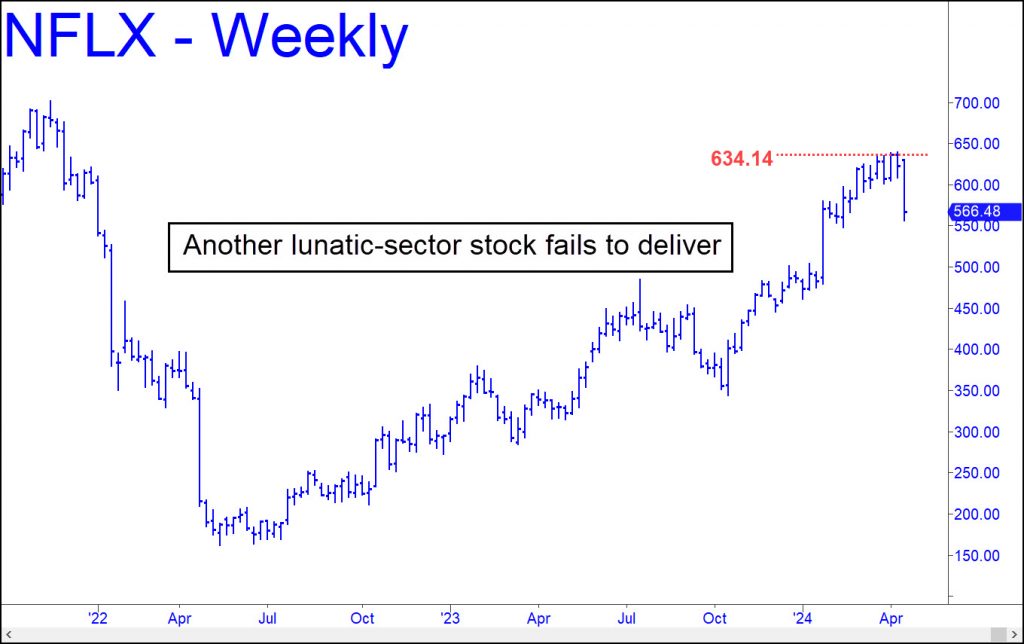

The portfolio managers who rig the markets appear to be losing their touch. Usually, they are able to short-squeeze stocks in the ‘lunatic sector’ — our label for the egregiously mis-named ‘Magnificent Seven’ — when earnings are announced after the close. This quasi-criminal manipulation can add hundreds of billions of dollars to the world’s ‘wealth effect’ in a literal blink of an eye when it occurs in a mega-cap stock such as NVDA or AAPL. But the greedy con-game conspicuously failed to ‘grow wealth’ on Friday after Netflix reported adding droves of new subscribers in the previous quarter. The good news supposedly caught dull-witted analysts by surprise, even though a half-smart chimpanzee could have seen it coming after Netflix put the screws to millions of viewers who had been using friends’ passwords. The stock should have vaulted into outer space, since, in a bull market, all earnings announcements are treated as wildly bullish regardless of whether the news is actually bullish. That’s how bull markets work.

Not This Time

Not this time, though, Instead of taking the obligatory short-squeeze leap into outer space, Netflix feebly head-faked to stop out a $640 peak from ten days earlier by a paltry $1. That peak and Friday’s slightly higher one merely dented a Hidden Pivot resistance at 634.14 that we’d told subscribers a couple of weeks ago could cap the bull-market. On Friday, if everything had gone according to the script after earning were announced, the stock should have begun to gyrate wildly, allowing DaBoyz to work the swings like killer whales herding dolphins. Lo, NFLX simply continued to fall, ending the day $90 below the fake-out high.

Ordinarily, we wouldn’t read too much into DaBoyz’ failure to hold NFLX aloft so that they could distribute millions of shares to widows, pensioners and orphans. But taken together with Microsoft’s month-long failure to surmount a $430.58 target we’ve been drum-rolling loudly since 2023, it suggests the 15-year-old bull market is struggling for air. Bottom line: If MSFT continues to pussyfoot beneath $430 and to fall further from the ‘Hidden Pivot’ with each selloff, investors had better prepare to pack up in May and go away.