally target disseminated last week, some may have elected to swing for the fences by staying short. However, although the trade could have produced a profit of as much as $1200 per contact, the possibility that we were getting the jump on the Mother of All Tops was never more than remote. If you still hold a position, please let me know in the chat room and I will furnish further guidance. Strictly speaking, a short would have survived yesterday’s nasty dipsy doodle if it had been tied to an impulse leg-based stop-loss on the hourly chart.