The Dow Industrials tacked on another big gain yesterday, blithely ignoring a global thumbs-down on Euroland’s latest, trillion dollar bailout package. The blue chip average finished up 149 points on the day, even as rumors circulated that Germany was about to ditch the euro and resurrect the D-mark. Whether or not this is true – and we doubt that it is – it’s clear that the Germans are becoming increasingly angry about having to play rich uncle to their n’er-do-well neighbors. Outside of Germany there appears to be a growing consensus that any further attempts to rescue, just for starters, Greece will simply be throwing (relatively) good money after bad. This thought surfaced with unsurprising vehemence in the Rick’s Picks forum, where hard money rules, but it was surprising to see how quickly it caught on globally. For even as stocks rebounded with psychotic energy following last Thursday’s fleeting dive, the world’s major newspapers were questioning whether the trillion-dollar credit line extended to the PIIGs would do any good. Pessimists were saying it would place a crushing debt burden on countries still able to pay their bills, and even the optimists were not claiming it would do much for Europe’s sclerotic economic growth.

The U.S. stock market seemed inured to such doubts – to doubts about anything, really – in continuing its upward course. As the saying goes, “If you can keep a cool head while all those around you are panicking, then perhaps you don’t understand the situation.” In fairness to the institutional speculators who have been teasing and manipulating U.S. stocks higher, they are not buying shares after having thought about the real world, but rather, because, at this moment in time, buying U.S. shares is what money managers are obliged to do with Other People’s Money. For sure, spare cash cannot go into money markets and other liquid vehicles, since the Fed has made certain that even the most frugal savers will be discouraged from sitting on their nest eggs.

Gold the ‘A’ Answer

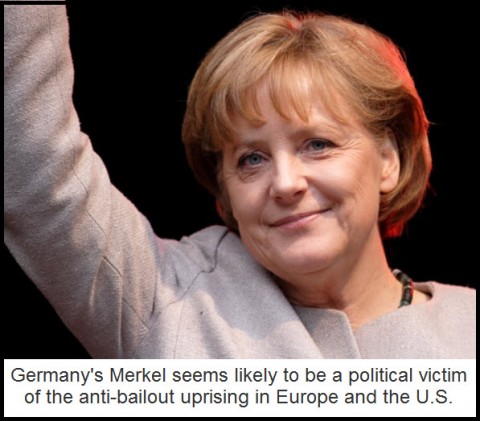

So, what does one do with one’s surplus capital in the face of a possible monetary blowout by Euroland? Putting it into physical bullion is always going to be the ‘A’ answer; but beyond that, the problem is difficult to solve, since the bailout is not inflationary per se. Indeed, the euro has taken a hit over the last few days, but not a very big one. For unlike the naked monetization that has occurred to facilitate America’s banking and real estate bailout, Europe’s rescue package merely promises low-interest loans to countries that get in trouble. This dog-and-pony show can work in the PR sense because, with low-interest borrowing power at their command, the PIIGs can cover cash needs more or less indefinitely. But the game will be up if the Germans pull away from it — as why should they not? It’s one thing for Wall Street and the news media to play along with the eurobailout, but we should pardon the Germans for being skeptical. They are the ones who will pay for it, after all, and they can therefore be forgiven for doing an endgame analysis that yields a toxic bottom line.

Meanwhile, the price of gold continues to reflect only the ugly truth about Western Civilization’s money. Yesterday, Comex June Gold hit a $1245 target that we disseminated a month ago when quotes were $100 lower. In fact, our target was exceeded by about $3, which according to the proprietary Hidden Pivot Method we use to trade and forecast, means still higher prices are imminent. The most immediate Hidden Pivot target is $1286, but as a result of yesterday’s surge we have shifted the analysis to the daily chart from the intradays, allowing for significantly higher projections. If you’d like to find out exactly what we’re thinking, you can take a free seven-day trial to Rick’s Picks by clicking here.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Not to do with Germany, again.

Let´s put these circuit breakers trailing under all stocks and OTC! Then we can send everybody home and start do worthwile things. 🙂

O, by the way, Germany. It´s not over, yet. SPD and big inner parts of CDU begin to retreat from their bail-out positions. Ackerman just called Greek credit more or less hopeless! On popular TV.