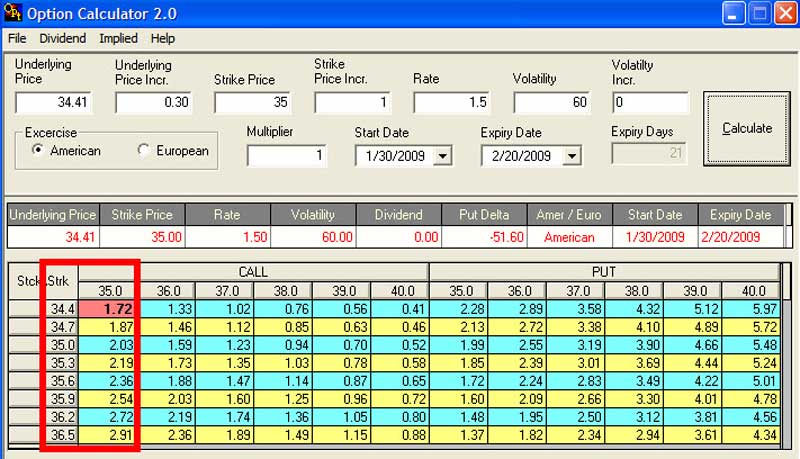

After buying three cents off this morning’s trampoline low, we took some profits and now hold 200 shares with an adjusted cost basis of 31.12. The rally has the potential to reach 38.06 over the next 3-4 days, subject to midpoint-pivot resistance at 35.03. Accordingly, I’ll recommend putting on a covered write by shorting two February 35 calls (GBJBI) if and when the stock touches 34.95. A tad less than $2 would be about right for the calls at that point. _______ UPDATE: With Comex Gold surging at 4 a.m., there’s a chance that GDX could open on a gap. If so, to guide you in turning our stock position into a covered write, I have supplied theoretical values for the February 35 call with the stock trading anywhere between 34.40 and 36.50. Keep in mind that if you are able to short the calls for $3 or more, it will produce a theoretical profit at expiration that is nearly equal to what you would make if the stock were to reach the 38.06 best-case target. However, if Gold futures are up $10 or more at the opening, it should be easy to reap at least $2 for the calls. ________ FURTHER UPDATE: With call options incredibly pumped on the gap-up opening to 35.54, we did our covered write at the best price of the day, 2.55. This will give our position excellent downside protection and, at expiration, an effective sale price of 37.55 on the stock if it’s trading $35 or higher. That’s equivalent to a profit of $1280 for a relatively small position — one on which we only risked $20 theoretical to begin with. Do nothing further for now, although we may adjust by covering, and then re-shorting, the calls at some point.

After buying three cents off this morning’s trampoline low, we took some profits and now hold 200 shares with an adjusted cost basis of 31.12. The rally has the potential to reach 38.06 over the next 3-4 days, subject to midpoint-pivot resistance at 35.03. Accordingly, I’ll recommend putting on a covered write by shorting two February 35 calls (GBJBI) if and when the stock touches 34.95. A tad less than $2 would be about right for the calls at that point. _______ UPDATE: With Comex Gold surging at 4 a.m., there’s a chance that GDX could open on a gap. If so, to guide you in turning our stock position into a covered write, I have supplied theoretical values for the February 35 call with the stock trading anywhere between 34.40 and 36.50. Keep in mind that if you are able to short the calls for $3 or more, it will produce a theoretical profit at expiration that is nearly equal to what you would make if the stock were to reach the 38.06 best-case target. However, if Gold futures are up $10 or more at the opening, it should be easy to reap at least $2 for the calls. ________ FURTHER UPDATE: With call options incredibly pumped on the gap-up opening to 35.54, we did our covered write at the best price of the day, 2.55. This will give our position excellent downside protection and, at expiration, an effective sale price of 37.55 on the stock if it’s trading $35 or higher. That’s equivalent to a profit of $1280 for a relatively small position — one on which we only risked $20 theoretical to begin with. Do nothing further for now, although we may adjust by covering, and then re-shorting, the calls at some point.