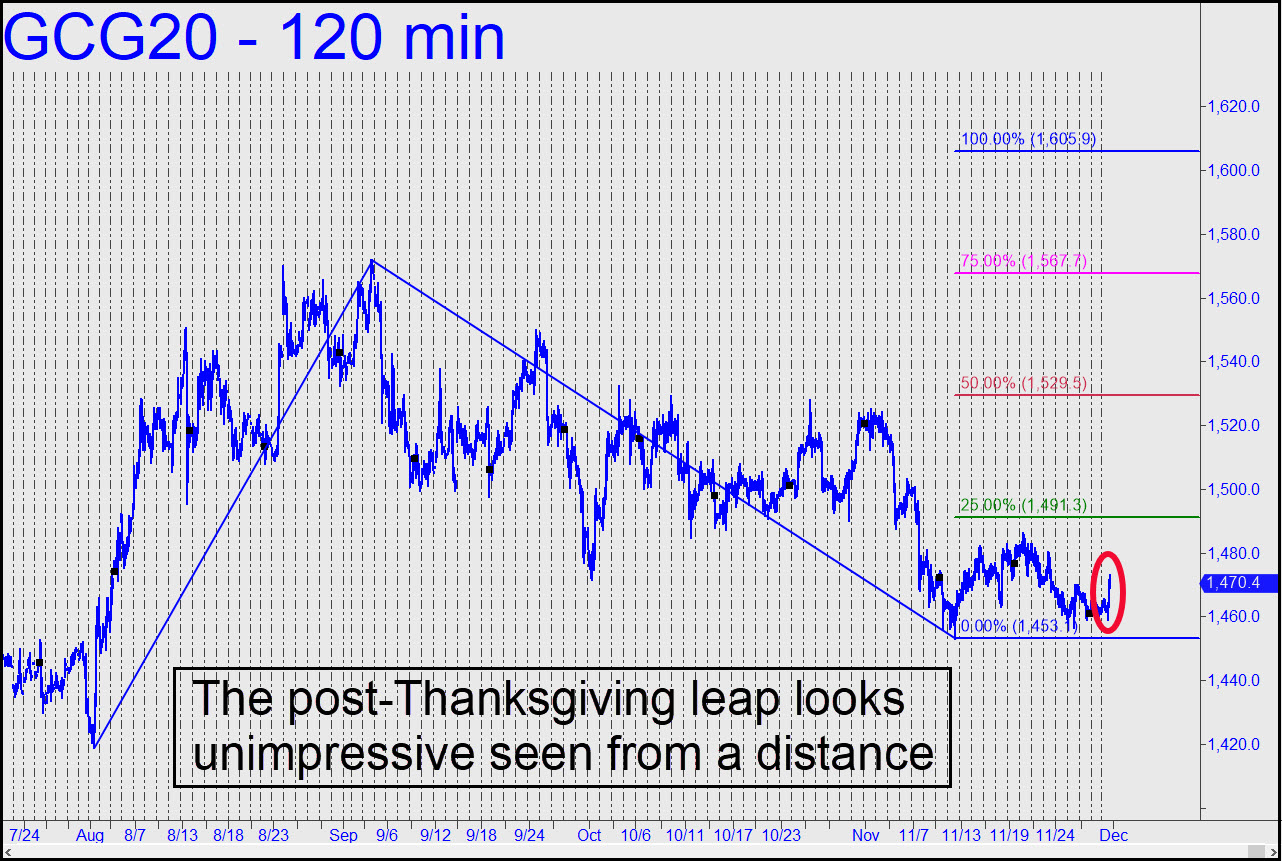

Friday’s exuberant but inexplicable leap may have felt encouraging at the time, but a chart that goes back a few months makes the rally look far from impressive. Even so, bulls deserve the benefit of the doubt for the moment, since the move was indisputably going their way at the closing bell. It would take a print at x=1491.30, the green line, to trip a theoretical buy signal, but only 1474.80 would be needed to generate a bullish impulse leg on the hourly chart. That could set up an appealing trading opportunity intraday, so stay tuned to the Trading Room if you’re eager to play. _______ UPDATE (Dec 3, 10:05 a.m. EST): The futures have taken wing this morning and appear bound for a minimum 1489.50. If this Hidden Pivot is easily exceeded, bulls could take heart. Here’s the updated chart. _______ UPDATE (Dec 3, 11:09 p.m.): Buyers should have been able to reach the 1489.50 target shown in this chart on the first try but failed. Disappointment would fade if they get second wind and take out the 1496.30 ‘external’ peak shown, but until such time as that happens we shouldn’t get our hopes too high. _______ UPDATE (Dec 4, 6:14 p.m.): The futures dove $12 after peaking at 1489.90, four ticks above the target flagged above. That is well shy of the 1496.30 I’d said was needed to turn the intraday charts unambiguously bullish. I’m going to raise the bar a tad just to be cautious, stipulating that the rally achieve 1503.10, just above the external peak shown in this chart, before I ratchet down my skepticism. Incidentally, a Trading Room denizen reported having used the 1489.50 target to get long and exit the position at the top for a nice profit. He posted as follows: “Exited the position overnight for a tidy profit. Thanks Rick for the heads-up yesterday. My sell order was for 1489.40, a tick below D, and it worked perfectly. I was late to the dance but still paid for this year’s subscription on that one trade as well as a steak dinner last night for my wife’s birthday.”

Friday’s exuberant but inexplicable leap may have felt encouraging at the time, but a chart that goes back a few months makes the rally look far from impressive. Even so, bulls deserve the benefit of the doubt for the moment, since the move was indisputably going their way at the closing bell. It would take a print at x=1491.30, the green line, to trip a theoretical buy signal, but only 1474.80 would be needed to generate a bullish impulse leg on the hourly chart. That