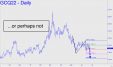

Gold remains a study in disappointment and tedium. We've focused on a too-obvious pattern with a bearish target at 1756.90, and even shorted it on paper at 1851.20, but with no great expectation of the futures getting there. Nor are they likely to achieve the very bullish, 2082 target of a much larger pattern any time soon. If you'd prefer to trade this vehicle nonetheless, try bottom-fishing in the range 1787-1792 with a 'camouflage' set-up using a chart of five-minute degree or less. _______ UPDATE (Jul 1, 9:27 a.m.): The futures are in a presumably meaningless bounce from 1783.40. That's below my bottom-fishing range, which was tied to a p2 'secondary pivot' at 1788.30. The $6 overshoot is sufficient for us to presume that the next leg down, if and when it comes., will be an even-odds bet to reach the worst-case, 1756.90 target. Ray-rah-sis-boom-bah, Gold! You go, girl!

I'd suggested paper-trading the 'mechanical' short at 1851.10 that triggered last Thursday, but the point of the exercise was to underscore my advice that any rally not be taken too seriously. This one came off a low at 1806.10 hit on Tuesday, and the trade became theoretically profitable the next day with a so-far moderate reversal. The price target is 1756.9o, a Hidden Pivot support that can serve as a worst-case objective for the next 7-10 days. _______ UPDATE (Jun 22, 9:20 p.m.): Gold's price action can be best understood if you see it as a Bill Cosby girlfriends, unwittingly drugged and in a deep stupor.

This will come as scant consolation to long-term investors who have suffered through three months of corrective pain and tedium, but the recent low failed to generate a bearish impulse leg on the weekly chart (see inset). It could still happen, but the implication of a second try would be that bears don't have the conviction to crack 1700. Whatever happens, bullion is just a trade at the moment and nothing more, with a time horizon of perhaps 2-5 days. _______ UPDATE (Jun 13, 10:13 p.m,): Here's a fresh chart with a 1773.70 downside target that is probably the best that bulls can hope for over the near term. A rally to x=1855.30 would trip an enticing 'mechanical' short, stop 1882.60, The trade is recommended for Pivoteers who are proficient with 'camouflage' triggers, since the initial risk on four contracts would be around $12,000 theoretical. ______ UPDATE (Jun 16, 10:32 p.m.): The rally tripped the 'mechanical' short noted above, but I am still recommending the trade only to subscribers proficient with 'camouflage' set-ups.

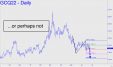

The chart implies that I am cautiously bullish, but that's a small exaggeration. The recent dip below 1800 seems to have exhausted sellers for the time being. However, bulls, such as they are, appear to lack the energy or enthusiasm for turning things around. For starters, they would need to surpass early May's 1917.60 peak to generate a bullish impulse leg on the daily chart. In the meantime, there's no point getting excited about gold's prospects until this happens. A relapse that breaches the 1792.00 low would have very bearish implications. Alternatively, if gold shocks with a powerful rally that blows up p=1937.20, we could justifiably take an earnest interest in the 2082.30 target, which is theoretically in play because the green line has been touched.

The most bullish thing you could say about this sack of cement is that the May 16 low at 1785.00 did not quite reach its 'D' target. That's why I am returning to a big-picture pattern that is bullish, even if its 'D' target at 2075.41 greatly exceeds our expectations at the moment. A theoretical 'buy' that triggered last week implies a rally over the next 5-7 days to p=1930.20, the pattern's midpoint Hidden Pivot. We'll be better able to judge whether the move is likely to hit D once we've seen buyers interact with that number. If it is impaled on first contact or the futures close above it for two consecutive days, that would shorten the odds of a continuation to 2075. ______ UPDATE: (May 31, 10:39 p.m.): Today's funereal price action raises the question of whether the future can even reach the midpoint pivot, let alone interact with it. The theoretical buy signal is still in effect, although there is no good reason to actualize it. The good news is that gold will rally, although not too far, once we have become despairing of the possibility.

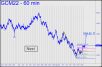

The shallow correction off a targeted high at 1846.00 portends another burst of strength this week. That's assuming one of gold's notorious mood changes doesn't occur when trading resumes Sunday evening. A strong upthrust should be presumed bound for the 1894.80 target shown in the chart. This is a 'reverse pattern,' and levels 'p' and 'x' should be suitable for bottom-fishing with 'mechanical' bids. Stay tuned to the chat room and keep email notifications switched on if you want to stay apprised. ______ UPDATE (May 25, 4:20 p.m.): The burst of strength has turned leaden. We won't give up on this glue horse yet, though, since it may simply need to consolidate for a bit longer after last week's sprint.

