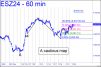

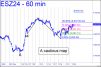

The December contract cheated us out of a profitable 'mechanical' buy at the green line when it erupted for a 60-point rally without having quite touched our 'launching pad' at x=2598.80. Price action is bullish but not quite bullish enough to make the bounce a shoo-in to achieve the pattern's 2770.70 target. We'll therefore begin the week without the usual confidence and clarity, so check for updates if there's any movement, since that cannot but shed light on the strength and resilience of the uptrend. My gut feeling is that it will achieve d=2770.70, but without making it look easy. _______ UPDATE (Dec 3, 3:58 p.m.): More sideways tedium this week has added nothing useful to an indecisive picture. I am proffering this chart nonetheless as a companion to the update moments ago of the Silver tout immediately below. Both need an upsurge through their respective midpoint Hidden Pivot resistances to signal the onset of a meaningful rally.

A bearish target at 28.445 target that has been forever in coming now looks highly likely to be reached. The reverse pattern with which it associated is sufficiently gnarly that you can bottom-fish there with a very tight stop-loss, preferably crafted with a 'camouflage' (i.e., small-pattern) trigger. Alternatively, the futures would signal an opportune 'mechanical' short on a rally to 31.880. That is a Hidden Pivot midpoint resistance associated with a=30.440 (10-8, 180-minute) _______ UPDATE (Dec 3, 4:09 p.m.): March Silver has tripped a theoretical buy signal with the potential to reach 34.870. The link is to a reverse pattern that I expect to work well for all purposes: buying, shorting, forecasting, determining trend strength. It is bullish that Silver has gotten traction, sort of, without having come down to the 28.455 target we were using to clock the correction. But the retest of the November 14 low should not have been necessary to jump-start Silver, and that will remain a concern until such time as the futures impale p=32.483, a key number for the near term.

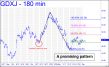

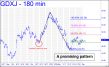

With its 'locked' point 'a' low, the pattern shown looks reliable for our purposes, whether trading or forecasting. It is not a healthy sign that the rally off the 44.76 low recorded on November 14 failed on the first attempt to reach the red line, a midpoint Hidden Pivot at 49.17. Bulls could still pull it off, but if GDXJ dips below C=44.76, negating the pattern, that would be more than a mild discouragement. The weakness so far is especially dispiriting because of the power of the impulse leg that took GDXJ quickly from 46.71 to 55.58, a 20% move, in mid-October. _______ UPDATE (Dec 9, 9:17 a.m. EST): This morning's gap through p=49.17 has guaranteed that the rally will reach D=53.58, at least. Be prepared for a stall there.

The chart shown (inset) substitutes a single target for two at, respectively, 107,670 and 119,253 that were given here last week. They will remain viable in theory, but it will be simpler to use a single target that would become a lock-up if and when the Hidden Pivot midpoint resistance is decisively exceeded. I have blanked out the Hidden Pivot levels for p, p2 and D because they looked too useful to share with outsiders. To reproduce the chart with the coordinates and precise levels, combine the visual information in the thumbnail chart with data I posted in the chat room at 2:00 a.m. Sunday morning. _______ UPDATE (Dec 6): If you're updating the chart, add in a low at 92,091 on Thursday that provided a textbook opportunity to get long 'mechanically' at the green line (x=93,344) for a so-far $8500 ride. Meanwhile, the target (1xx,343.54) I posted last Saturday at 2:20 a.m. remains not just valid, but downright enticing.

The big pattern shown in the inset is too ambitious to frame the so-far timid gyrations that have lifted T-Bonds from their bear-market low. However, I have used it anyway because lesser charts magnify TLT's indecisiveness even more. Regardless, the gyrations have triggered a theoretical 'buy' signal that will require a follow-through to at least p=116.27 for validation, TLT is tradable in the meantime, but only by way of short-term signals on the intraday charts. A breach of c=82.42 would be discouraging news for the few bond bulls who have bucked the tide, although not necessarily for those who have been waiting for a washout to load up the truck.

