The Morning Line

Prepare to Sell in May and Go Away

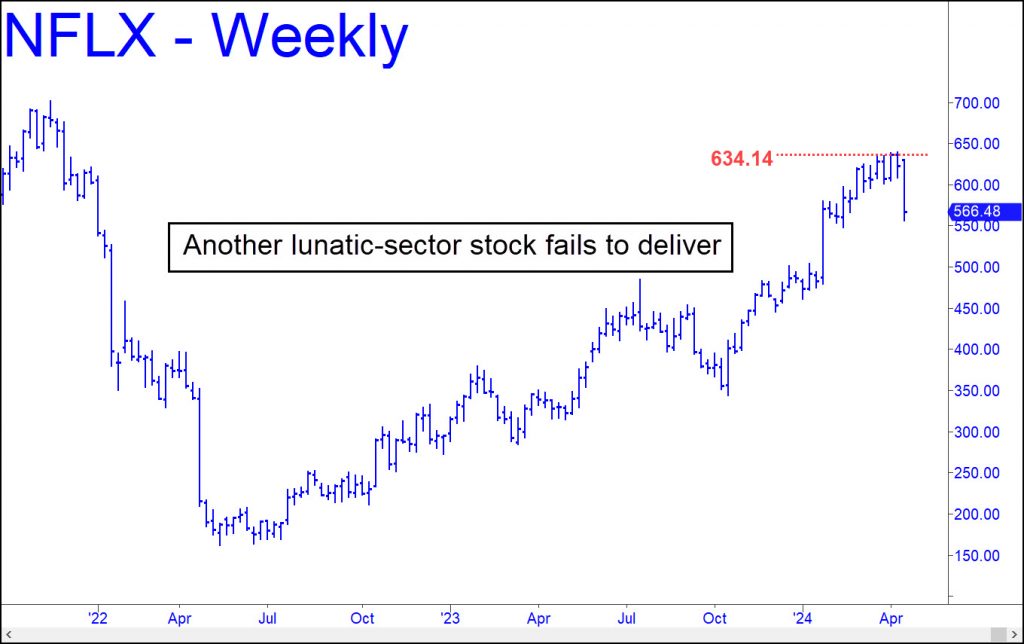

The portfolio managers who rig the markets appear to be losing their touch. Usually, they are able to short-squeeze stocks in the ‘lunatic sector’ — our label for the egregiously mis-named ‘Magnificent Seven’ — when earnings are announced after the close. This quasi-criminal manipulation can add hundreds of billions of dollars to the world’s ‘wealth effect’ in a literal blink of an eye when it occurs in a mega-cap stock such as NVDA or AAPL. But the greedy con-game conspicuously failed to ‘grow wealth’ on Friday after Netflix reported adding droves of new subscribers in the previous quarter. The good news supposedly caught dull-witted analysts by surprise, even though a half-smart chimpanzee could have seen it coming after Netflix put the screws to millions of viewers who had been using friends’ passwords. The stock should have vaulted into outer space, since, in a bull market, all earnings announcements are treated as wildly bullish regardless of whether the news is actually bullish. That’s how bull markets work.

Not This Time

Not this time, though, Instead of taking the obligatory short-squeeze leap into outer space, Netflix feebly head-faked to stop out a $640 peak from ten days earlier by a paltry $1. That peak and Friday’s slightly higher one merely dented a Hidden Pivot resistance at 634.14 that we’d told subscribers a couple of weeks ago could cap the bull-market. On Friday, if everything had gone according to the script after earning were announced, the stock should have begun to gyrate wildly, allowing DaBoyz to work the swings like killer whales herding dolphins. Lo, NFLX simply continued to fall, ending the day $90 below the fake-out high.

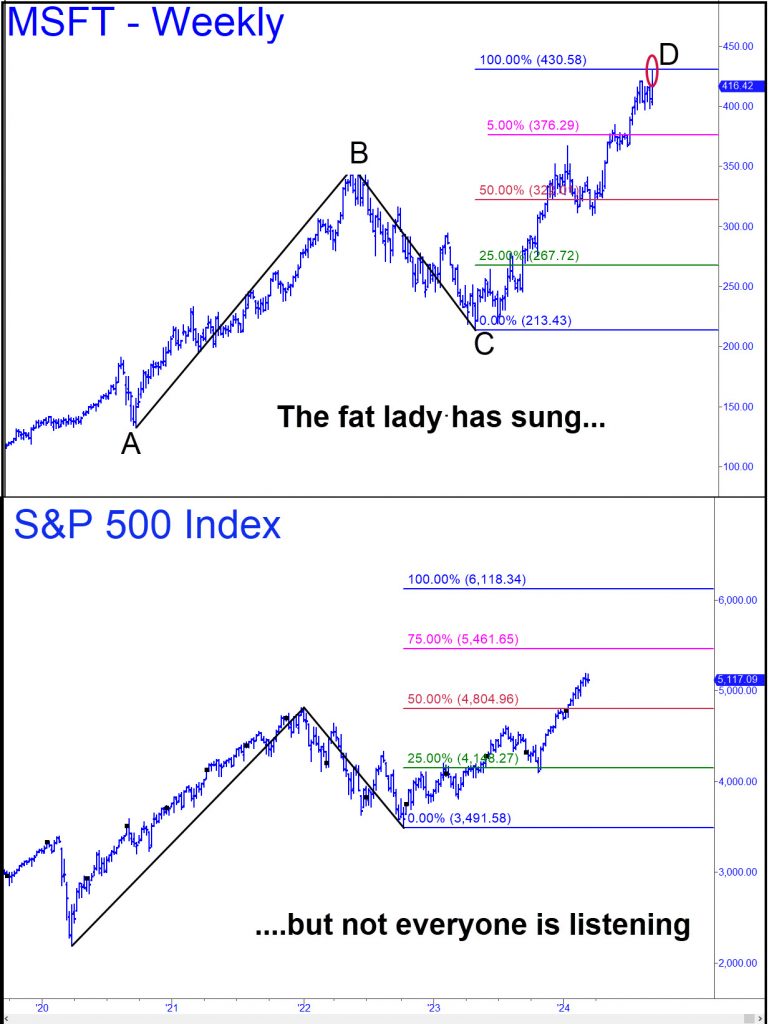

Ordinarily, we wouldn’t read too much into DaBoyz’ failure to hold NFLX aloft so that they could distribute millions of shares to widows, pensioners and orphans. But taken together with Microsoft’s month-long failure to surmount a $430.58 target we’ve been drum-rolling loudly since 2023, it suggests the 15-year-old bull market is struggling for air. Bottom line: If MSFT continues to pussyfoot beneath $430 and to fall further from the ‘Hidden Pivot’ with each selloff, investors had better prepare to pack up in May and go away.

