If nothing else can stop a runaway stock market, there’s always the astrologers. Pick any day of the year, and odds are it’s circled in red on some star-gazing guru’s End of Days calendar. The higher stocks go, the louder their predictions of disaster. Not that we haven’t joined the chorus of despair ourselves from time to time. How else is a guru supposed to gin up business during the dog days of summer? At the moment, the sexiest prediction out there is the Mayan apocalypse slated in 2012. Perhaps the Mayans would have pushed that date back a few years, giving themselves a little extra room, if they’d known that Goldman Sachs – the antichrist at the moment — would be running the world.

Some of you will already know that the date December 21, 2012, marks the final 24 hours of a Mayan calendar that for thousands of years has been counting down a 5,126-year span. The bookstores have at least a dozen titles on this subject, and it seems to have captured the popular imagination in the same way the Y2K scare did. Mind you, this isn’t a cycle that’s supposed to begin anew; rather, it is simply the end of time. Assuming December 22, 2012 never arrives, then, do we infer that that will suffice to keep mortgage lenders at bay? Or will they be waiting to dun us as soon as the next Big Bang starts to cool?

Looking on the Bright Side

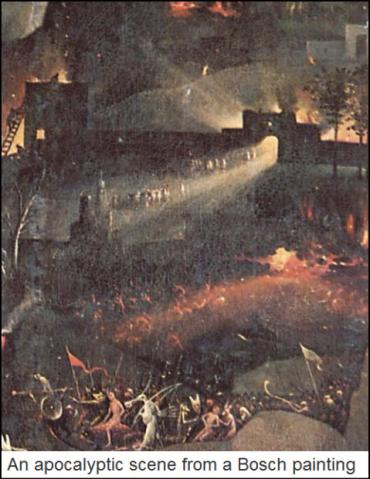

Whatever happens, we shouldn’t count too heavily on debt forgiveness, since debt collectors are probably even hardier than cockroaches. But there may be a bright side: Spiritual healer Andrew Smith, for one, thinks 2012 will usher in a “true balance between Divine Feminine and Masculine.” If so, at least a couple of the world’s Great Religions are going to have some serious explaining to do. But Smith is the outlier, since most of the books envision something like Ghostbusters with an unhappy ending. But don’t be surprised if the Dow Average initially shrugs off the mayhem, even as flames lap at the stone walls of the New York Stock Exchange.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

My friend Rick,

I would have lost alot of money. But I alway’s read between the lines on your post’s. IMO the BDI index predict’s a lower stock market! The banksters’s IMO want to suck any newbee’s to their spider webb of evil !!!