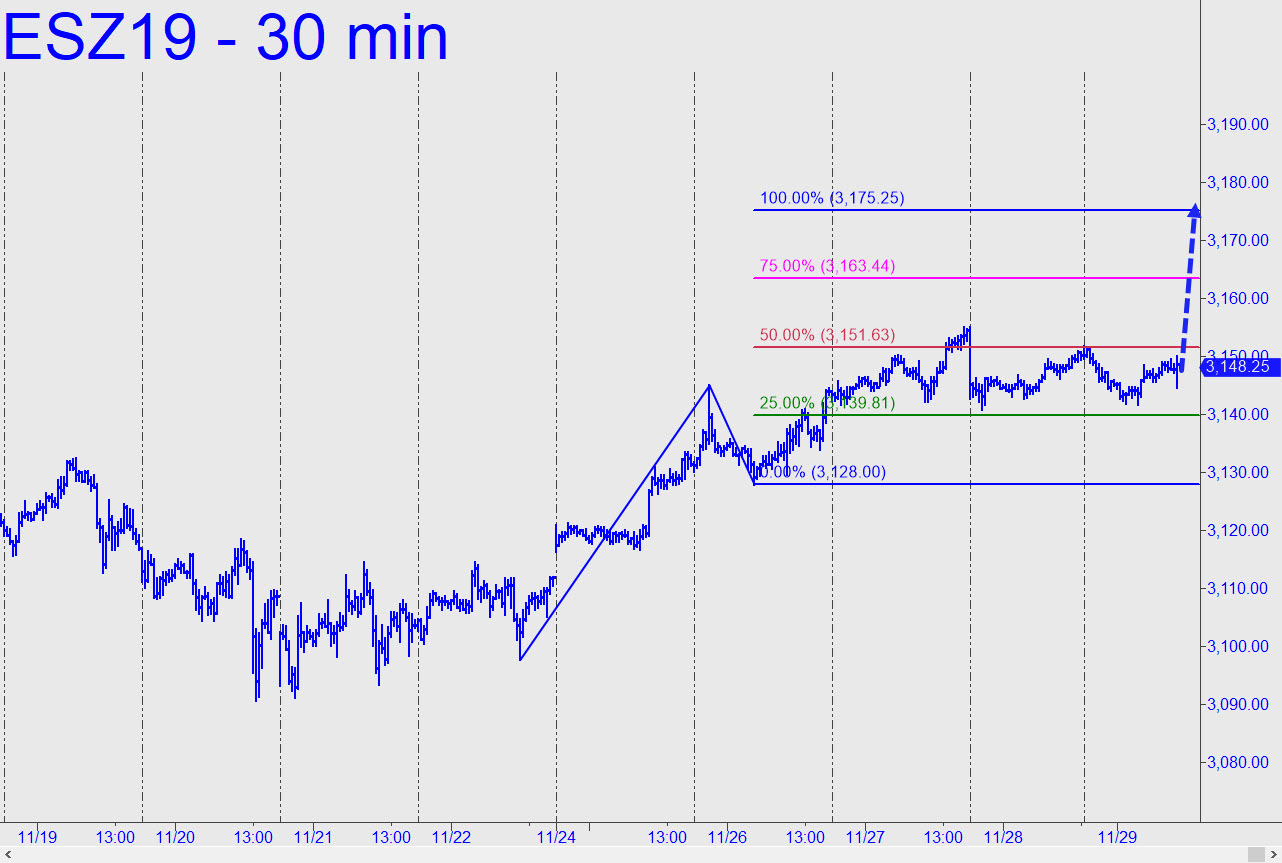

The 3160.25 rally target we’ve been using to keep us properly bullish remains to be achieved. Even though Wednesday’s push to 3155.00 came close, it wasn’t as close as we should expect, given the way buyers took out the 3125.50 midpoint resistance earlier in the week. All that aside, the futures are trading above a major trendline after impaling it last week, presumably adding to the euphoria, so extra caution is warranted. That means monitoring price action at 3138.00 for now, a minor Hidden Pivot support that should be expected to produce a tradeable bounce (15-minute, a=1555.00 at 6:15 pm. EST on 11/27). A 3138.25 bid for a single contract, stop 3136.25, is suggested. You’ll be on your own if the order fills. _______ UPDATE (Dec 1, 11:31 p.m.): Cancel the bid, since the futures have rocketed skyward after having gone no lower than 3139.50. _______ UPDATE (Dec 2, 10:14 a.m.): And now stocks are plummeting. It would appear that ‘trade hopes’ have faded just a smidgen this morning.

The 3160.25 rally target we’ve been using to keep us properly bullish remains to be achieved. Even though Wednesday’s push to 3155.00 came close, it wasn’t as close as we should expect, given the way buyers took out the 3125.50 midpoint resistance earlier in the week. All that aside, the futures are trading above a major trendline after impaling it last week, presumably adding to the euphoria, so extra caution is warranted. That means monitoring price action at 3138.00 for now, a minor Hidden Pivot support that should be expected to produce a tradeable bounce (15-minute, a=1555.00 at 6:15 pm. EST on 11/27). A 3138.25 bid for a single contract, stop 3136.25, is suggested. You’ll be on your own if the order fills. _______ UPDATE (Dec 1, 11:31 p.m.): Cancel the bid, since the futures have rocketed skyward after having gone no lower than 3139.50. _______ UPDATE (Dec 2, 10:14 a.m.): And now stocks are plummeting. It would appear that ‘trade hopes’ have faded just a smidgen this morning.

ESZ19 – December E-Mini S&P (Last:3126.00)

Posted on December 1, 2019, 5:15 pm EST

Last Updated December 4, 2019, 11:56 pm EST

Posted on December 1, 2019, 5:15 pm EST

Last Updated December 4, 2019, 11:56 pm EST

- December 2, 2019, 2:30 pm

Bulls have a leg up from 11/20 3090.75 low targeting 3177.5 by 12/11 if they stay above today’s (12/2) 3110.25 low so far. Conversely, bears have a leg down from today’s 3158 high targeting 3085.25 if they stay below today’s 3126.75 intraday high. Bulls have advantage above 3116.5 target and point of inflection.