Springtime for Bonds?

The devastating bear market in Treasury paper since 2020 may be nearing an end. I was pessimistic about this myself when TLT, an exchange-traded fund, that tracks the long bond, broke down last week. But a bigger picture saw this as occurring in the context of a market that may have bottomed last October. The bounce from that low triggered a theoretical ‘buy’ signal in bonds in mid-December when it touched the green line shown in the chart.

Don’t expect a meteoric rise, however, since it could take a while for T-Bonds to build a base for a sustained move higher. Assuming the 107^04 low holds, however, the worst may be over. That would imply that long-term rates, currently at 4.53% for 30-Year T-Bonds and 4.38% for the 10-Year Note, have peaked. In any event, I do not expect them to exceed the highs they achieved in October at, respectively, 4.99% and 5.15%.

Debt’s Real Cost

I should point out that this is not necessarily cause for jubilation, especially if recession causes asset values to deflate. That would return us to the financial environment of the 2007-08 Crash, when even 4% mortgages placed a crushing burden on homeowners whose property values had gone underwater. It is real rates — yield minus inflation — that ultimately matter, not nominal rates. Unfortunately, there is no escaping the debts we have amassed publicly and privately, and there are reasons to strongly doubt that those who owe will get to stiff creditors via hyperinflation or even sustained inflation. Regardless, and irrespective of the nominal level of rates, payback will exact a heavy toll on future production and our standard of living.

At Ringside for Another Freaky Friday

[Many readers of these weekly commentaries may not be aware that the focus of Rick’s Picks each day is on timely trading ideas. Below is chat room banter for a typical ‘freaky Friday’. The discussion includes several trades that were posted ahead of actionable opportunities in a few stocks, including McDonald’s, Tesla and Amazon. All the links are live, most of them displaying charts with the ABCD patterns we use to trade. Some display two key pieces of the pattern: Hidden Pivot midpoints (p) and targets (D). For some of you, the jargon might take a little getting used to. However, trade instructions are usually phrased so that even beginners can follow them. There is a separate chat room called the Coffee House for off-topic conversations where ‘anything goes’. IF you’d like to sample Rick’s Picks, click here for a free two-week trial subscription. RA ]

Microsoft’s Hat-Trick

8:55 Rick: MSFT setting up for a hat-trick of mechanical winners — or will it be a rare failure?

09:00 Formula382: Looks like a trampoline Rick. Ya need that energy to get the bouncy bounce.

09:52 Rick: I just sent out a tout update for MSFT that offers a perspective on the bounce.

10:03 Formula382: Anyone in here have any idea how nat gas sits in the dumpster while the pipelines have been quite good to own for example, KMI, OKE, KYN, FCG. I own them all, but that was based on the predication that “surely nat gas has to go up”, which it has not!

10:07 Spartacus: McDonald’s… A trouper

10:14 Rick: Here’s my MickeyD prognosis

10:22 Spartacus: Now Short NVDA and TSLA using Apr 12 puts

10:23 Spartacus: MCD Thanks Rick I think I will cover off of that chart

10:23 Ronbl: Gold is obviously going to go up but will bitcoin really do the same? Seems like bitcoin is following the market

10:25 Rick: Bid 0.55 for expiring MCD 267.50 calls to bottom-fish the 267.05 target. Order good till 11:00 a.m.

10:27 Spartacus: MCD Cover the MCD short by buying back the calls. Profit $11,900 Thanks for the help Rick. OK lets spec on the bounce

10:27 Rick: Ur welcome. Great trade, Sparty!

Did We Get Front-Run?

10:30 Spartacus: MCD 167.5 calls.. Did we get front run?

10:35 Rick: Not sure. The so-far low at 267.30 missed my target by 0.25, or less than 1/10 of one percent. Seems close enough for us to consider the target fulfilled, but I’ll leave the 0.55 bid in for the calls anyway. They expire tomorrow and are already melting away; that’s why I am lowballing my bid and time-limiting it. The offers are skittishly high, but I’d rather not buy the calls at all than pay up for them. That’s because their volatiity will get crushed if the stock does rally from my target.

10:41 Spartacus: TSLA grinding away at P level. Very sickly action. Still a short IMO with fresh money. I am holding short.

10:45 Spartacus: All the newbie nervous nellies (NNN) bailed on their big gains in the PM sector fearing losing the initial gains. But it’s powering higher.

10:49 Spartacus: MCD right there 167.1

10:53 Rick: Your question has been answered: The 267.05 target did get front-run. This is certain, given the way the stock played toe-sies with it for ten minutes. So many are evidently aware of the target that it is now predictable that it will be breached. Lower the bid for the calls to 0.40.

10:53 Spartacus: OK who is the spy in here?

10:56 Spartacus: I guess I need an education. Why if it got slightly front-run will it actually lead to it going lower?

10:56 Rick: The pattern would have generated a trampoline bounce in the past. However, the ability of dolts and riff-raff to read fairly gnarly patterns is continuing to evolve.

10:59 Rick: I am expecting more of a relapse based on the ‘gangs-all-here’ buying I was seeing just above the target. Bulls went all-in, leaving no one to buy MCD back up to 270. How much lower than 267.05 this impending relapse goes will tell us how big the crowd of village idiots was that were able to identify 267.05. // UPDATE 11:10 a.m.) It’s starting to look like a Village Idiots Convention at 267. I’m canceling the call bid. They will make money, but not enough, and it’s already been too much work. The goal is to buy the calls and have them go instantly in-the-black. These calls will struggle when the stock finally turns.

11:08 Spartacus: TSLA just cracked

Notice Gold’s Bounce…

11:13 Killington: Notice how gold bounced off Rick’s 2344 target.

11:14: Rick: That target was for the August contract. THE KEY NUMBER FOR THE JUNE IS 2356.90!

11:15 Rick: MCD now looks like it will turn from 266.53, a target that the riff-raff will NOT have figured out. // UPDATE: Sorry, but I cannot keep up with the new option-trading opportunities. Can’t post AND trade myself.

11:18 Henry608: GDXJ/NEM/GOLD all closing in on targets. When they trade like this it always brings doubt that the move could possibly stop. Begining to downsize positions. Just talking out loud.

11:21 Spartacus: Sold TSLA Apr 12 175 puts bought an hour ago.. Profit $8,000

11:26 Roxygroove: Which strike did you use for TSLA, Sparty?

