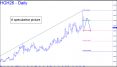

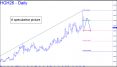

Copper's correction exceeded the midpoint Hidden Pivot support of a pattern I've partially concealed. The overshoot is not sufficient to infer that more slippage to d=5.0095 is a done deal. However, a bounce to the green line (x=6.1896) would set up a moderately attractive 'mechanical' short, stop 6.5830, that presumably would be good for a one-level ride back down to p. If a rally from the green line comes from further below p, that would sweeten the odds for shorts initiated at x.

TLT has done nothing to alleviate a dismal picture on the long-term charts. I am switching the view this week to a chart of long-term Treasury rates which points toward 5.078%. It would be the first time they've traded above the psychologically important 5% level since July, when a peak at 5.077% was recorded. My gut feeling is that anything that close to last May's watershed 5.153% would be tested and exceeded, putting Trump's plans to stimulate the economy in jeopardy. His lips have been pushing hard against the uptrend in yields, but market forces seem to be winning.

Copper and a rotating selection of popular symbols will be replacing Bitcoin on this page, although I will continue to provide timely analysis for Bitcoin on demand in the chat room. The chart shows how copper's price has tripled since bottoming just beneath $2 a pound in March 2020, when covid fears seized the world's machinery. 'Doc' Copper has seemingly done its job since in predicting an upswing in global industrial activity. In particular, it included a surge in demand caused by a worldwide push toward renewable energy and electric vehicles, which require a lot of copper for batteries, charging infrastructure and renewable energy systems. However, copper's ascent has nearly reached a hard target at 6.18 a pound that suggests the bull market may have run its course. Does that mean a global recession-or-worse looms? We will not likely know until a recession is well under way. It is coming eventually, but in the meantime, a bull market that has been galloping along for 16 years should command our respect, if not our unquestioning confidence. If an important top is in at 6.1540 (basis the March contract), it would be corroborated by a pullback that decisively exceeds 5.36. A somewhat higher top would require an adjustment in that number, a Hidden Pivot, so stay tuned.

The mindless herd breathed a collective sigh of relief over the tariff tizzy's latest cliffhanger, celebrating its resolution with a short squeeze up their own wazoos that played out mostly on a single day, Wednesday. The spree left the futures just shy of a 6984.00 target that is nothing special, although its decisive breach would suggest a possible breakout above the range that has asphyxiated the S&Ps since Halloween. More likely is a drop back into the valley, whose floor lies as much as 1400 points below. The 6984.00 target is shortable, but you could also attempt a ride to it, since it is all but certain to be reached. _______ UPDATE (Jan 27, 9:28 p.m.): ES is breaking out, as painful as it is for me to believe. See my comments in the chat room.

DaBoyz took advantage of bearish expectations that had been intensifying since the stock began its long dirge in the final days of October. The rabid short-squeeze pushed MSFT to the top of the list of Friday's percentage gainers. It also slightly pierced a midpoint Hidden Pivot resistance at 469.36 that is associated with a 'D' target at 500.03. Penetration was not sufficient to clinch more upside to the target, nor to guarantee the profitability of a 'mechanical' buy at the green line. (As things stand, it would rate a still-enticing '7.3'.) A bullish trading bias is warranted now, as is the expectation that this behemoth's continuing ascent will add buoyancy to the broad averages and the lunatic sector (aka 'Magnificent Seven').

The daily chart yields two logical possibilities for a top, or at least a pause, at either of two prices: 5132.20, which I've been drum-rolling for a while; or 5300.50. The latter represents an extension of the A-B leg that features a highly unorthodox low labeled A2. Both targets are sufficiently compelling to suggest that bulls will not easily get past them. The patterns, while not in-your-face obvious, are easy enough to identify that we should not expect them to show precise stopping power. Let's therefore be prepared for a stall in a place no one is watching: 5129.60, midway between p2 and D of the larger bottom. Notice that it coincides with the lower target at 5132.20, implying there will be double stopping-power there. _______ UPDATE (Jan 27, 9:35 p.m.): A stall? What on earth could I have been thinking?? This evening's lunatic leap will achieve a minimum 5281.90, exactly 66 points above; and thence, assuredly, a minimum 5300.50.

