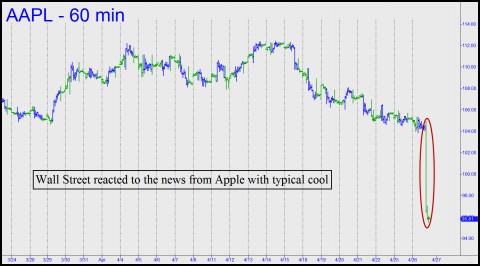

At the end of 2015, Apple was the most valuable company in the world. With Tuesday’s after-hours plunge, however, it may have slipped to third, behind Google and Exxon (which, ironically, just lost its triple-A credit rating). Apple reported its first drop in sales since 2003. In the same quarter last year, revenues were $58 billion, or $2.33 per share. This time, the company had revenues of $50 billion, or $1.90 per share. The news has caused AAPL shares to plummet 8.5% so far this evening, from 104.30 to a shaky-looking low at 95.51. If you didn’t see it coming, here’s a Rick’s Picks ‘tout’ emailed to subscribers last October that did:

At the end of 2015, Apple was the most valuable company in the world. With Tuesday’s after-hours plunge, however, it may have slipped to third, behind Google and Exxon (which, ironically, just lost its triple-A credit rating). Apple reported its first drop in sales since 2003. In the same quarter last year, revenues were $58 billion, or $2.33 per share. This time, the company had revenues of $50 billion, or $1.90 per share. The news has caused AAPL shares to plummet 8.5% so far this evening, from 104.30 to a shaky-looking low at 95.51. If you didn’t see it coming, here’s a Rick’s Picks ‘tout’ emailed to subscribers last October that did:

A Drexel Hill analyst’s prediction that AAPL, currently trading for around $110, will hit $200 a share sent me to the long-term charts to see who’s crazy, me or them. Drexel believes iPhone sales in China will ultimately boost sales very significantly. I’m not so sure myself, but I’ve been bearish on the stock for other reasons that have continued to accumulate, to wit: 1) Incredibly, with the release of iPhone6, Apple has once again failed to address its embarrassing battery problem, still the elephant in the room; 2) it won’t be long before Xiaomi sells a phone for $60 that can do everything the $600 iPhone does; 3) Apple’s insane profit margins, driven by clamorous cult buying, are far more vulnerable to a global economic downturn than competitors’ margins; 4) Apple has entered the streaming music business 12 years behind the leader, Spotify; 5) Apple has entered the car business a hundred-and-twelve years behind the pioneer, Ford; 6) Apple teamed with Hermes to produce a wristwatch so un-revolutionary that it probably has Steve Jobs turning in his grave. So much for being on the cutting edge. What’s next for Apple — an upscale toaster oven? An iFood processor? iChocolates?

From personal experience, I can also attest that Apple’s software is getting almost as annoying as Microsoft’s. Two-thousand mp3 music files disappeared from my PC-based iTunes — twice — for no apparent reason. I had to re-import them into the application both times to get them to play again. You might think their ‘Genius Bar’ would have an instant fix, but you’d be wrong. Instead, they pretended I’m the first PC guy who has ever come to them with the problem and that they have no idea what is causing it. Yeah, sure.

As Greedy as Microsoft

Even worse is the story of a friend and long-time Apple proselytizer who discovered last week that all of his emails had been deleted — permanently. This happened ostensibly because Apple has gotten as greedy as Microsoft in requiring users to update their hardware and software constantly — far more often than most customers would deem necessary. My friend’s problems began when he tried to update his iPhone and got a message that he would need to update iTunes first. Simple? Guess again. The latest iTunes would require him to update his iPhone’s operating system, and therefore to update his Apple computer’s operating system. He tried, but wound up with his computer frozen, his emails gone forever, and his cell phone, although working, no longer capable of playing iTunes. Apple’s tech support guy conceded that this wasn’t the first call he’d handled concerning this nasty cluster of problems.

From a technical standpoint, I’d have to concede there’s no reason why AAPL could not rally to new all-time highs, or even to $200 a share. If this is going to happen, the stock could first fall all the way to 96.41, a ‘midpoint Hidden Pivot’, before bouncing, and still look promising. More bullish still would be a rally to new highs without AAPL’s even having fallen to 96.41. We shall see. As always, I will let my unbiased technical indicators guide me. Whatever happens, I’d be tempted to short a rally to marginal new highs if there’s a clear price target associated with the move. _______ UPDATE (April 29, 10:15 a.m. ET): AAPL looks bound this morning for 92.50, a midpoint Hidden Pivot support. This is a good place to try bottom-fishing — doubly so if you’ve been short for the ride south. Click here for a free trial subscription that includes Rick’s daily forecasts and updates in real time, plus access to a 24/7 chat room that draws veteran traders from around the world. _______ UPDATE (May 1, 6:08 p.m.): The 92.50 target proffered above came within a penny of nailing the low of AAPL’s $2.31 plunge on Friday. I’ll wait until I hear from subscribers who took the trade, however, before I establish a tracking position. _______ UPDATE (May 3, 12:43 a.m.): There was just one report from a subscriber who bought near the recent low, so I won’t be establishing a tracking position. AAPL is still not out of the wood and would need a thrust surpassing 95.13 to turn the lesser charts impulsively bullish.

Rick,

Youre right, there is no particularly significant strength from China to support Apple. Yes, China absolutely loves the world of Apple, and yes China’s domestic consumer middle class rise continues very strongly. For example the cruise ship industry growing by leaps and bounds will continue for at least another decade. There is a new rising economy here, pay attention.

However that’s about it as far as good news goes. Fierce competition, banking concerns, too much change too fast, China’s heyday growth period is obviously over. Consumers have plenty of money, yet are much more knowledgeable, savvy and choosy, and because their Apts aren’t going up in value 20% per year anymore, because the old economy growth has peaked, they’re not that stupid.

And so it’s an easy bet Apples heyday is over as well.

We need to turn our attention on the new market opportunities looking forward, as the one I mentioned, and where to short/long in the markets.