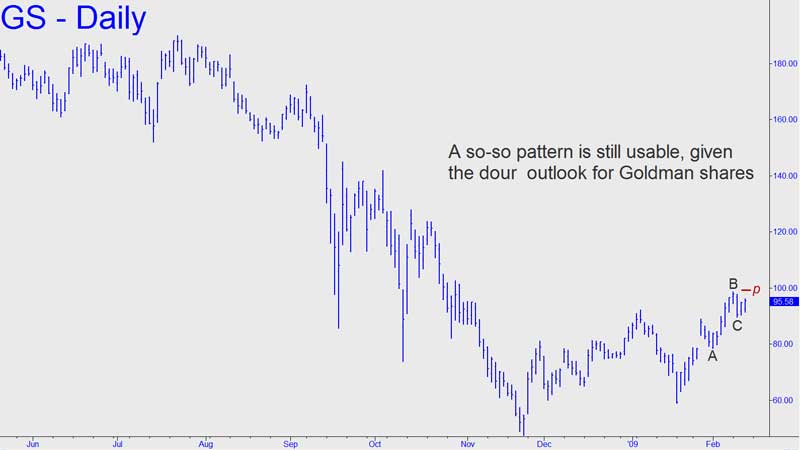

Since I’ve projected a spectacular decline to $29, we should be on the alert for good shorting opportunities in this stock. It is likely to be tricky, though, since any stock with $100 of “juice” left in it these days is going to be a very tempting target for bears. At the moment, the most promising place to attempt getting short is 99.74, the Hidden Pivot midpoint of the pattern shown in the chart. The pattern is far from ideal, so we’ll play it conservatively, bidding for a single July 80 put (GSSP). The option last settled at 12.20 and should be trading for around 11.10 with the underlying stock at or near the target. However, I plan to monitor this trade closely and will update my advice if it looks like we can do better. To stay apprised in real time, simply switch on the Bulletin Launcher on the Home Page. This will trigger a pop-up when I post an alert under Intraday Notes. Note: On the way up, we’ll also try to short 200 shares at 96.61, stop 96.81. That’s a promising Hidden Pivot associated with a lesser trend. _______ UPDATE: We were stopped out on the stock trade for a $40 loss about 30 minutes into the session. Today’s histrionics were pointing toward a Hidden Pivot at 99.23, with another, lesser one at 98.62. We’ll try to short 100 shares at each target just to stay limber and alert. A stop-loss of 7 cents is advised.

Since I’ve projected a spectacular decline to $29, we should be on the alert for good shorting opportunities in this stock. It is likely to be tricky, though, since any stock with $100 of “juice” left in it these days is going to be a very tempting target for bears. At the moment, the most promising place to attempt getting short is 99.74, the Hidden Pivot midpoint of the pattern shown in the chart. The pattern is far from ideal, so we’ll play it conservatively, bidding for a single July 80 put (GSSP). The option last settled at 12.20 and should be trading for around 11.10 with the underlying stock at or near the target. However, I plan to monitor this trade closely and will update my advice if it looks like we can do better. To stay apprised in real time, simply switch on the Bulletin Launcher on the Home Page. This will trigger a pop-up when I post an alert under Intraday Notes. Note: On the way up, we’ll also try to short 200 shares at 96.61, stop 96.81. That’s a promising Hidden Pivot associated with a lesser trend. _______ UPDATE: We were stopped out on the stock trade for a $40 loss about 30 minutes into the session. Today’s histrionics were pointing toward a Hidden Pivot at 99.23, with another, lesser one at 98.62. We’ll try to short 100 shares at each target just to stay limber and alert. A stop-loss of 7 cents is advised.