11:28 Rick: Urgent update just mailed out re June Gold. Target, as noted above, 2356.90. This pattern is fairly gnarly and should be expected to work precisely.

11:29 Spartacus: See above: 175

11:40 Spartacus: Close in silver objective:…..

11:42 Spartacus: BOT 150 MCD 167.5 calls avg price 0.40… look at it run!

11:45 Rick: 150! I admire your patience and perspicacity.

11:46 Spartacus: I’m out of the MCD 167.5 calls. Excellent guidance Rick… Profit $4,500

11:46 Spartacus: But I sold too early… Way too early!!!!

11:50 Spartacus: Gave up on the NVDA puts. Sold and took a $2,200 loss

11:57 Roxygroove: Still impressed by your trading, Spart.

12:00 Spartacus: AYA Silver… breaking out. This one is a coffee-can keeper. (no trading, just hold)….

12:01 Spartacus: The the two MCD trades will buy a lot of Big Macs!

12:02 Henry608: Great call on NEM Rick. Didnt take the whole ride, but scalped a nice move in the middle.

12:08 Rick: Thanks for the upbeat report, Henry. Glad to have helped. . The stock has had quite a move — up $5, or 20%, in the last week. However, it is currently within 13 cents of the 39.33 target, so it’s time to take profits on at least half of any positions acquired at 34.80.

12:15 Rick: With NEM and June Gold just millimeters from compelling rally targets, the yellow flag is out on gold.

12:18 Spartacus: Sold another 10 Apr 19 AAPL 150 calls @ 20.7

12:21 Rick: Thanks for the timely heads-up, Sparty. Naked-shorting calls is the ticket in AAPL at the moment. The stock looks like a 95% shot of falling to 147.64, about 13% below the current 170.24.

Elation’s Downside

12:24 Henry608: I’m an old guy (67) and love your analysis. I have learned over the years that the more elated one is feeling, the more care needs to be taken. Today, for me, Gold up nearly $40, after already large moves. Elation all over. Can it break and keep going? Yep. Learned a long time ago not to worry about the 20% times that happens. Love your insight and small quips every now and then. Thanks.

12:24 Spartacus: WOW did I leave a lot of money on the table in those MCD calls…..$$$$ no guts no glory

12:25 Dan: MCD moving up , still holding a few april 12 170 calls

12:27 Baplg: Does it make any sense to buy AAPL puts at 165 strike for 4/12 or 19?

12:30 Rick: It almost NEVER makes sense to buy puts. This will still hold true when the bear market begins.

12:32 Baplg: Thx

12:33 Rick: You should buy them — and calls – only when you expect your position to go in-the-black immediately. The potential for this has just been signaled in AMZN, by the way. Give me a moment to figure out a strategy for…NOW.

12:33 KGS: To anyone interested: SIK 24 – 60m, choose an ‘A’ point at the 04/01/24 11:00 ET low with a ‘C’ @ yesterday’s 22:00 ET low suggests a run with momentum over the next 1 – 2 weeks to 29.001 if it breaks above the tout level at 27.55…

12:35 Spartacus: Puts require a good sense of market timing or trading sense. Plus a whole lot of luck and good fortune. I use the shorted calls as my core short and bulk up on purchased puts and calls when a move seems imminent. Today’s example of buying 15 TSLA puts and only had to hold them for an hour is a perfect example

Cashing out of MickeyD

12:38 Dan: Sold my MCD calls for small profit

12:42 Rick: Bid 0.48 for AMZN 12 April 180 puts, day order. Currently trading for 0.78. I may adjust this price before the close, so stay tuned. We really do want to buy ’em, based on this appealingly gnarly pattern in the underlying:

12:44 Rick: This one is for novices, too — especially if you’ve never made a profitable option trade.

12:44 Roxygroove: That’s the kind of advice that helps us newer traders, Spart. Very appreciated. RA has shared some things too. Knowing strategy of ‘what to use, and when to use it’ is valuable. I know you do in-the-money and out-of-the money strikes. maybe sometime you can elaborate on reasons behind that, too.

12:46 Roxygroove: RA, your AMZN tout very timely, I oopsed and went in too early on a short call. one small correction and I’m ok.

13:00 Baplg: NEM has surpassed the 39.33 target. I see where that number came from, but don’t quickly see another

13:01 Rick: Any next target must come from a bigger pattern. The only one available — it’s a beauty that will work for trading and forecasting — is this ‘reverse’ on the daily: a= 37.45 on 11/3. Today’s price action plotted on this pattern gives NEM a VERY good chance of hitting 47.38! First, let’s see if the stock can blast free of 39.33’s gravitational pull. Anyone who trades NEM should work through this pattern to see what a glow-in-the-dark opportunity in gold looks like.

13:05 MM18: Sold 1 Apr 19 AAPL 150 calls @20.45 as per Spartacus Bid 5 AMZN 12 April 180 PUTS @ .48 as per Rick

13:24 Rick: MSFT did in fact achieve the hat-trick that began this morning’s thread, bouncing $9 to reach p= 426.07 and record a third consecutive ‘mechanical’-trade winner. This is of course bullish, adding weight to the likelihood that the tedious masturbation since mid-March has been a consolidation. This matters a great deal, since the picture threatens to brush aside a crucial, 430.58 Hidden Pivot target that has held for nearly a month.

13:43 Philjr25: Bid in April 12 AMZN

14:09 Spartacus: I just came off margin in all of my PM stock portfolio. Still holding a chunk but no longer leveraged

14:15 Ronbl: thanks Spartacus

15:04 Bill: Thanks for the reco on NEM, Rick. It has worked well for me.

16:01 Roxygroove: AMZN tout helped me ride it down to afternoon lows. i had a very minimal loss after taking a early morning position that went sideways on me. tout very appreciated,

17:00 Lasker: Rick, I have arrived here late but over the weekend. If you have any way to project a target for June Gold on the downside should it turn at 2356.90 or thereabouts, please share. Would the ‘B-leg’ of the pattern charted give any clues about likely downside?

9:02 Dan: BTW, Spartacus, I followed you yesterday and made 5k. and that makes a difference for me. Thanks so much.

10:09 Jeff: Rick, thank you for your guidance in the room on Futures. Very much appreciated.

12:48 Dan: Yes, I want to say it as well: Many thanks for 150% you give us every day.

15:25 Kerrdog: This is the perfect place to be for any trader, seasoned or new there’s constant input and learning. Thanks to all.

