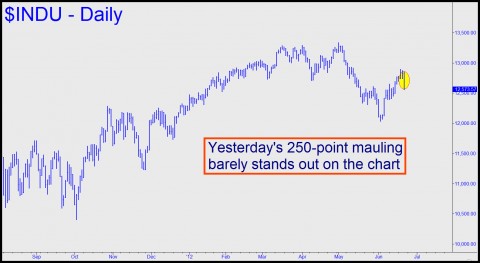

The Dow got sacked for 250 points yesterday, but consider the chart below if you think it’s too late to jump on the bearish bandwagon. Of course it isn’t. On the daily chart, the bar graphically representing Thursday’s selloff barely stands out. It’s not even as bad as the 275-pointer that occurred on June 1. A thousand-point rally followed, turning the downdraft retroactively into a bullish swoon. So don’t despair about missing a great opportunity. This bear market is just getting rolling, and it is all but certain that there will be plenty of chances to get short down the road with stocks rising. Not that it will be easy, since every Tom, Dick and Harry will be trying desperately to get on the right side of the move. More on that in a moment. Concerning yesterday’s mini-avalanche, we were a day late ourselves, having challenged subscribers the night before to help us pick the top. We figured it would be as easy as shooting fish in a barrel, since nearly 800 traders,

many of them regulars in the Rick’s Picks chart room, have taken the Hidden Pivot Webinar. (Click here to find out about the next class — and get a $50 discount.)

many of them regulars in the Rick’s Picks chart room, have taken the Hidden Pivot Webinar. (Click here to find out about the next class — and get a $50 discount.)

Keep this well-trained army of chartists in mind as you read the following excerpt from a DJIA trading “tout” that went out to them Wednesday night:

My goal is to short a top that will be distinctively recognizable as such after-the-fact. The risk, of course, is that I will miss this top while greedily attempting to milk the rally for that last oh-so-satisfying inch. In attempting to [short the top], I’d welcome some help from chat-roomers, since the next thousand-point move in the Dow has home-run potential in comparison to whatever base-hits you may be pondering at the moment. To guide you in this class project, I’ll note that my own forecast calls for a tradable peak at 12931, or perhaps 12973 if any higher.

Diabolically Evasive

Ahh, that last inch! After the shellacking stocks received yesterday, we should resign ourselves to the possibility that Papa Bear has gotten under way without the expected last-gasp rally to 12931. The highest the Dow got, three days ago, was 12899. Oh well. As noted above, however, and as we all know, there will always be another opportunity. Even so, we should be aware that as the bear market develops and more and more traders scramble to get on the right side of it, this feat will become increasingly difficult. It is in Mr. Market’s nature to become increasingly evasive – diabolically so — as it dawns on a growing number of traders (and investors, a handful of whom remain in this world) that stocks are indeed in a major bear market. Assuming this is so, we

are certain to see spectacular rallies in the months and years ahead as the Dow ultimately plummets to depths few might imagine. It is at the Hidden Pivot peaks of bear rallies that we will attempt to get short, since the downdrafts are likely to be too steep and dangerous to catch. The news media will trumpet each and every one of those rallies as evidence that the economy is recovering, just as they did during the 1930s. They will be dead wrong, however, for the economy will be sinking into a morass far worse than the Great Recession that even now is only ambivalently acknowledged.

are certain to see spectacular rallies in the months and years ahead as the Dow ultimately plummets to depths few might imagine. It is at the Hidden Pivot peaks of bear rallies that we will attempt to get short, since the downdrafts are likely to be too steep and dangerous to catch. The news media will trumpet each and every one of those rallies as evidence that the economy is recovering, just as they did during the 1930s. They will be dead wrong, however, for the economy will be sinking into a morass far worse than the Great Recession that even now is only ambivalently acknowledged.

In the meantime, we invite you to watch the action from the perspective of traders who have seen many bear markets before (even if they have not “seen it all.”) A free trial subscription, including access to a chat room that never sleeps, is yours merely by clicking here.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Mario:

Here you can see it trying to explode during the panic of 2008 until the Fed squashed it like a bug with $trillions of liquidity.

http://www.wsjprimerate.us/usprimerate-vs-libor-vs-fedfundstargetrate-chart.htm