The Plunge Protection Team has been hard at work lately, although not in the way some traders might imagine. The very name evokes the shadowy activities of a group of Svengalis believed to control the stock market through timely interventions in such key trading vehicles as the S&P 500 futures. In fact, the PPT, more blandly known as the President’s Working Group on Financial Markets, was commissioned under President Reagan after the 1987 Crash to prevent meltdowns. These day, however, nearly six years into a ferocious bull market that seldom pauses for breath, one might question why a Plunge Protection Team is needed at all. The answer is that the PPT, far from defending against selling panics, has been furtively on the offensive, triggering short-squeeze panics that spike shares to new record highs at every opportunity. Usually, the news catalyzing these rallies hits the tickertape on a Friday, when the effects of a short-covering binge are apt to be most pronounced. It is hardly a stretch to imagine that these engineered events have been scheduled and coordinated by the PPT, working in concert with the central banks.

Last Friday, for instance, U.S. stocks opened with a ballistic lurch higher on news that China, increasingly fearful of deflation, is about to ease. This had already sent stocks in Europe and Asia screaming overnight, setting up Wall Street’s by-now reflexive reaction. Recall that just five weeks earlier – on a Friday, as it happened – Japan announced its own, epic stimulus package – Max Keiser wryly called it QE9 – to the same effect: stock markets around the world soared. A presumably intended side-effect was that U.S. T-Bond prices spiked higher, briefly pushing yields down to lows that will linger in investors’ collective subconscious with a sedative effect against whatever fears they may have harbored about any future tightening.

Losing Steam?

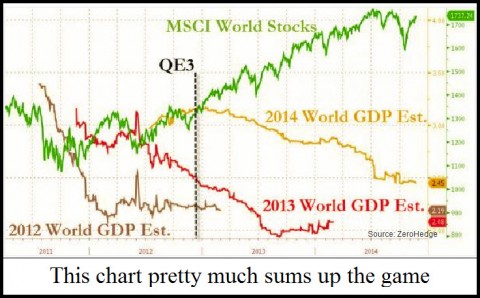

Permabulls who believe this game can continue indefinitely are in for a rude awakening, especially if they have ceased paying attention to certain technical signs that might warn of a downturn. One of them, declining volume since 2011, has been too obvious and important even for fools to miss. However, this yellow flag is all too easily dismissed with stocks in a parabola since mid-October. Less obvious, and possibly significant, is that Friday’s rally failed to get second wind. The news from China juiced the Dow 175 points on the opening, but the surge petered out in just ten minutes before giving way to a ratcheting downtrend over the next four hours. And did anyone notice that crude oil quotes barely budged? What this suggests is that the central banks have held interest rates near zero for so long that easing itself is no longer seen as capable of stimulating economic growth, only of goading share prices higher.

For our part, we’ll continue to get short at every promising ‘Hidden Pivot’ rally target, since the stock market could go into a 5000-point dive at any time. Granted, there’s no way technical analysis can ‘prove’ the Dow isn’t about to head the opposite way, to 20,000 or even higher. But with earnings flattening at some very large U.S. companies, Europe’s economy on the brink of a deep relapse, U.S. home prices stagnating, commodity prices falling and China looking winded, it’s hardly crazy to say that permabulls are playing with fire. We’d rather trade both sides of the market anyway, getting long near the lows of targeted swings, then reversing the positions at projected highs. On Friday we used this tactic to buy DIA puts in conjunction with a 178.47 rally target. The actual high, recorded at the top of the opening bar’s wild spasm, was 178.60, allowing subscribers to buy put options that went solidly in-the-black by day’s end. Typically, and with put options in particular, we try to sell half of any option position that has doubled in price as soon a s possible, so that the remaining options can be held without risk. If you are skeptical that this strategy can work, come into the chat room and ask subscribers yourself. Click here for a two-week trial subscription that includes all features and services of Rick’s Picks, including impromptu technical analysis/trading sessions conducted on ‘live’ charts during market hours.

For our part, we’ll continue to get short at every promising ‘Hidden Pivot’ rally target, since the stock market could go into a 5000-point dive at any time. Granted, there’s no way technical analysis can ‘prove’ the Dow isn’t about to head the opposite way, to 20,000 or even higher. But with earnings flattening at some very large U.S. companies, Europe’s economy on the brink of a deep relapse, U.S. home prices stagnating, commodity prices falling and China looking winded, it’s hardly crazy to say that permabulls are playing with fire. We’d rather trade both sides of the market anyway, getting long near the lows of targeted swings, then reversing the positions at projected highs. On Friday we used this tactic to buy DIA puts in conjunction with a 178.47 rally target. The actual high, recorded at the top of the opening bar’s wild spasm, was 178.60, allowing subscribers to buy put options that went solidly in-the-black by day’s end. Typically, and with put options in particular, we try to sell half of any option position that has doubled in price as soon a s possible, so that the remaining options can be held without risk. If you are skeptical that this strategy can work, come into the chat room and ask subscribers yourself. Click here for a two-week trial subscription that includes all features and services of Rick’s Picks, including impromptu technical analysis/trading sessions conducted on ‘live’ charts during market hours.

Long have I pondered what the first domino would be. Japan currency crisis? Euro meltdown? US equities collapse. No. All these are under control of the central banks. The answer is oil. The one important commodity price not easily controlled/manipulated by the central banks. Charles Hugh Smith is all over this and I think he’s right. Oil in the ground will prove to be the next flimsy collateral underpinning vast amounts of debt.

&&&&&&

I’ve been doing some pondering myself, BC, and my favorite black swan is the dollar, since there are far, far too many of them in play to control. In my scenario, there’s a run INTO dollars when some ostensibly minor crisis disrupts very short-term rollovers.

Thanks for the Charles Hugh Smith citation. Everything he writes is worth reading. Click here to be taken to his blog. RA