We must confess that our heart wasn’t in it when we suggested here the other day that the stock market’s already superheated rally might accelerate rather than flatten with the approach of summer. Such a scenario is of course possible, and it did occur last year. But this time around, with stocks trading nearly 40% higher, it would flout Mother Nature in ways that are most difficult to imagine. For who could possibly believe that an economy in the throes of a debt deflation could be revived by precipitously borrowing more trillions of dollars against future output, then pumping nearly all of that money into goods and services that are economically questionable at best and purposeless at worst?

The strong impression one gets is that Wall Street believes it, since stocks have been in a relentless rise for months. It requires a healthy dose of cycnicism, however, to see what has really been going on. In fact, the public has abandoned the stock market, leaving the hedge funds and trading desks to run a shell game on the taxpayers’ dime that makes it relatively easy to hog-trade stocks higher and higher on almost no volume. This has been occurring nearly every day for months: index futures waft higher overnight on light short-covering, setting up a second wave of short-covering on the NYSE opening.

No Skin in the Game

It is tempting to view this action as a wealth-creating perpetual-motion machine even if we know the game cannot continue forever. What is different and dangerous about this bull cycle, however, is that those who have been causing stocks to rise – Goldman Sachs, J.P. Morgan and other Masters of the Universe – have no skin in the game. They have simply been trading amongst themselves, applying relatively small sums of cash to the leveraging of stocks against futures, options and ETFs. One senses that if the stock market were to collapse tomorrow, DaBoyz would be enjoying the show from the sidelines before the Dow had shed its first 1000 points. CALPERS and your 401K would ultimately take the hit, but for institutions whose trading desks have been racking up quarterly profits of $3 billion or more, where’s the risk? These guys are using computers that can trade many thousands of times per minute, and unless the markets freeze completely – dare we hope for so severe an emetic for the financial system? — there’s little chance the rats will go down with the ship.

Meanwhile, speculation concerning when the bear will come roaring back is rampant among chartists and traders. Friends of mine with solid technical judgment were e-mailing me all week with persuasive reasons why this is about to occur. I didn’t need much convincing, really. Merely pondering the “recovery” stats that make headlines each day in the Wall Street Journal should be enough to convince anyone that the economy’s death spiral has continued into its third year more or less unabated.

Knee-High to a Dreadnought

We’ll concede that shoppers have beaten 2009’s Depression-level numbers; that the banks are making money hand over fist; and that Washington D.C. is enjoying a spectacular boom under a Democratic administration with aspirations for Big Government that beggar FDR’s wildest dreams. But all of these things together do not rise above the knees of the economic dreadnought bearing down on us. It has taken the form of high unemployment, cascading foreclosures, and a wave of bankruptcies – currently running at 6,900 per day – that is beyond anything ever experienced before in this country. And you can forget about the ridiculous 9.7% unemployment figure quoted by the mainstream press; the real number is closer to 22%, according to John Williams of ShadowStats.com. As for a turnaround in housing, there were a million foreclosures in the first quarter of 2010 — up 16% from the first quarter of 2009, and 7% higher than in the previous three months.

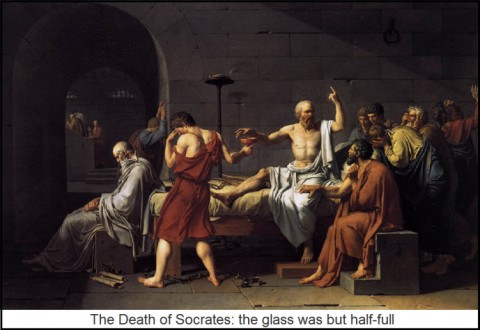

The recovery story, such as it is, has provided cover for DaBoyz as they’ve pyramided stocks higher and higher. With the Dow now moving above 11000, many gullible observers, as well as the self-aggrandizing mountebanks who dominate the discussion on CNBC, are saying the glass is half-full. That it is, we would agree – but of hemlock, not tonic. Let those who would have us believe the economy has blossomed drink from the glass, that we might purge from our midst such dangerous quantities of self-deception as will only increase the pain of the economic catastrophe that impends.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

American Socialossism.

Somebody said. If it were not so sad in the 3-D world, this would be funny.