18:07 Rick: Thanks for the encouraging words. Glad Rick’s Picks evidently is working for you. Looking ahead to next week, you should consider all three bullion touts out Sunday evening together. The resulting picture suggests that although the bullion vehicles I track regularly have stalled at daunting HP resistances, the odds of a powerful breakout are probably no worse than 50-50. I’ve included quite a few extra charts in this week’s updates to help you judge for yourself.

04:57 Artie: Anyone? July wheat futures A11/27/23@586 B12/6/23@666 C3/11/24@537. It is already through P if I have the chart correct. Calling for lot higher prices if war starts. Did it bottom?

9:20 Rick: The chart is calling for a possible 6% move to 617.75. The rally so far has triggered two profitable ‘mechanical’ buy signals. Why worry about whether it has bottomed, or whether war will turn out to have been the cause? No one can say, but it isn’t necessary to form an opinion about either to trade July Wheat profitably.

Why We Fail to Fix Things

[My colleague Charles Hugh Smith is a true outside-the-box thinker who tackles big questions with intellectual rigor and bold imagination. In the commentary below, he explains why neither our political system nor technological wizardry have been able to solve problems that threaten to topple the global economy and destroy our quality of life. You can support excellence by subscribing to his blog, Of Two Minds, on Patreon. RA]

We say we want solutions, but we actually want a specific subset of solutions: those that already meet with our approval. The possibility that none of these pre-approved solutions will actually resolve the problem is rejected because we are wedded to the solutions that we want to work.

The sources of our resistance to admitting that our solution is now the problem are self-evident: holding fast to an ideological certainty gives us inner security, as it provides a simplified, easy-to-grasp frame of reference, an explanation of how the world works and a wellspring of our identity.

Our ideological certainties also serve as our moral compass: we believe what we believe because it is correct and therefore the best guide to solving all problems faced by humanity.

If we frame all problems ideologically (i.e. politically), then there is always an ideological “solution” to every problem.

If we frame all problems as solvable with technology, then there is always a technological “solution” to every problem.

If we frame all problems as solvable with finance, then there is always a financial “solution” to every problem.

In each of these cases, we’re starting with the solution and then framing the problem so it aligns with our solution. This is not actually problem-solving, and so the solutions–all blunt instruments–fail to actually resolve the complex, knotty problems generated by dynamic open systems with interconnected feedback loops.

Self-interest also plays a role, of course, as self-interest is core to human nature, along with an innate desire to serve the best interests of our family, group, tribe, neighborhood, community enterprise, class and nation. That we prefer solutions that maintain or enhance our current financial and social position in the status quo is no surprise.

Many of the built-in biases we are prone to serve to protect and solidify our beliefs. When challenged, or proven incorrect, rather than relinquish our beliefs, we double-down and defend them more aggressively.

We can understand this irrational attachment as sunk costs: we’ve invested so much of ourselves in an ideological certainty that letting go of it is a tremendous loss: our inner security collapses into an unmoored chaos that is disorienting and uncomfortable.

We also fear the consequences of the world turning against our certainties, for both our inner security and real-world security are at risk.

No wonder we double-down on defending our certainties as evidence piles up that our proposed solutions are failing or making the problems worse.

Our initial response is emotional rather than rational: we slip into the comforting arms of magical thinking and reductionist thinking, simplifying the bewilderingly complex, interconnected problems down to either-or choices–left or right, capitalism or socialism, globalism or nationalism, etc.–and see glimmers of hope in unrealistic magical thinking: our desires for endless low-cost energy will be met by switch grass, test-tube biofuels, etc.

Technology-based magical thinking becomes a comforting ideology in and of itself. If we can return to the Moon, it means we can accomplish anything. We will innovate our way to technological solutions to all our problems. We’ll bury billions of tons of carbon, geo-engineer our atmosphere, launch tens of thousands of additional satellites, build new sources of limitless energy, all without having to sacrifice any of our current consumption, and in doing so we’ll create millions of good-paying jobs that will support permanent growth of our consumption of the planet’s resources.

Historian / critic Christopher Lasch (who died in 1994) saw that the either-or mindset of left-right, Progressive-Conservative was already a dead-end in 1990 when he wrote The True and Only Heaven: “We need to ask whether the left and right have not come to share so many of the underlying convictions, including a belief in the desirability and inevitability of technical and economic development, that the conflict between them, shrill and acrimonious as it is, no longer speaks to the central issues of American politics.” (page 23)

If this is true–and it seems self-evident to me–then we’ve squandered 30+ years clinging to solutions that have not only failed, they’ve become problems that existing conventions cannot possibly resolve.

Lasch also grasped the impossibility of endless growth on a finite planet: “Both left and right, with equal vehemence, repudiate the charge of ‘pessimism.’ Neither side has any use for ‘doomsdayers.’ Neither wants to admit our society has taken a wrong turn, lost its way, and needs to recover s sense of purpose and direction. Neither addresses the overriding issue of limits, so threatening to those who wish to appear optimistic at all times. The fact remains the earth’s finite resources will not support an indefinite expansion of industrial civilization.”

“This program (of endless expansion of consumption) is self-defeating, not only because it will produce environmental effects which even the rich cannot escape but because it will widen the gap between rich and poor nations, generate more and more violent movements of insurrection and terrorism against the West, and bring about a deterioration of the world’s political climate as threatening as the deterioration of its physical climate.”

Though Lasch is often characterized as a social conservative, he had a keen appreciation of Marx’s critique of capitalism and the extension of this critique to the social order by 20th century Marxists. (Understanding Marx’s critique does not make one a Marxist; as with all either-or false choices, one can value Marx’s critique while dismissing his utopian vision of the workers’ paradise.)

Here is Lasch: “American imperialism grew out of the structural requirements of capitalism itself, which continued to rest on colonial exploitation. Those who rejected the economic determinism often associated with Marxism nevertheless took it as an essential principle of social analysis that a society’s institutions had to be understood as expressions of its underlying structure.”

“But the attraction of Marxism, in my own case, lay not only in its ability to provide a general explanatory framework but in its more specific insights into the ‘devastated realm of the spirit,’ in Gramsci’s wonderful phrase. I was much taken by the Marxist critique of mass culture. They (the critics) were on the track of something more ominous: the transformation of fame into celebrity; the replacement of events with images and pseudo-events; and the replacement of authoritative moral judgment by the need to know what insiders were saying, the hunger for the latest scandal or the latest medical breakthrough or the latest public opinion polls or market surveys.”

Everything Lasch identified 30+ years ago has continued on its trajectory to further extremes, extremes of dysfunction and derangement that now threaten to upend the entire status quo. This reality is, as Lasch observed, rejected as “pessimism” in a mass culture which demands optimism at all times.

