Stocks took a nasty reversal off yesterday’s fleeting high after falling an inch shy of a benchmark where we’d warned that bears would have to start worrying. Specifically, we’d said that if the E-Mini S&P futures exceeded 1196.50, that would set them up for an even more vicious short-squeeze that could last for weeks if not months. In the actual event, the E-Mini topped Monday at 1192.75, four points beneath our bullish trigger threshold, after rallying the equivalent of 100 Dow points Sunday night on near-zero volume. Low-volume rallies have been the bulls’ modus operandi since the Mother of All Bear Rallies began in March of 2009. Typically, index futures that trade round-the-clock get squeezed higher on extremely light volume in the dead of New York’s night. It is no great trick for firm traders to accomplish this with relatively modest capital outlays and very little risk – especially on quiet Sunday nights when there is but a mote of faintly positive economic news on the tape. Once the short-squeeze fuse is lit, DaBoyz sit back and wait for bears to come stumbling out of their lair, choking and coughing on smoke, when the NYSE opens. Typically, bears will be in a panic to catch up with the index-futures rally that has occurred overnight. The sure-fire money-making scheme concludes with DaBoyz selling into the rally that they themselves stirred up. Often, the short-covering is sufficiently urgent to keep stocks buoyant even after bears have thrown in the towel and taken their losses.

The “big news” out Sunday night was that consumer spending had risen a very modest 0.2% in September. There was also this kicker: manufacturing activity expanded faster than expected in October. Taken together, these two items don’t add up to a hill of beans. But in a market where there are almost no institutional sellers, and no individual investors even in the game, it takes very little in the way of good news for DaBoyz to manipulate the broad averages higher. Actually, much of the time, the mere absence of negative news will suffice as an excuse to trigger off a buying spree.

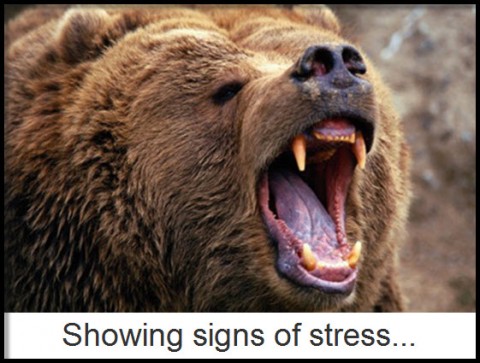

Brace for New Onslaught

Fortunately, the rally did not catch Rick’s Picks subscribers unawares. Here’s the tout for the E-Mini S&Ps that went out to paid subscribers Sunday night: “The futures are up nine point Sunday evening — for whatever dumb reason — but it’s not all innocent play, since the move has exceeded Friday’s high, 1187.50, and thus sets up this vehicle for an even nastier short-squeeze at the opening. The (very) crucial number is 1196.50, equal to an important peak made last April on the way down. If it’s exceeded, it seems likely the visually obvious peak at 1208.00 just to the left of it will be exceeded as well.” So what do we make of the E-Mini’s narrow failure to push above 1196.50? We think the resistance is a dead duck and that it will get blown out of the water shortly, notwithstanding the fact that the futures sold down hard – the equivalent of 180 Dow points — after topping at 1192.75. Much as we’d like to believe that the stock market is finally beginning to respond to economic reality, which remains grim, we will always defer to the irrational forces that have been moving stocks higher regardless of the news. Mainly, it has been a case of OPM (Other People’s Money) and surplus bailout funds that have helped promote this reckless binge (which in March would enter its third year). Although we’ll continue to go with the flow as long as the madness of crowds persists, we’ll never stray more than a step or two from the fire exit.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Rick has a pretty good method for playing with fire. I’ve never done it, being mostly a physical bullion guy, but I think one step from the exits is more appropo these days. Richard Russell says the winner in times like these is he who loses the least