Although we can be certain Americans and their government owe far more than they will ever be able to repay, the question of how this debt eventually will be discharged is the economic conundrum of the day. Some think hyperinflation is the only way out, since it would allow debtors to repay all that they owe with worthless bank notes by then in copious supply. However, this is hardly a solution, since those on the receiving end – i.e. the lenders — would be ruined, as would the bond markets, banks and all other institutional conduits and agents of saving.

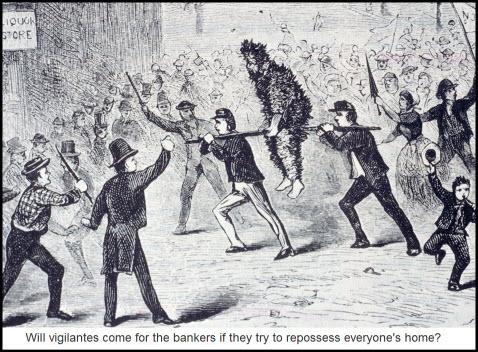

We’ve argued here that deflation will prevail, visiting pain on borrowers more or less in proportion to their sins. Lenders would wind up with the collateral, mainly in the form of residential real estate, but the advantage in this would probably be far less than what has been imagined by those who see bankers as conniving thieves out to steal the whole world’s tangible assets. In fact, the bankers would have to rent the homes back to those who had defaulted, saddling themselves with the politically unseemly problem of squeezing blood from a stone. Would they risk stirring up the mob, or would they instead settle up on relatively easy terms? We don’t think they’ll have much choice.

Why No Inflation?

Our reasoning about such things has always been intuitive — and so far correct in explaining why the huge fiscal and monetary blowout by the Federal Government during the last two years has produced no significant inflation. This fact is especially telling in the housing sector, which as the inflationists well know was the main target of the government’s historically unprecedented fiscal and monetary blowout.

Anyone interested in the inflation/deflation “debate,” will be abundantly rewarded by reading the superb essay by Jeffrey Rogers Hummel at the Library of Economics and Liberty. Hummel does not explicitly support the arguments of the deflationists, but he has nonetheless made a compelling case against the possibility of a Zimbabwe-style hyperinflation. Instead, he sees a much greater likelihood that the U.S. will simply default on some of its Treasury debt while acting to prevent the dollar from plummeting to the threshold of worthlessness. He also explains why “seigniorage” – i.e., revenue generated by monetary expansion – can no longer help the U.S. or any other government buy its way out of trouble.

If you read just one more essay on the subject of inflation/deflation, make it this one by clicking here.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

RJ, one of the purposes for completely auditing the Fed, Mint and Treasury gold in NYC, West Point and Ft Knox is to see if it’s really there, or just gold plated lead, and who actually owns it. The Fed is a privately owned 6% dividend for-profit institution with extremely high ROEs claiming to be governmental by returning surplus profits from their usury to the Treasury. According to Alan Greenspan, the Fed is above or beyond the law by design to prevent politics and keep the dollar, economy, free markets and money supply stable. Right. The Fed’s website claims oversight by Congress (and the people). Really. Ron Paul’s bill unlikely to pass the Senate.

Treasury and Mint are governmental agencies accountable to Congress, Constitution and the people (except when it comes to bank bailouts, gold and silver standard, perks and stims.) How the mighty have fallen.

In the 1792 Mint Act, adulteration of monetary standards detected by annual audits of specie coin was treason punishable by hanging.

So far, BB and TG, former NYC Fed President, oppose further audits of the Fed, Mint or Treasury, pointing out they are already audited. They want to make the Fed even more powerful and unaccountable. (When pigs fly.)

Milton Friedman long ago said the Fed should be replaced by a computer. Then the 25,000 overpaid employees, 47 Fed Lear jets, 59 personal cars, fine art and wood-paneled dining clubs could join the real world and be opened to the little people like the Historic Preservation Trusts in England including Rothschilds, who invented the central banking scientific socialism Jefferson decried.

Every President who has opposed the Fed has been censured, removed from office or killed. Today Congress subpoenaed the Fed over the BAC affair. Could be interesting or a coverup. Time will tell…