Colorado ski properties are enjoying a dead-cat bounce, although readers of a recent article in the Denver Post might infer there is something more to it than that. The article noted that in Eagle County, which includes tony Vail, residential transactions were up 190% year-over-year for the first quarter. That represents 276 properties changing hands, compared with 145 during the same period a year ago. However, as the article acknowledged, the surge was from very depressed levels, and it still fell 27 percent shy of the total for 2008 and 58 percent shy of the figure for 2007. Nowhere was there any mention of price trends or rental costs. If these factors had been taken into account, it would have made clear that valuations will have to fall much further before ski homes and condos could conceivably experience a sustainable bounce.

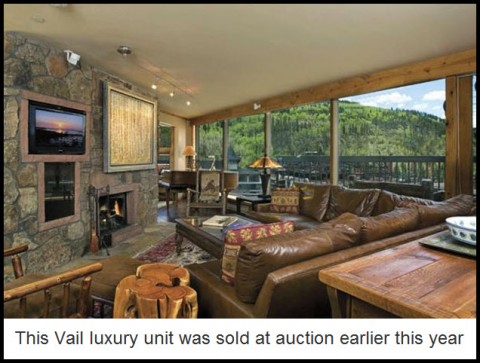

We recently sat down with a Vail property owner who worked the numbers for us. He said that even after collapsing from a peak price of $1.3 million to around $800,000, a two-bedroom luxury condo in Vail is still a lousy investment. Assuming the unit is rented 130 nights at $350 per night – a fairly optimistic assumption, according to our source – annual gross income would be $45,500. Half of that would go to the leasing agent, leaving $22,750. Subtracting a further $15,000 for taxes, maintenance and homeowner association fees would leave $7,750. Then there are mortgage costs of about $30,000 per year. This is based on a 6.5% loan on 60% of the property’s value. You should add a 6% opportunity cost, or $19,200, on the 40% not financed, since that’s what you could earn – without all the hassles – in a closed-end muni-bond fund. Thus, the investor who scooped up a $1.3 million property for a supposed fire-sale price of $800,000 would still have negative annual cash flow of a little more than $41,000. That might work if ski condos were appreciating in value by 15% of more per year, as was the case before the housing market collapsed in 2007. But because prices have instead been falling, most speculators who bought within a few years of the top have taken a bath.

It Gets Worse

Things are likely to get much worse before they improve for a couple of reasons. For starters, listings in Vail, as well as in other Colorado ski resorts, not to mention ski properties in California, Vermont, New Mexico, Wyoming, Utah and other states popular with skiers, are said to be as thick as the phone book – enough inventory to last for years, even in a booming market. But what makes ski homes and condos particularly vulnerable is that they represent mostly speculative investments that are the first to be liquidated when property owners get on the ropes financially. It is far easier for them to sell a ski-condo in Vail, Breckenridge or Winter Park than to move their families into less affluent neighborhoods at home. The bottom line is that for ski properties in Colorado and elsewhere, the 40 percent markdowns that have occurred so far are just the beginning of a real estate collapse that will take years to play out.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

As a UK citizen with an investment condo in Teton Village, Jackson Hole, Wyoming I read the article with interest. I believe JH is less affected than a lot of other Rocky mountain ski resorts i.e much less inventory due to 2% restriction on overall land development, it is an all year round resort due to very close proximity of Yellowstone, in fact we have more rental income in the Summer season than the ski season. Places like Vail are very developed with far more inventory and consequently diluted rentals and to my knowledge doesn’t share the all year round appeal of JH. I am talking specifically about Jackson and Teton Village here as bucking the trend to some degree. The opposite is true in Teton County and the Driggs/Victor areas bordering Idaho. There was over development there (largely speaking the 2% land restriction doesn’t apply there) over the past few years which has led to a glut of properties being available including some foreclosures and distressed sales. Our rental income is still down but holding up and in fact ticking up a little, the management at the lodge are saying the corporate bookings which tanked over the last 2 years are beginning to trickle in which is very good news. The lodge is also anticipating a stronger Summer and are working hard with inducement packages to get the customers in. Speaking purely about Jackson Hole overall it could be a lot better but it could be far worse and there are encouraging signs that the worst may be over but it will be a couple of years yet before things get back even remotely near to what we all believed was ‘normality.’