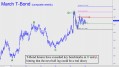

Since April, the futures have been consolidating bull-market gains that took more than four years to achieve. In the long-term composite chart shown, there are two especially encouraging signs for the future. For one, the peak at 166^27 recorded in April exceeded a crystal-clear target at 164^08 by two-and-a-half points. In context, and considering the clarity of the large ABC pattern, the overshoot is not merely significant but decisive. The second encouraging thing to notice is that the consolidation pattern toward the right-hand axis of the chart has broken well above a 159^09 midpoint Hidden Pivot, telegraphing an impending bull leg to at least 165^08, or possibly 171^07 if any higher. Notice that I used the word “impending” rather than “imminent.” That’s because there is no way to tell exactly when the next bull-market leg will get decisively under way. However, that this will happen should not be doubted, given the eagerness with which the futures blew past p=159^09 back in August.

Since April, the futures have been consolidating bull-market gains that took more than four years to achieve. In the long-term composite chart shown, there are two especially encouraging signs for the future. For one, the peak at 166^27 recorded in April exceeded a crystal-clear target at 164^08 by two-and-a-half points. In context, and considering the clarity of the large ABC pattern, the overshoot is not merely significant but decisive. The second encouraging thing to notice is that the consolidation pattern toward the right-hand axis of the chart has broken well above a 159^09 midpoint Hidden Pivot, telegraphing an impending bull leg to at least 165^08, or possibly 171^07 if any higher. Notice that I used the word “impending” rather than “imminent.” That’s because there is no way to tell exactly when the next bull-market leg will get decisively under way. However, that this will happen should not be doubted, given the eagerness with which the futures blew past p=159^09 back in August.

My hunch is that the futures are biding their time, waiting for evidence of a global recession before they blast off, fueled by flight capital from around the world. Keep in mind that the rally targets noted above are destined to become mere weigh stations if my extremely bullish long-term forecast for Treasurys pans out. As noted here earlier, I expect rates on the 30-year to fall to 1.64%, about half of their recent peak, before the bull has run its course over the next 4-5 years. Were this to occur, a fixed-income portfolio weighted toward the long end of the yield curve would enjoy spectacular capital gains.