The Dow Industrials have rallied 367 points from Friday’s oversold lows, a feat that looks much less impressive when you consider that the blue chip average had lost 980 points in the preceding two weeks. Most of the frenetic buying over the last two days has been done by panicky bears who literally got caught short when stocks exploded on the opening bell Tuesday. We got caught mildly short at the turn ourselves after having broken a rule that anyone who trades options should heed rigorously – i.e., never, ever pass up an opportunity to take a partial profit when a put trade goes your way for three straight days.

Too bad we didn’t do as we say, since it would have given the theoretical gain we achieved anyway a nice boost. Although we’d correctly predicted a 96.13 low in the Diamonds that came within 0.04 points of nailing Monday night’s key bottom, we let our bearish position ride. Dumb. Any time an option trader fails to adjust a put position after three consecutive profitable days, he is just being greedy. Statistically speaking, a three-day selloff is probably as good as it will ever get – a fact that held true even in the case of the October 1987 Crash. It may have seemed as though the world was ending at the time, but in actuality, anyone who bought puts on Friday, October 16, when stocks began to plunge, had to be out of them by Tuesday morning, October 20, to avoid one of the nastiest whiplash rallies in stock-market history.

97% Losers

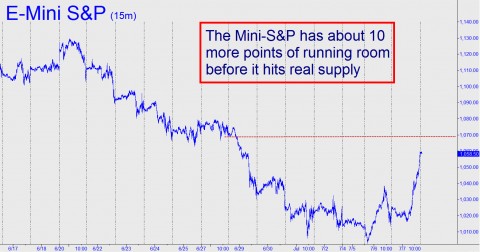

Naked put buyers have probably lost money 97% of the time since options were first listed in 1973, but it is still possible to beat the odds. We attempted to do so by exiting July 96 Diamond puts near yesterday’s opening, realizing a theoretical gain on each put of 27 cents just before they plummeted toward zero. Applying the paper gain to some August 98 puts that we still hold, and to a few more that we acquired yesterday for an average 2.65, gave us an adjusted theoretical cost basis of 2.13. It helped that we waited for a 270-point rally to unfold before adding to our put position. The decision to do so was based on the very bullish projection that went out Tuesday night for the E-Mini S&Ps. We were expecting a monster rally to 1049.25: “…there are obviously more than a few panicky shorts still alive. They’ll get what they deserve…if the futures push above 1027.50 [on Wednesday]. More bullish still would be a move above 1031.50, the midpoint resistance of the pattern begun from yesterday’s low. It projects as high as 1049.25.”

In the actual event, the futures rallied yesterday to 1059.50. As the above chart shows, they could go for another 10 (or so) points on Thursday before running into serious resistance. With any luck, we’ll still have a little dry powder left to buy some more put options when the rally finally tops out.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

I absolutely agree with you that manipulation does occur especially during the opening bell.

In the end all it does is create a build-up of pressure when a dire economic situation becomes clear. It actually creates its own worse scenario. Preventing orderly selling during these times creates crashes. Ironic aint it.