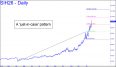

The ballistic, $30 climb since December appears to have topped within spitting distance of my 103.215 target. That could be it, but I'm not counting on it, especially since I have higher targets outstanding in gold. The chart shows an alternative possibility at 122.305 that leaves room for a further rally of 18% above Friday's high. The pattern itself is unusual, but I am comfortable using it to project yet another, potentially important, high because I've seen this one work before in a roughly matching time frame. Be prepared for a stall or worse at 109.043, the secondary Hidden Pivot. ______ UPDATE (Jan 26, 5:30 p.m.): Everyone's been telling themselves they'd buy this little monster on weakness. Well, here it is. The 98.575 target shown in this chart is almost certain to be achieved, but it is tied to a pattern that every clown in the trading world sees and is planning to use. If you plan to join them, make sure its with a 'camo' trigger that they wouldn't know from a barstool. Alternatively, shorting x=107.035 'mechanically', stop 109.860, will enjoy better odds. I'll publish more correction targets if and when they become available. For now, though, there are only 'conventional' patterns to use for that purpose. Because I'd rather not bump heads with a thousand clowns, you'll have to be patient until more rABCs develop, including the obscure ones I prefer. _______ UPDATE (Jan 27, 8:29 a.m.): Silver picked up strength overnight and never looked back, never mind fulfill the 98.575 correction target identified above. The major Hidden Pivot at 122.305 will likely be achieved and still deserves caution, but I am not going to lay odds that it will cap the bull market.

The chart replicates the pattern I've used to project a 5300 target for Feb Gold. The corresponding target for GDXJ is 151.42, and although the pattern, like the one for gold futures, starts with an un-kosher point 'A' low, it should prove more than good enough for government work. In fact, it provides an anchor that visually suggests that 151.42 will be a resistance point of consequence. It is the highest target I can project with unexceptionable coordinates. Using a longer-term chart here is not particularly useful for creating new point 'A' beginnings because it would simply recall whatever relatively undramatic lows occurred with GDXJ trading beneath $40. Some of the ups and downs back then may have felt like a big deal, but in the context of the big move up that has occurred since August, they were just grassy bumps on a rural airstrip. _______ UPDATE (Jan 26, 12:02 p.m.): Like much else in the bullion world, GDXJ has gone all lunatick-y, starting today's session with a wildly exuberant gap to the 151.42 target advertised above. It has spent the day so far diddling this Hidden Pivot, but the already 70-cent overshoot has practically guaranteed still-higher prices. I am able to project them only by using 'extension patterns' along the Big Picture's C-D leg, but what would be the point? Query me in the chat room if you get desperate for further guidance. _______ UPDATE (Jan 27, 9:45 p.m.): If buyers shred their way past a Hidden Pivot midpoint resistance at 148.99, assume they are bound for 158.51 (60m, A= 133.08 on 1/21). A secondary 'hidden' resistance ay 153.75 could slow them down.

The futures were on a 'mechanical' sell signal to D=6925.25 when the week ended. It came in the final hour of the session, well after the trade was triggered 'conventionally' on the way down on Thursday afternoon. Price action continued a lengthening string of Fridays so boring that a trader fixated on his screen could fall into a trance. We may not know for a few weeks or longer whether this has been topping action or alternatively a consolidation for a run at higher prices. In any event, I wouldn't suggest bottom-fishing at the target of the pattern shown, since it is compromised by a coincident low on Wednesday that is bound to attract a thousand clowns. ______ UPDATE (Jan 19, 12:40 a.m.): Sellers went bananas over more Trump tariff bullshit, sending the futures down to 6911.00 so far. That's 2.0 points from the 6909.00 target I billboarded in the chat room last Tuesday as a back-up-the-truck number. It still is, provided you know how to set up a 'camo' trigger on the hourly chart. The tactic is explained in detail in the Hidden Pivot Course I've made available free to subscribers. _______ UPDATE (Jan 20, 10:10 a.m.): Sellers crushed the 6909.00 support, putting the futures on course for a rendezvous with 6819.75 or worse. In theory, 6869 has triggered a 'mechanical' buy and would be the second signaled at the green line of a bullish pattern that projects to 7163 (60-min, A=6596 on Nov 21). That pattern would be wrecked, however, and stopped out, with a print at 6771.00.

The stock spent most of the week lollygagging near the 457.04 'secondary Hidden Pivot' of the bearish pattern shown. Its eventual target is 444.89, a $15 fall from here. However, the breach of p was such a laborious affair that I cannot guarantee that it will be achieved. But if p2 is decisively exceeded to the downside, or if the stock closes for two consecutive days beneath it, odds of further fall to 444.89 would shorten significantly. For now, 444.89 should be viewed as a worst-case low for the near term. It is also a back-up-the-truck number for bottom-fishing, since even with the somewhat obvious pattern, D=444.89 cannot possibly give way without a struggle. ________ UPDATE (Jan 21, 5:57 p.m.): After the stock MSFT has put in a tradable bottom at or very near 431.89, the rally along a big-picture C-D leg would have the potential to reach 593.79. Seems farfetched, I know, but the stock will face a test we can rely on near 469.29, a major midpoint Hidden Pivot that coincides with the 2024 top. Neither of those Hidden Pivots exists yet, and their exact, respective locations will depend on where the actual low occurs. Please note that the time stamp for this post, along with the last price, come from my update in the chat room yesterday.