could set up an appealing trading opportunity intraday, so stay tuned to the Trading Room if you’re eager to play. _______ UPDATE (Dec 3, 10:05 a.m. EST): The futures have taken wing this morning and appear bound for a minimum 1489.50. If this Hidden Pivot is easily exceeded, bulls could take heart. Here’s the updated chart. _______ UPDATE (Dec 3, 11:09 p.m.): Buyers should have been able to reach the 1489.50 target shown in this chart on the first try but failed. Disappointment would fade if they get second wind and take out the 1496.30 ‘external’ peak shown, but until such time as that happens we shouldn’t get our hopes too high. _______ UPDATE (Dec 4, 6:14 p.m.): The futures dove $12 after peaking at 1489.90, four ticks above the target flagged above. That is well shy of the 1496.30 I’d said was needed to turn the intraday charts unambiguously bullish. I’m going to raise the bar a tad just to be cautious, stipulating that the rally achieve 1503.10, just above the external peak shown in this chart, before I ratchet down my skepticism. Incidentally, a Trading Room denizen reported having used the 1489.50 target to get long and exit the position at the top for a nice profit. He posted as follows: “Exited the position overnight for a tidy profit. Thanks Rick for the heads-up yesterday. My sell order was for 1489.40, a tick below D, and it worked perfectly. I was late to the dance but still paid for this year’s subscription on that one trade as well as a steak dinner last night for my wife’s birthday.”

GCG20 – February Gold (Last:1480.40)

Posted on December 1, 2019, 5:10 pm EST

Last Updated December 4, 2019, 7:21 pm EST

Posted on December 1, 2019, 5:10 pm EST

Last Updated December 4, 2019, 7:21 pm EST

- December 5, 2019, 9:32 am

Bull leg up from 11/12 1453.1 low targeted 1489.5 which was hit on 12/4 w/ a high so far of 1489.9. A 2nd leg up targets 1513.5 by Xmas if bulls stay above the 12/4 1476.7 low. Conversely, bears have a leg down from the 1489.9 high targeting 1475.9 today (12/5). Bullish tell if this doesn’t happen, all bullish bets off if bears go below a nested 1475.9 target up from 11/26 1456.6 low.

&&&&

Yo, GC ol’ boy: I’m doing the forecasting around here, okay? Your liable to confuse my subscribers with all of those if/then predictions. But if you think you can do better than I, I’d encourage you to start your own guru service. It can be quite lucrative if you cater to wealthy widows and one of them likes you enough to put you in her will. RA