We are trapped in an self-destructive feedback loop of applying “solutions” that were obvious dead-ends 30+ years ago, and when they fail yet again, we double-down and claim that the “solutions” were inadequately pure and so larger doses of our “solutions” will do the trick.

As our dead-end “solutions” fail, we slip into the deranging polarization of us-vs-them: the problem isn’t our “solution,” the problem is the resistance of “them.”

We cannot bear to admit that all our existing ideological / technical / financial “solutions” are incapable of solving the problems that have arisen from the foundational economic and financial structures of industrial civilization that have destabilized systems we don’t understand and democracy by concentrating wealth and power in the hands of the few.

Our insecurities imprison us in dead-end polarities and magical thinking, and our response to the failure of our solutions is to double-down: the fix is an ideologically pure “solution.”

This all-or-nothing thinking is powerful evidence of a profound insecurity: we can’t let go of our beliefs and the “solutions” that come with them, and so we flounder into the swamps of magical thinking, distancing ourselves further from potential solutions which do not fit into our simplified positions of what is acceptable.

Lasch saw the end-game three decades ago: “My own reading and experience had convinced me that American society suffered from the collapse of legitimate authority and that those who ran our institutions, to the degree which they had lost public confidence, had to rely on bribery, manipulation, intimidation and secret surveillance.”

That is an accurate summary of the present.

We keep trying to “solve problems” by framing the problem as a lack of ideological purity (markets weren’t 100% unfettered, our social reform wasn’t 100% rigorous, etc.) or as a problem that awaits a technological innovation as the painless solution.

To keep our magical thinking hopes alive, we’ve “saved” the status quo from consequences by creating “money” in various forms, all of which are claims on future surpluses of production and resources which we measure as “income.”

History reveals the self-defeating futility of this project, yet we remain confident that technology will save us from consequences, even as technology creates new problems it cannot solve. Our magical thinking belief is that all we need to do is keep the status quo glued together long enough for a technological “solution” to arise and solve all our problems.

Some humility might be in order. As Lasch understood, an acceptance of limits is a necessary starting point. Admitting that our pre-approved “solutions” have failed and cannot possibly fix the problems that they’ve created would be useful. We could admit we don’t understand the systems we’re destroying. We could admit that the global Eternal Growth Machine is “melting everything solid into air” and reducing human life to a series of transactions.

Letting go of simplistic global “solutions” would be useful, as would embracing a more practical approach of social as well as technical experimentation and pursuing those incremental improvements that show promise.

Problem-solving demands we reject everything that gives us security. To frame the problems as they are rather than shoehorn them into simplified boxes requires us to embrace insecurity, contingency and uncertainty, all of which make us uncomfortable. This is one reason why “solutions” are so elusive.

Another reason is solutions are rarely painless and sacrifice-free. We must risk what we currently devote our surplus to–consumption, speculation, “investing” in excess and failure–in order to invest in potential solutions, none of which carry any guarantee of success.

As we all know, we only change when there’s no other option. The era of papering over crises by framing our complex, interconnected problems to fit existing “solutions” is ending, whether we approve of it or not.

Bullish and Bored? Here’s the Cure…

The Fed’s main job supposedly is to manage our expectations. But have Powell & Co. painted themselves into a corner? At the moment, it would appear that investors have no clue what to expect from the Fed. That wouldn’t necessarily be a bad thing, except that their default mode has been to push stocks with multitrillion dollar capitalizations into unsustainably steep rallies. This trend is growing more dangerous and delusional by the week, and even a slight feint toward monetary clarity by policymakers could pop the bubble, turning an economic boom quickly into a global downturn. Meanwhile, the Fed’s credibility suffers every time they suggest inflation is mellowing. What their hemming and hawing suggest in reality is that no one on the Open Market Committee has bought gas or groceries in a long time.

The Fed’s main job supposedly is to manage our expectations. But have Powell & Co. painted themselves into a corner? At the moment, it would appear that investors have no clue what to expect from the Fed. That wouldn’t necessarily be a bad thing, except that their default mode has been to push stocks with multitrillion dollar capitalizations into unsustainably steep rallies. This trend is growing more dangerous and delusional by the week, and even a slight feint toward monetary clarity by policymakers could pop the bubble, turning an economic boom quickly into a global downturn. Meanwhile, the Fed’s credibility suffers every time they suggest inflation is mellowing. What their hemming and hawing suggest in reality is that no one on the Open Market Committee has bought gas or groceries in a long time.

Stocks have been in an unnaturally steep climb since October, and no one would be surprised to see it end. Yeah, you’ve heard that before. But we’ll continue to serve up bear market porn anyway because the bullish case is too stupid and boring to write about. However bullish you might be, let’s face it: Stocks do not remotely deserve to be trading at these levels, and only an imbecile or someone paid to lie about it would argue otherwise.

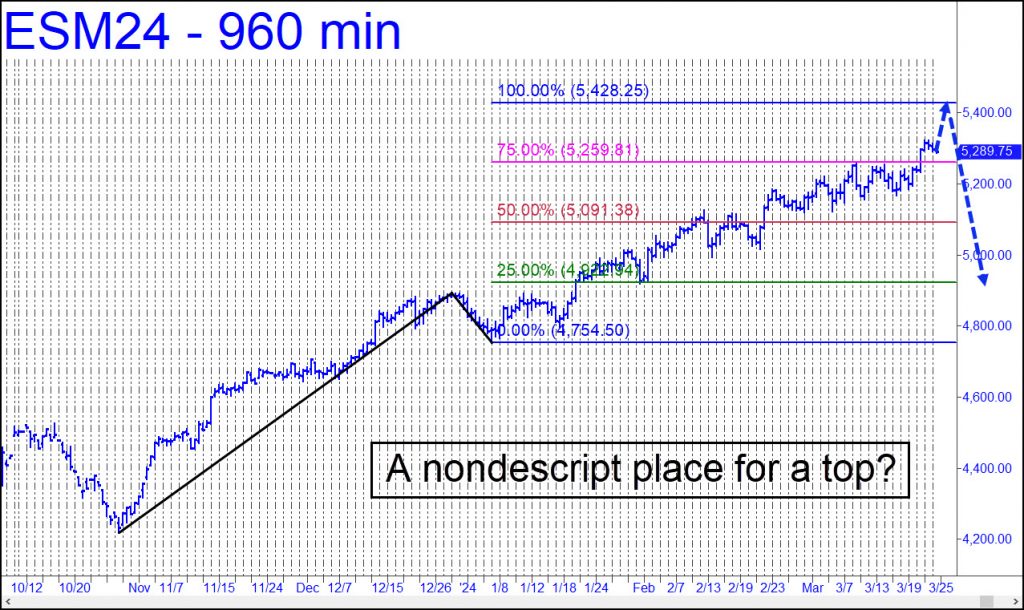

Lunatic Sector

So how soon might we expect the market to go into a hellish dive? The chart above suggests the S&P Index could make an important top just 2.6% above these levels. We like the target because there is so little drama in the chart pattern that produced it. However, before we infer that the end is nigh, we need to put aside the fact that some key stocks in the lunatic sector — specifically Microsoft, Nvidia and Facebook — have already topped within a hair of major Hidden Pivot targets. NFLX in particular looks to have peaked last week with a high at 634.36 that exceeded a longstanding target at 632.47 by just 0.3%.