There's a Hidden Pivot support at 1757.40 to break gold's steepening fall, but then what? A tradeable low seems very likely to occur there, or somewhat lower near one of several 'external' lows that stairstep down to 1704.30. The downtrend could even end with Friday's 1797.20 low, the pattern's 'secondary' pivot, but I wouldn't count on it. The futures are certain to be volatile and therefore tradeable while they carve out a bottom, but opportunities will necessarily be labor-intensive and short-lived.

My apologies for putting out a gold tout Sunday night so confusing that it confused even me. It were as though aliens had beamed signals into my head when I composed and published it. The 1825,8 target we've been using all along is still a 'definite', and it would be a load-up-the-truck-price were it not for the fact that I have been drum-rolling this number for the last several weeks. We can still make use of it when the time comes, so tune to the trading room when the futures get within $7-$10 of it. ______ UPDATE (May 11, 10:33 p.m. EDT): Today's nitwit-powered conniptions push the June contract moderately higher but failed to surpass any 'external peaks even on the hourly chart. This is disappointing, considering the rally came off a longstanding, very important Hidden Pivot target at 1825.80. Perhaps it was too well advertised and must suffer a relapse before gold can bottom? Regardless, an important low appears all but certain to occur somewhere very near here because the target is so clear and compelling. _______ UPDATE (May 12, 9:55 p.m.): The futures crashed the 1825.80 'hidden' support, so I've shifted to the 'marquee' point A high, which allows for a bottom at 1814.20. That 'D' target has been exceeded, but only by $5. The jury is still out, but it'll take a print at 1864.80 to get out of immediate jeopardy.

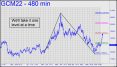

The week ended with a feebly impulsive rally, so we shouldn't get our hopes too high that the June contract will somehow avoid a predicted fall to at least the 1825.80 target of the pattern shown. It ha s been working fairly well for trading purposes although, strictly speaking, the rally to the red line on Friday did not trigger a valid 'mechanical' short because it came from a low that missed touching p2 by a hair's breadth. ______ UPDATE (May 2, 6:47 p.m.): Mechanical trades rated higher the '7' are rare, but here's one that triggered today -- on the monthly chart, no less! With more than $60,000 of initial risk on four contracts, however, this is one you should either paper trade or execute using 'camouflage' in the full-size contract or the mini. My target for the corrective move, basis the June contract, suggests the futures will go lower, to at least 1825.80, before they can turn around. The 2329.10 rally target is hardly a done deal, but it is not looking too shabby for the long term, given the way buyers impaled p=2011 in March. _______ UPDATE (May 4, 10:45 p.m.): So far, so good! The corrective rally implied in my last update has traveled $50 since bottoming. This occurred a millimeter from an 1852.30 low I'd rated 8.1 for 'mechanical' longs. Anyone aboard? _______ UPDATE (May 5, 9:31 p.m.): Yet another promising rally turned to dross when the futures reversed near the opening and gave up nearly all of the previous day's gains. I'll have little more to say ahead of the weekend.

Subscribers should have exited a profitable long trade using a 1942.30 stop-loss before the futures turned limp on Friday. The fact that a moderately appealing 'mechanical' play didn't work better suggests weakness will be the coming week's theme. But probably not too much of it, since sellers have not shown much gumption either. My gut feeling is that DaBoyz will stop out C=1893.20 before they gratuitously reverse until hopes are high enough to dash yet again. Set your snooze alarm for 2018.40, a tick above an 'external' peak recorded on March whose breach would signal a bullish resurgence. _____ UPDATE (Apr 25, 5:04 p.m.): After plunging sharply overnight, the reversal came exactly as anticipated, from a hair below C=1893.20. One subscriber reported making hay with the $13 rally that ensued. The futures spent the rest of the day playing footsies with 'C', leaving me with little more to say at the moment. _______ UPDATE (Apr 26, 11:55 p.m.): Although June Gold has bounced from precisely where we'd anticipated, the countertrend has been weak. This has activated the bearish pattern shown in this chart, with a D target at 1825.80. It is an odds-on bet to be reached because of the easy with which the downtrend penetrated p=1914.40, then made it resistance. _______ UPDATE (Apr 28, 10:16 p.m.): The futures bounced sharply off p2=1870.10 of the bearish pattern that projects to 1825.80, delaying a still-likely fall to that number. This has activated Matt's Curse in a bullish way, although I'd need to see the rally surpass 1922.80 before I change my tune.