DXY's sharp poke on Friday through p=107.55, the midpoint Hidden Pivot, implies the rally is very likely to reach the pattern's 108.98 target. This symbol is not optionable, but you can trade the futures contract by interpolating my targets. It is encouraging to see bullion strengthen with the dollar rampaging higher. Its potential on DXY's long-term chart is to 119.37, or 124.82 if any higher (monthly chart, A= 89.54 on 5/31/21). A move of that magnitude would put enormous strain on all who owe dollars, and a ruinous deflation would likely be the result. This would occur irrespective of the level of nominal interest rates, since it is the real (i.e., inflation-adjusted) burden of debt that matters, not the marquee number.

Since it has become difficult even to imagine a prolonged downturn, I'm being extra cautious with this week's projection. It points most immediately to a potentially tradable top at 6007.50. This reverse-pattern Hidden Pivot resistance is well located, and the pattern is not too obvious; that's why odds for shorting there are attractive. However, any progress above the resistance, especially if easily achieved, would imply more upside to 6019.50, the midpoint pivot of a larger, conventional pattern; or even to D=6101.75. There is one more trade possibility to recommend, a 'mechanical' buy if the futures fall straightaway to the red line (p=5931.25). The stop-loss would be at 5905.75, but you'd want to use a 'camo' trigger to reduce entry risk by as much as 95%.

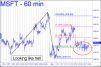

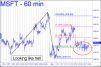

I've always treated MSFT as an infallible bellwether. My narrow, if not to say obsessive, focus has served us well, since MSFT has stayed consistently a step ahead of the broad averages, and even ahead of other stocks in the lunatic sector (i.e., the atrociously misnamed Magnificent Seven). But the long bull market has not conditioned us to think that when MSFT acts like crap for an entire year, as it has, that it is signaling a possible end to the bull market. This I will infer, however, implying that the failure to produce an easy 'mechanical' winner after falling to the green line on November 18 is further evidence of a waning bull. This observation would be strengthened by a dip below C=405.57 without having first achieved D=435.90. The target and pattern will remain viable as long as 405.57 is not breached.

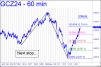

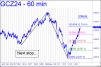

Last week's powerful surge made the futures an easy bet to reach the 2724.40 target we used to stay confidently abreast of the trend. The target, a reverse pattern Hidden Pivot resistance, is shortable, preferably if you know how to set up a small-pattern (i.e., 'camouflage') entry trigger. If the rally easily exceeds d=2724.40, use 2769.00 as a minimum upside objective, and expect it to work precisely. It is calculated by sliding 'a' down to the 2580.80 low recorded on September 18. That is what I refer to as a 'locked' point 'a', since there are no lower lows to be found that would still yield a reverse pattern. _______ UPDATE (Nov 25, 1:42 p.m.): Something has changed, since nasty old Mr Slammy has been showing up too frequently in the last month. Today's gratuitous pounding triggered a 'mechanical' buy at the red line (p=2656.10) that we will shun because of gold's punk behavior of late. The trade is holding so far, since the intraday low at 2617.90 is $1.30 above the textbook stop-loss. However, I'll recommend bottom-fishing only at the green line (x=2598.80), provided you understand the trade and can manage entry risk tightly. Also, don't expect the bounce to reach the D target at 2770.7. This one should be played for a one-level gain, from x to p, since it's possible an important top was seen with October 30's print at 2801.8, inches from a key target I'd billboarded months earlier.

The weekly chart makes a compelling case for more slippage to the 28.455 target we've been using as a minimum downside projection. The initial penetration of p=31.763 was decisive, and the subsequent selloff exceeded p2=30.109. This implies that we should short x=33.416 'mechanically' if a rally reaches it. There would be $5 potential in any subsequent drop, one of the juiciest trades we've seen in a long while. Profit aside, my point is that even a strong rally right now should be viewed with caution, if not outright skepticism. If you want to get long in the meantime, I'd suggest using the d target of a reverse pattern on the 60-minute chart or less.