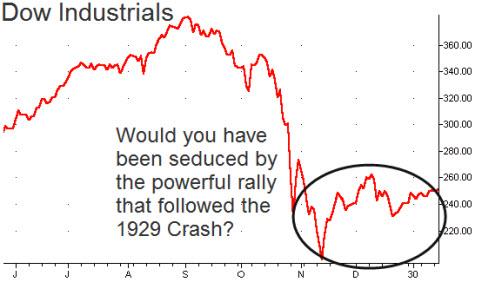

With the help of a credulous news media, Obama, Bernanke, Geithner et al. have continued to sledgehammer the “green shoots” story. Actually, it is no longer timid green shoots that supposedly are sprouting up, but a recovery so strongly rooted and powerful that it has sent stocks soaring since March and, more recently, goosed T-bond yields skyward. Have mere words caused this, jolting the economy from its worst slump since the Great Depression? We very strongly doubt it, much as we doubt that a rising stock market has anything whatsoever to do with the nation’s economic health. If you doubt this, take a good look at the chart below and consider the ebullient mood of America in August 1929.

Still, we don’t fault the spinmeisters for trying so desperately to tell it like it isn’t. As Joseph Goebbels famously said, “If you tell a lie big enough and keep repeating it, people will eventually come to believe it.” The rest of this quote is less often repeated, but it holds dire implications for the economy and perhaps even for the political system if and when Americans realize that it is lies alone that have kept us from crashing. Here’s how the Nazi propagandist finished the thought: “The lie can be maintained only for such time as the State can shield the people from the political, economic and/or military consequences of the lie.” And so we might ask, how much longer can taxpayers be shielded from the consequences of a federal deficit on its way to $14 trillion or more? And how many believe the whopper that spending yet more trillions in Keynesian fashion – which is to say, flushing it down the toilet – will enable us to grow the economy from a cosmic trench of indebtedness?

The Bailout, Up Close

This is surely the biggest and most obvious lie of all – that we can somehow borrow our way back to prosperity. In reality, debt deflations cannot be cured – ever — by more borrowing. This fact alone should serve to refute whatever tales of alleged recovery the news media may hasten our way. The sordid details of the ongoing bailout, for one, are so brazenly bogus that one wonders how anyone could believe that TARP, Cash for Clunkers and all the rest have somehow benefitted us collectively. Look no further than the weekend Wall Street Journal’s editorial page for clear evidence not only that the bailout has failed to do its intended job, but that it is about to deliver a knockout blow to many state budgets already verging on bankruptcy. The blunt fact is that $200 billion in federal stimulus cash was incentivized to create new programs rather than adjusting to lean times. “[The states] added health and welfare benefits and child care programs. Now they have to pay for those additions with their own state’s money,” the Journal’s editors noted. “For example, the stimulus offered $80 billion for Medicaid to cover healthcare costs for unemployed workers and single workers without kids. But in 2011 most of that extra federal Medicaid money vanishes. Then states will have one million more people on Medicaid with no money to pay for it.”

Strings, or Nooses?

Just so. There were also strings attached that will turn into nooses, courtesy of the public employee unions. They saw to it that any state that took a dime of stimulus money would have to maintain spending on 15 programs, from road building to welfare. “One provision prohibits states from cutting Medicaid benefits or eligibility below levels in effect on July 1, 2008. That date, not coincidentally, was the peak of the last economic cycle when states were awash in revenue,” the Journal noted.

Goebbels would have been impressed with the way in which economic policies with potentially catastrophic consequences have been spun as a viable recovery package — and a successful one at that. So egregious are the lies that have been required to sustain this illusion that it seems almost impossible they will survive the tests that lie ahead in 2010.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Hi Rick,

As a trader(in my IRA account), I was wrong. I lost money.

The current Time and BW magazines came out of a doom and gloom. As a contrarion, IMO the FED will accomodate! IMO no bear market until later.