For now, set a screen alert as a reminder that 5428.25 is an opportune spot to short the E-Mini S&Ps. Even if there’s no immediate reaction, remember that bear markets do happen and that this bull is long overdue for a rebuke.

Something’s Got to Give

For nearly a year, I’ve promoted the idea that the post-covid bull rampage would end when Microsoft shares hit $430. They effectively achieved that benchmark on Friday with a pre-dawn print at 428.95 that gave way to a $16 plunge. If this was not THE top, it certainly felt like A top, and a potentially important one. However, before we draw any conclusions, let’s see if the selloff gets legs, since we don’t want to underestimate the power of a market that has been in the grip of mass psychosis since October. If there were any doubt about this, consider how stocks have rallied into the Fed’s decision to stay tight even after investors had deluded themselves into expecting aggressive easing in 2024.

Originally I’d picked Apple as our infallible bellwether, because it is the most valuable company in the world, and because its shares are so heavily owned by institutions. But so are Microsoft’s, with a key difference: Although iPhone sales are poised to implode in the severe economic downturn that’s coming, Microsoft is unlikely to feel much pain even in the hardest of times. That’s because revenues from Microsoft 365 will continue to flow from more than 60 million subscribers, regardless of the economy’s condition. The company’s earnings are nearly bomb-proof, and that it is why it is arguably the best stock in the world to own, as well as the most important stock to follow. When it is rising strongly, the broad averages cannot fall; if it falls, it will take the broad averages with it.

What If?

However, the technical picture is not complete without considering the very bullish chart of the S&P 500. It says that before the 15-year-old bull market ends, the S&Ps are likely to hit 6118.34, a 20% gain from current levels. How do we reconcile this with signs that MSFT may have peaked? A plausible answer is that both are topping but will resume their respective uptrends after significant corrections. A hard fall seems likely for Microsoft, if not necessarily for the S&Ps, because the software giant’s ABCD uptrend is so clear and compelling. It’s tempting to say there’s no way MSFT will simply blow past $430 without a struggle that features a punitive selloff and then a running start to new all-time highs. If so, the bull-market target would rise to 456.88, a Hidden Pivot derived from extending the pattern’s C-D leg to its maximum theoretical length. That would avoid having to use the bigger pattern’s puny December 2018 low at 93.96 as the starting point for the biggest bull market of them all. We’ll revisit this conundrum if and when MSFT gets second wind following a correction from these levels.

P.T. Barnum Would Have Loved Bitcoin

Bitcoin mania looks likely to blow itself out at somewhat higher levels. The bitcoin ETF chart above suggests buyers will encounter significant resistance at 64.95, a Hidden Pivot target that lies 5% above Friday’s closing price. If this impediment gives way easily or is exceeded for two consecutive weeks on a closing basis, however, you can expect more upside to the alternative target at 70.35. That’s fully 14% above these levels, and although that might seem to portend a powerful move, especially if it occurs in a matter of days, it would probably come as a huge disappointment to countless bitcoin fanatics who have been weaned and nurtured on predictions of $100,000 or more.

I doubt we’ll see anything like that, especially since the shitballs who control bitcoin, Black Rock chief among them, will have reaped more than their directors could spend in a thousand lifetimes if it climbs ‘only’ another 14% . It is for their benefit that regulators approved bitcoin ETFs in the first place, making the cryptocurrency affordable to riff-raff who had been priced out of the market even at its bear-market low near $15,000 in January 2023. Fractional ownership, including with leveraged options, made it possible for kids who were collecting Pokemon cards just a few years ago to become players in the global casino.

Virtual Tulips

It’s hard to imagine how high tulip-bulb prices would have climbed if Dutch teenagers had had access to virtual tulips in 1637, when the mania peaked. We are going to find out, though, when the crypto blowoff sputters out, as all manias eventually do, for lack of greater fools. In the meantime, here’s a link to a recent interview I did with Howe Street‘s Jim Goddard. It explains why bitcoin would be more reasonably priced at $1-$2 instead of $70,000-$80,000.

Full disclosure: I was involved in a crypto scam myself that promised to triple one’s stake in three years. It paid off not in dollars, but in crypto-credits that could be redeemed for Ethereum, which in turn could be swapped for actual money. Unfortunately, when bitcoin collapsed from $70,000 to $15,000 in 2022, my credits, along with nearly all of the 2000 boutique flavors of cryptocurrency that had come to exist at that time, became worthless. I lost only a few thousand dollars, however, because I signed up mainly to see how the scammers, mostly young Asians, worked the grift rather than to make a quick buck. I remain impressed to this day by how these ass-bandits were able to hang tough for long enough to rip off the public much worse this time and to vastly expand the pool of suckers far beyond anything P.T. Barnum or Bernie Madoff could have imagined.

The Dregs Take Flight

The endgame inched closer to singularity last week with rigged rallies in stocks that had rightfully been given up for dead. There was the more than doubling in the price of Beyond Meat, for example. Until last week, shares of the veggie-burger upstart seemed content to scuddle sideways on a tortuous path to death. At $7 a share, the stock had lost 97% of its value since peaking at $240 after its 2019 debut When it was apexing, Wall Street incited the usual wack-jobs into believing that meatless burgers were the food of the future. Cattle ranchers parried this nonsense with a campaign that emphasized why real meat was better for you. They needn’t have worried, however, since most people had already discovered that real meat also tastes a lot better.

Carvana is another stock to have received premature last rites from Rick’s Picks. Consumer complaints about the used car dealer had been piling up mountainously, like grievances against the airlines, causing the stock to pancake from $376 to under $4. Its clever handlers managed to waft it back up to $40, which eventually became a launching pad for an undeserved pop last week to $80. Watch for freaked-out shorts to continue covering their bad bets in the weeks ahead, giving the stock an artificial boost before it finds well-deserved obscurity in the low teens during the next recession.

