Cramer says commercial real estate has bottomed, and Abby Joseph Cohen evidently thinks we’re in a new bull market. The uncharitable thought, “Idiots!” springs to mind, but neither of these celebrated commentators lacks for brains, as we well know. Abby is simply following a how-to-succeed script that she wrote years ago and which has made her rich and powerful, to wit: Remain outrageously bullish no matter what the economy is doing, and sooner or later investors will embrace your every utterance as though it were the Sermon on the Mount. She was out-of-fashion and nowhere to be seen in the late stages of the dot-com crash, and missing in action once again when the stock market collapsed last year. But Abby is back in the spotlight now, and doubtless attracting hordes of investors who are hoping with all their hearts that she’s right. Of course, it doesn’t hurt that her sponsor is Goldman Sachs, a firm with enough clout to move heaven and earth if nothing less will suffice to make her predictions come true.

Abby has an acolyte in the ubiquitous Larry Kudlow, a guy who would say virtually anything to get his mug on television. But Cramer tops them all with his frenetic, high-decibel broadcast that seems to echo in the room even after you’ve turned off your TV. Cramer is a guy we love to hate, but in the end, because he’s so entertaining, we give him a free pass, even when he says things that flatly contradict the reality we see all around us. (Have you visited the local mall lately? Companies that decorate the windows of vacant shops are probably among the few growing businesses in the retail sector.)

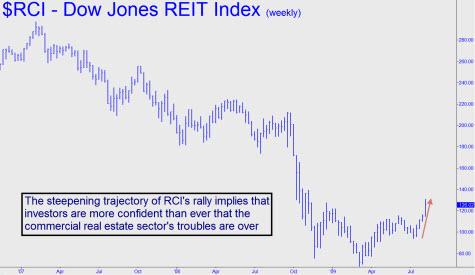

Cramer clearly is not the only person who sees good times ahead for commercial real estate. Notice in the chart above that prices have nearly doubled since March for the Dow Jones REIT Index, a good proxy for real estate-based assets. The rally steepened this past week into a parabola that looks like a blow-off to us. It’s possible that Cramer’s enthusiasm helped turbocharge the buying. We’re not suggesting that you go against the tide by betting against him – only that you trust your own observations to tell you whether such heedless exuberance is warranted. We think not, but there is no doubting the power of hope when it comes to transcending mere facts. That’s why the stock market has been on a holy tear since March. Go with the flow if you can’t stand being in cash, but be sure you’ve got an escape route if sanity returns with a vengeance, as it surely will.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

I have a solution that will benefit home owners and the public in general. And none of this will go to the banks!

Hear me out. My ideas is to let each family print their own money. I’m serious here. Stop laughing! Allow each family to use their color laser printer to print up to $2500 per month until this crisis is over. If the family has been foreclosed on, then allow them to print an additional $1000 per month for each child they have. They will then be able to spend this money and create a booming economy once again. If Ben Bernanke, a non-goverment employee, can print money, then it should be the inalienable right of each American to do so too. People will soon be buying cars, plasma screens, and maybe a house or two. Since the money is created by the consumer, he can spend it on what they want without any government red-tape or waiting months for a government check. He would once again be in control of their own destiny. Of course it goes without saying that the consumer would not print any more money than what is really necessary. At $2500 per family per month, I figure it would be less than the bailout money that has already been spent. This is the real way to stimulate the economy, by giving the consumer the ability to spend once again without any guilt of going into debt. This is what fiat currencies are all about. Print as much money as you really need, but not a cent more.

Dusty

&&&&&&

Germany came close to this tactic during the hyperinflation of 1922-23, Dusty. Certain employers were allowed to issue a form of makeshift currency called Notgeld. Here’s what “When Money Dies” had to say about it:

“Because the Reichsbank’s printing presses and note-distribution arrangements were insufficient for the situation, a law was passed permitting, under licence and against the deposit of appropriate assets, the issue of emergency money tokens, or Notgeld, by state and local authorities and by industrial concerns when and where the Reichsbank could not satisfy employers’ needs for wage-payment. The law’s purpose was principally to regularise and regulate a practice which had gone on extensively for some years already, with the difference that authorised Notgeld would now have the Reichsbank’s guarantee behind it. Before long, as that guarantee became increasingly less esteemed, the tide of emergency money that now entered local circulation, with or without the Bank’s approval, contrived enormously to raise the level of the sea of paper by which the country was engulfed. As the ability to print money privately in a time of accelerating inflation made possible private profits only limited by people’s willingness to accept it, the process merely banked up the inflationary fire to ensure a still bigger blaze later on.”

[Here’s a link to the complete book, which was written by Adam Fergusson : http://mises.org/resources/4016%5D