Over One Thousand Paid Subscribers Won’t Make A Trade Without Looking At Rick’s Picks First…

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Rick's work has been featured in

Rick's Free Picks

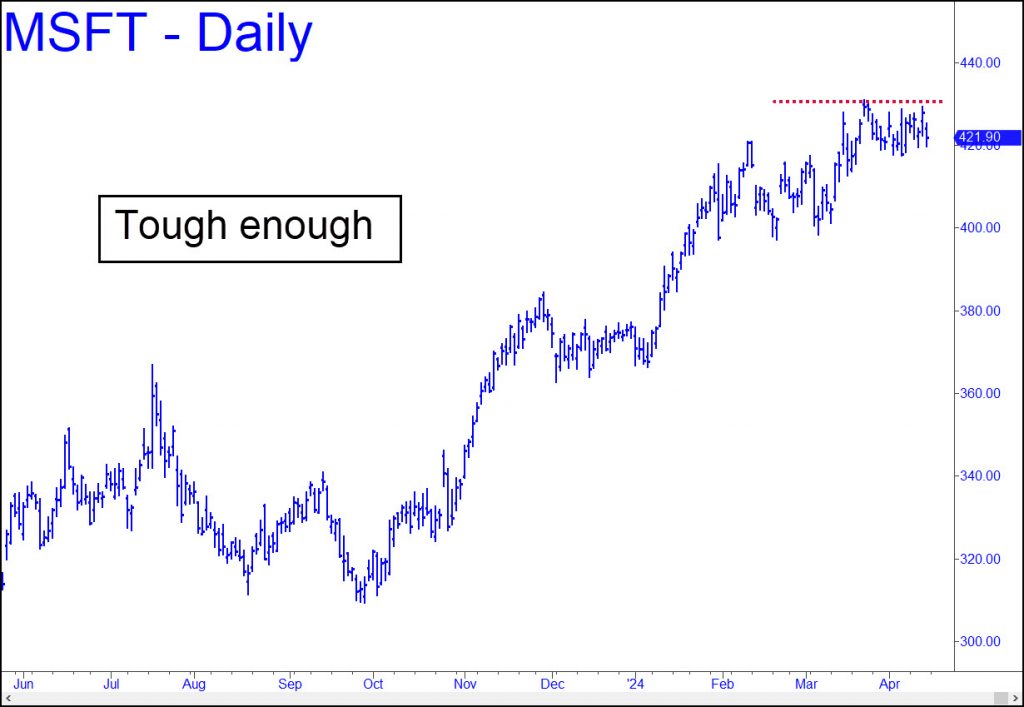

$MSFT – Microsoft (Last:421.90)

The stock is entering its fourth week after stalling pennies from a 430.58 target that I first broached here last January. Isn’t that sufficient evidence that THE top is in? asked a subscriber in the chat room. Ordinarily, I’d say yes. But this is no ordinary bull market, and we

$SIK24 – May Silver (Last:28.93)

Precious metals got bludgeoned on Friday after a strong rally spiked this vehicle to 29.90 around 11:15. The downdraft should not have caught any of you by surprise, since we were already using a 1.09 trigger interval (TI) to warn if intraday weakness looked likely to snowball. It did, but

$GDXJ – Junior Gold Miner ETF (Last:41.99)

If the beating that gold and silver futures took in the last half of Friday’s session was unnerving, we should still be reassured by the robust look of GDXJ’s weekly chart. There are a few reasons to expect the bull cycle begun in September 2022 to achieve the 48.55 target.

$TLT – Lehman Bond ETF (Last:90.50)

TLT looked like hell again last week, as usual. However, I will accentuate the positive for a rare change, as I did in this week’s commentary featuring T-Bond futures. Turns out 2024’s downtrend in both vehicles occurred within the context of respective reverse-pattern buy signals. Yes, it’s a stretch to

Member Content

Unlock member content with a free trial subscription

THE MORNING LINE

Springtime for Bonds?

The devastating bear market in Treasury paper since 2020 may be nearing an end. I was pessimistic about this myself when TLT, an exchange-traded fund, that tracks the long bond, broke down last week. But a bigger picture saw this as occurring in the context of a market that may have bottomed last October. The bounce from that low triggered a theoretical ‘buy’ signal in bonds in mid-December when it touched the green line shown in the chart.

Don’t expect a meteoric rise, however, since it could take a while for T-Bonds to build a base for a sustained move higher. Assuming the 107^04 low holds, however, the worst may be over. That would imply that long-term rates, currently at 4.53% for 30-Year T-Bonds and 4.38% for the 10-Year Note, have peaked. In any event, I do not expect them to exceed the highs they achieved in October at, respectively, 4.99% and 5.15%.

Debt’s Real Cost

I should point out that this is not necessarily cause for jubilation, especially if recession causes asset values to deflate. That would return us to the financial environment of the 2007-08 Crash, when even 4% mortgages placed a crushing burden on homeowners whose property values had gone underwater. It is real rates — yield minus inflation — that ultimately matter, not nominal rates. Unfortunately, there is no escaping the debts we have amassed publicly and privately, and there are reasons to strongly doubt that those who owe will get to stiff creditors via hyperinflation or even sustained inflation. Regardless, and irrespective of the nominal level of rates, payback will exact a heavy toll on future production and our standard of living.

What our customers are saying about us...

Forecasts Delivered Before

The Morning Trading Bell Rings

As a Rick’s Picks subscriber, you will be getting this information the moment it’s posted on the membership site, usually shortly after midnight Eastern Standard Time… more than enough time to capitalize on Rick’s suggestions.

Then, throughout the day as Rick updates his forecasts with additional guidance based on market conditions, you’ll be instantly informed via email alerts… allowing you to take full advantage of breaking trends and market fluctuations.

These picks include a rotating basket of stocks, futures, indexes, and other hot issues, with a daily focus on precious metals. Rick’s Picks subscribers have their favorites, so Rick regularly covers Comex Gold & Silver, the NASDAQ, the Euro, and the E-Mini S&P in addition to the hot issues he believes will offer significant profit-taking opportunities for his subscribers.

Each specific pick is hand-selected by Rick, and includes actionable trading advice, specific price targets, and annotated Hidden Pivot charts with supporting data.

Your Free Subscription Includes:

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- ‘Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Your Satisfaction is Guaranteed

Once you see how powerfully accurate Rick’s forecasts truly are, we’re sure you’ll stay on as a full member. But if for any reason you’re not convinced, simply cancel before the two week’s end and you won’t owe us a single dime. Fair enough

Paid Subscriptions We Offer

Monthly

Annually

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Mechanical Trade Course

A very simple set-up that will have you trading profitably quickly even if you have never pulled the trigger before, and even with a small account.-

Leverage violent price action for exceptional gains without stress

-

Select trading vehicles matched to your bank account and appetite for risk

-

Reap fast, easy profits by exploiting the ‘discomfort zone’ where most traders fear to go

-

Enter all trades using limit orders that avoid slippage, even in $2000 stocks

-

Learn how to read the markets so that you no longer have to rely on the judgment of others