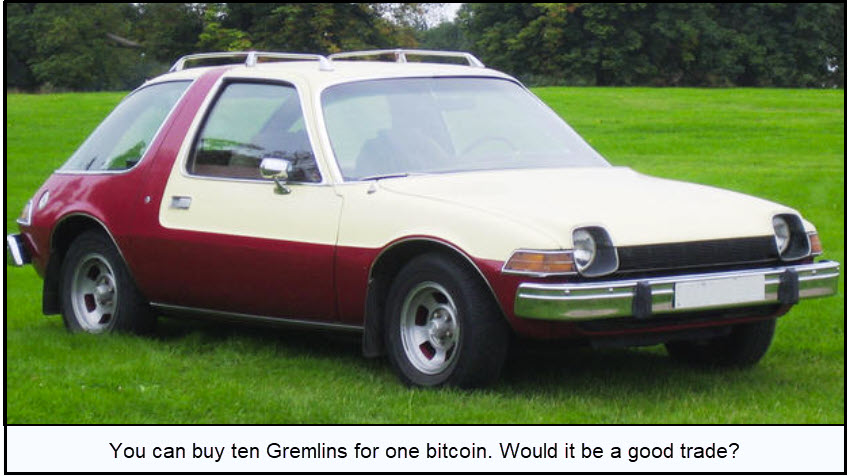

Two Kinds of Sardines

Even so, if Carvana had just one Pontiac Aztek or an AMC Gremlin sitting on a lot, the company’s intrinsic value would exceed that of the world’s entire supply of bitcoin. This inconvenient fact seems not to have deterred speculators from bidding up BTC to $64,000 last week, where it sat poised to take on the all-time high at $70,000 recorded in November 2021. We expect the price to hit $80,547 before the fact of cryptocurrency’s near-worthlessness begins to dawn on speculators, and not for the first time. Indeed, a friend who is a demon-genius with numbers calculated that bitcoin if correctly priced would sell for around $1.38 per copy. This valuation is based mainly on the blockchain’s usefulness for recording financial transaction securely. So far, though, the only other argument we’ve heard for why bitcoin should be worth anything is that it is scarce. But money it ain’t. It is universally hoarded rather than spent, recalling the old joke with the punchline: “These aren’t eatin’ sardines, these are tradin’ sardines!” In any event, we’re inclined to agree with Warren Buffett, who evidently thinks cryptomania will not end well for those who own it at these heights.

The Fallacy of the Wall of Worry

So much for the wall of worry! Optimists and visionaries supposedly climb it while ignoring troublesome signs that leave most investors on the sidelines, paralyzed with fear. Last week, as soaring shares of Nvidia tugged stocks higher around the world, speculators swarmed the wall like cockroaches gorging themselves on dried beer, glue and animal feces. Do insects ever pause to worry? More likely is that even the dark shadow of a size 14 shoe descending on their wretched banquet would not quiet the feverish din of a hundred thousand mandibles crunching away.

And so it is these days on Wall Street, scene of an epic wallow that is far removed not just from worry, but from reality. The so-called Magnificent Seven — we have always referred to these stocks, more appropriately, as the Lunatic Sector — all by themselves created more than a trillion dollars of ‘wealth’ in just the last week or so. This occurred when stocks took volumeless leaps on earnings announcements whose details, whether bullish or bearish, were of scant concern. No one maintains any longer that this is rational behavior. But leave it to Wall Street’s hype machine to tell us that earnings eventually will catch up to the craziness. Really?

Celebrate This!

The megastocks have gone vertical at a particularly unsettling time. Commercial real estate is collapsing, government is doing most of the hiring, brutal price increases for nearly everything have crushed middle-class purchasing power; and borrowers, led by the U.S. Treasury, will need to refinance more than eight trillion of debt this year at significantly higher rates. To make matters worse, inflation is poised to take off again, in part because of higher costs incurred by shippers avoiding Houthi missiles in the Suez.

Under the circumstances, it is far more likely that the next move by the Fed will be to tighten, not loosen. This should have caused investors to knock down stock prices by at least 10%-20%, especially since they began the year expecting the FOMC to ease credit seven (!) times. Wall Street, Europe and American businesses have been counting on it, but Powell has stood firm.

So how do we explain the hyper-bullish reaction to the most negative scenario investors could have imagined just a few months ago?

Mass Psychosis

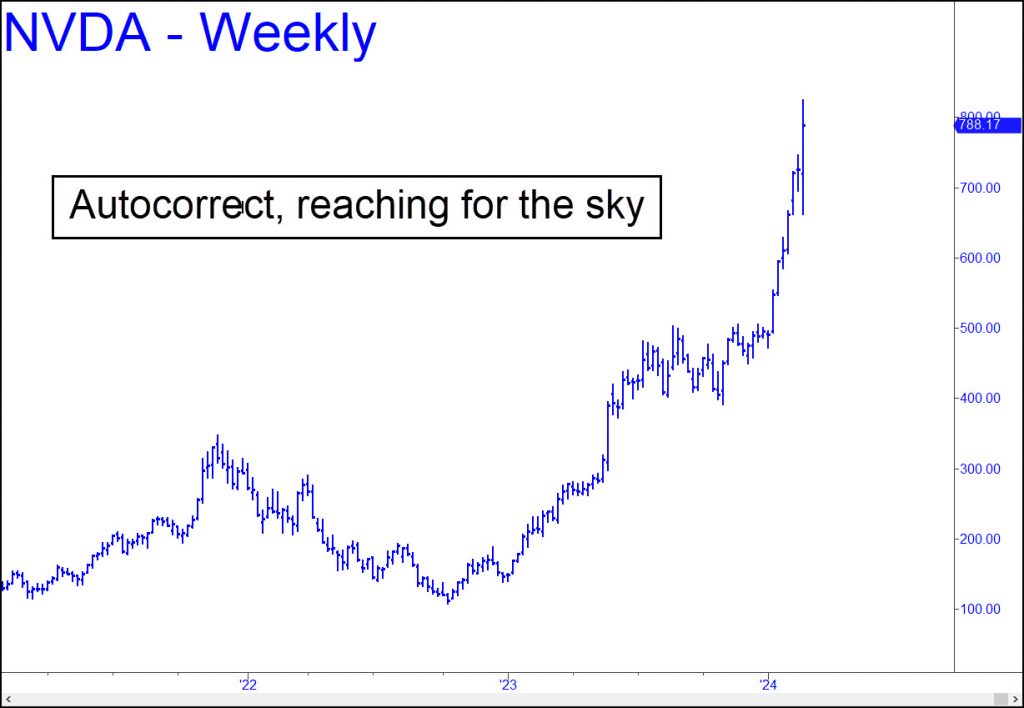

Let’s start by ruling out the idiotic notion that stocks have been climbing a wall of worry. It could not be clearer that mass psychosis, currently at a civilizational apogee, is behind the bullish rampage; that it is oblivious to economic data, no matter how grim; and that it is as clueless about the future as Wall Street’s shills and media lackeys. We’ll also need to ratchet down AI hubris, since, let’s face it, the technology has yet to elevate two widely used applications, Spellcheck and Autocorrect, to the level of imbecile, let alone produce a driverless car. To be sure, AI’s laughable mediocrity won’t hold back its commercial success, since it has the potential to replace half the drones in our workforce. In practice, though, we’d be stuck with massive unemployment and the realization, even in the greediest precincts of Wall Street, that jobless people don’t buy enough goods and services to keep the economy afloat.

