We’ll never be entirely comfortable cheerleading bear rallies, but what else can a guru do when stocks want to go higher for all the wrong reasons? Although shares fell hard yesterday, there was little in the sell-off to suggest that the short-squeeze begun three weeks ago is over. More likely is that the smart money simply fell away on news that the Obama Administration is going to play hardball with the auto manufacturers — or rather, will pretend to play hardball, since the President has made clear that he’s not going to let the car makers go down no matter how grim their prospects.

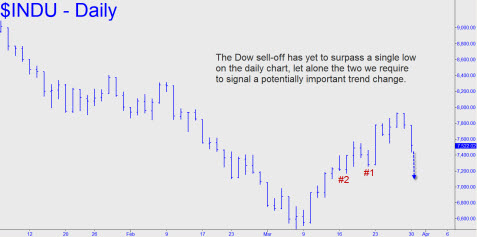

From a technical standpoint Monday’s weakness did almost no damage to the S&P 500 Index or the Industrial Average. According to the Hidden Pivot Method that we use to forecast prices, meaningful trend changes in either direction always begin with thrusts that exceed two prior highs or lows. But in the daily chart above, you can see that, so far, the decline of the Industrial Average has yet to surpass even a single prior low. Granted, it has already done so on the hourly chart, and that hints of more selling for perhaps another 1-3 days. But unless the Dow were to fall a further 350 points, and do so this week with nary a pause, we would have little reason to re-think our bear-rally bullishness.

It’s Not Just the Charts

It’s not just the charts, either. Quite a few investors evidently believe the worst of the financial crisis is behind us. Indeed, the stock market’s biggest rallies recently have been triggered by ostensibly good news from the banking sector. Even though nothing occurred recently to discourage such delusional thinking, financial stocks got hit hard yesterday, and our favorite bellwether for fatal hubris, Goldman Sachs, has fallen more than 15 percent in the last week. We see this weakness as a shakeout engineered to allow DaBoyz to load up at relative bargain prices in advance of yet another distributive rally. That yesterday’s selling should have been attributed to supposedly bad news for the auto sector only increases our suspicion of a shakeout, since the very worst that any investor might imagine for the car manufacturers has already been discounted to death.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)