Another 200-point rally in the Dow, and it’s hard to say exactly what has put Wall Street in such a giddy mood. Talk about climbing a wall of worry! Is it perhaps the increasingly shrill warnings of an oil-induced Armageddon that have sparked a binge of contrarian buying? Or maybe it’s the gap that has begun to open up between a Europe hell-bent on “austerity” and a stimulus-addicted America about to launch yet another $50 billion jobs package? The money managers who have been recklessly pouring O.P.M. (Other People’s Money) into stocks lately must think the dollar weakness that a tight-fisted Europe will inevitably bring about is going to boost U.S. exports — what exports? — and bring back prosperity.

But wait, here’s another possibility: Because Wall Street hates uncertainty more than anything else, perhaps investors are comforted by the growing certainty that our President is so utterly lacking in competence as to all but ensure a landslide victory for the Republicans in the November? Another factor that could account for the rally is the afterglow of some recent economic data suggesting that housing, jobs and retail sales are all tanking simultaneously following a $13 trillion attempt to get the economy moving. Great! Now the Fed can finally get serious about lowering rates below zero so that borrowers will literally get paid for doing what already comes naturally. Or so investors must think.

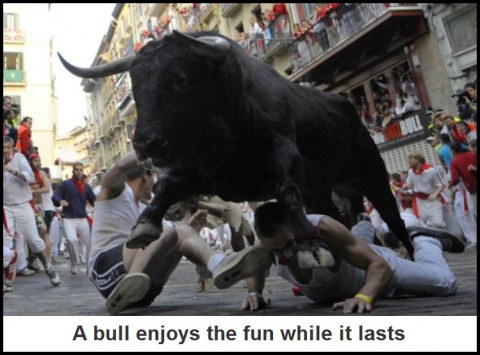

Considering the foregoing, we needn’t have wondered why the bulls are so jazzed. In fact, their all-but-insatiable lust for shares these days only proves once again that on Wall Street, too much of a bad thing is never enough.

Our Bearish Hunch

For our part, we’ve been laying in a modest inventory of put options on the Diamonds as stocks have moved higher. The strategy is highly speculative, since it’s based, not on our proprietary technical indicators, but on a gut hunch that a collapse cannot be far off. However, our approach has been anything but willy-nilly. Yesterday, for instance, we didn’t even start buying puts until the S&P futures were within a few ticks of the day’s highs. Earlier in the session, during an impromptu webinar for subscribers, we’d projected a peak in the E-Mini S&Ps at 1110.50; in fact, in the final minutes of the day, the futures topped at 1111.50, up 25 points, before receding, presumably to provide the dirtballs who work the night shift with better buying opportunities.

We find ourselves buying a few put options at these levels for the same reason we throw $5 at Powerball every time the jackpot goes above $120 million. It’s probably money down the drain, but the temptation is irresistible. And besides, the options yield better odds, especially considering the news.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

There is not much more to the bull than just plain BULL.