If Nvidia is perceived as having all the answers, as its $2 trillion valuation would seem to suggest, investors are not asking the right questions.

The Coming Crash of Bigness

[Globalism has peaked, says my colleague James Howard Kunstler, and with it a trend toward corporate bigness that has all but extinguished quality and vitality from the marketplace. Bloated corporatism is about to come crashing down, he says, in a process of creative destruction that will allow us to rescale the economy so that it better serves our needs as individuals. With his permission, I have reprinted his most recent essay, Think About It, from Clusterfuck Nation. On Amazon, here’s a selection of his brilliantly insightful books, many of them bestsellers RA ]

***

“It’s not enough to be against globalism or the WEF, we have to also be for something better.” — Tom Luongo, Gold, Goats ‘n Guns

Mr. Luongo makes an important point. I want you to think about this: There is a reason that the WEF-Globalist cabal is losing the battle to control and dominate the rest of us. They are trying to power straight into the opposing currents of reality. Above all, they seek to centralize power and decision-making. But the world is moving in the opposite direction. All of the WEF’s aims founder on the macro trends unspooling in history.

The rising rule for human affairs now is that anything organized at the giant scale is going to wobble and fail. There will not be any world government run by the creatures of Davos or Brussels, or Washington DC, or any other place that the grandiose imagine would be their seat of global power. It’s not going to happen, so you can stop worrying about it. But you’d better prepare for what is happening: everything in our world wants to get smaller, slower, finer, and more local. Anything that opposes these trends is pissing into the wind.

Since every activity we humans practice has to move in that direction, we are seeing colossal industries, institutions, and arrangements crack up: everything from national government to long-distance supply chains to giant retailing outfits to worldwide business networks to overgrown universities and high schools to transport matrices to metroplex cities to mega-farms to political parties.

Where the Rot Is Greatest

Where the rot is probably greatest, but more veiled for the moment, is in the operations of organized capital, the banks and money systems, including financial markets. When these monsters blow, as they must, all the others will shake, rattle, and roll. They have to blow because the fuel tank is emptying.

American oil production may be at an all-time peak now at about 13-million barrels-a-day, but most of that — about 8-million — is shale oil, which is a manifestation of our tremendous debt roll-up since 2009. Now that we’re at the absolute limits of debt, we’re also at the limits of shale oil. The production of shale oil paralleled the accumulation of all that debt both in size and rate of increase, and as the debt goes bad — meaning, unpayable — the organized capital sector will blow and shale oil production will fall as sharply as it rose. It is also a fact that shale oil is subject to natural limits — we’re out of “sweet spots” to drill.

That’s America. Europe is way worse because aside from whatever oil is left in the North Sea (not much), Europe has no oil. Europe’s largest gas field — Groningen in the Netherlands — is scheduled to cease operations in October of this year. You all know what happened to the Nord Stream pipelines. And then Germany, in some psychotic fugue state, shut down its entire nuclear power industry, while France is just not replacing its nuke plants as they age-out. Europe is completely screwed. They won’t have anything we might call modern industry. In the meantime, the WEF is playing them like a flügelhorn, keeping them distracted with “green” politics, an unchecked immigrant invasion, and sexual confusion.

The ‘Secret’ About Biden

A lot of the same nuttery afflicts us in the USA, of course, but none of that alters the real macro trends. Our federal government is not really getting more powerful, it’s cracking up, starting from the very top, with a mentally incompetent president — the secret that everybody knows. Agencies like the DOJ and Homeland Security may seem more tyrannical for the moment, but they are actually breaking as institutions because in their lawlessness they’ve lost the trust of the people — and nothing is more fundamental to a civilized society than trust in the law. That’s what consent of the governed means.

So, the period of disorderly transition we’re in is not moving toward greater dominance by giants, but to the survival of the small and nimble. We will not see capital formation like the orgy of recent times; rather the vanishing of things falsely presumed to be capital, contraction not expansion. You’ll be struggling to identify and preserve real wealth, which you’ll find in unexpected places, like the friends you can count on, your reputation for honesty, your dependability, acquired skills, and your health, physical and psychological.

The WEF won’t be able to impose its Globalist nightmare of elite transhumanism and surveilled bug-eating serfs, and they know it now. They’re running scared. The vile Yuval Noah Harari has even said so publicly. The political figures and agents serving that cabal will be lucky if they are not hanged in the public squares. The political criminals here in America, the hoaxsters, the grifters, the seditionists, the Lawfare agents, the election fraudsters, know very well the danger of their looming prosecutions, and that’s exactly why the Democratic Party and its blob henchmen and flunkies are acting like desperate lunatics.

Failed…Everything

Expect: failed national governments, maybe even state governments; failed supply lines; failed electric supply, failed trucking, failed big box stores, failed supermarkets, failed giant companies; failed banks, failed investments, failed money, failed news orgs, failed airlines, failed car dealers, failed hospitals, failed colleges, and much more. But don’t discount human ingenuity and resourcefulness, our ability to work-around and reinvent systems for daily life, even if it’s on a downscaled and more modest level.

Expect rebuilt local economies from production to wholesale to retail. Expect smaller stores, fewer things to buy but much of it better quality. Expect a lot less long-distance travel but a lot more happening in your locality. Expect the rebirth of local culture — theaters, live music, news-sheets, dances — to replace all the canned entertainments we’re used to. Expect small private academies to rise to replace the shuttered central schools. Expect small, local clinics to appear from the ashes of the medical conglomerates. Expect Americans to return to churches as an organizing mechanism for community relations. Expect more formality and less slobbery in public. Expect all of us to feel a renewed sense of gratitude for being here instead of rage, resentment, and grievance, because it’s likely there will be far fewer of us around.