Stocks got a lift yesterday from retail numbers that supposedly weren’t as bad as economists had expected. Sales dropped “only” 0.2% last month versus economists’ dartboard expectation of a 0.6% decline. Because it was merely a bunch of economists who were doing the expecting, perhaps we shouldn’t be surprised that the numbers were so far off. No matter though, since the not-totally-disastrous stats were exactly what the doctor ordered to send shares into a bullish spasm that left the Dow sitting 123 points higher by day’s end. The sales data evidently had been leaked Sunday night, and DaBoyz lost no time using it to put the squeeze on bears. They effortlessly ran the index futures up the equivalent of more than a hundred Dow points in thin trading overnight, all but guaranteeing that the broad averages would have to play catch-up on the opening bell. This is exactly what they’ve been doing for more than two years as the Mother of All Bear Rallies has run its course, but in psychological terms, they don’t seem to be getting as much bang for the buck. There was little joy in Mudville, for one, where a trader quoted by the Wall Street Journal allowed only that stocks were due for a snapback rally. However, he added, “I don’t think one day makes a trend.”

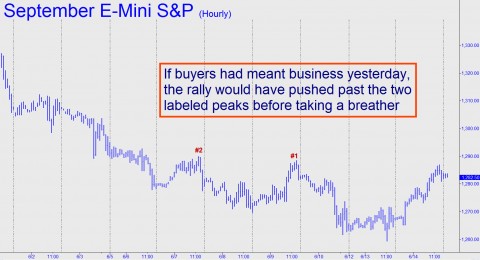

For sure. Permabears looking for the dark cloud rather than the silver-flecked lining need only ponder the hourly chart of the E-Mini S&Ps above. Notice how yesterday’s supposed stampede turned docile just inches shy of two important prior peaks. We’d have been impressed if the rally had gotten past those peaks on the first try, but now they’ll have to try again on Wednesday, presumably with a running start from yet another thinly traded night session. While it sometimes happens that “real” rallies begin as timidly as this one, accelerating as more and more shorts are induced to cover, we doubt that yesterday’s upthrust has the moxie to get very far. Nor does it have the support of economic data that would persuade anyone besides the village idiot or the mainstream media that a strong, broad-based recovery is under way.

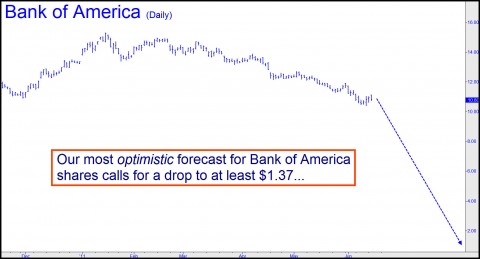

To the contrary, even the fraud-based resurgence of the banking sector has come a cropper, with the chart of Bank of America’s shares, for one, looking like the company is headed for bankruptcy (see above). Hidden Pivot analysis implies that the stock could fall to as low as minus $17. That’s impossible, of course, but we learned during the Great Financial Crisis of 2008-09 that such numbers do have meaning. For in fact, we came up with similarly negative numbers for Bear Stearns (!) and Lehman Brothers (!) when we sent out an alert to subscribers just before the banking sector went into its nearly fatal dive back then. Even our best-case forecast for B of A is nothing to cheer about. We see the stock falling to at least $1.37 (and you heard it here first). If you want to learn how to do your own forecasting and to be far better at it than many gurus who do it for a living, consider taking the upcoming Hidden Pivot Webinar in late June. For further information click here, and use this code for a $50 discount: 7D5629.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Dear Mr. Market,

Please stay in the range where you are. We beg you. We traders love you, but only if we’re disciplined and sharp enough with our trades. You should not go a lot higher because its not justified. Nor should you go a lot lower. Stability!….ahh what a nice word and in fact, exactly what we need! Please continue to indulge us, stay in this sweet spot swinging range. Oh thou S&P vacillate thee like a wild bucking bronco between 1250 and 1350 for the next six months. Oh dearest crude please continue forgetting the realities of supply and demand, just swing baby swing! Between 94 and 104, drop it down a notch to Ricks 85 to 95 range if you like. We are happy no matter what, the speculative trading short squeezes up and and back down in mere hours if not minutes are manna from heaven to our trading riches, only if they don’t wipe us out when we blink.

Yes yes I’m so damned happy to be doubling my money on a trade in an hour, this is what markets were meant to be! Speculators reign! Screw the fundamentals and the betterment of society! Everyone can follow the trader’s march! We can all exit the system, exit the matrix! Just trade the volatility and watch your account grow and grown! God bless cheaper deeper in the money options, thanks to Buddha for forex and CFD accounts we can fund with Paypal! Living, eating, breathing money on our Ipads and Iphones we should be teaching this stuff to our grandparents and 12 year olds, to those who are unemployed so they can day trade their way to a steady monthly income. We can teach everyone the hidden pivot method so they don’t need to be part of the society that is ruined anymore!

Please Mr. Market stay in the range and stay volatile, swing like Frank Sinatra baby with the Duke’s big band Plunge oh waning USD and I know gold and oil and bonds will rise. Or dont plunge!…no no, rise up as the safe world’s currency reserve you are no matter how bad the banking system underneath is. Rise rise rise! And we know the stocks will plunge and oil will fall! What could be simpler!

Trade my dear friends…trade the speculative short squeeze swings whose meaning is only that very notion unto itself; that they are speculative short squeeze swings and absolutely nothing more.

Swing in the range Mr. Market. Please, that’s what we need you to do. We go forth like apostles of a prophet and teach all to trade the swing on the chart, to set the stop below the support level and to set the limit to catch the unexpected spike.

Exit the matrix. Trade the market swings. And all will be well with the world.

Yours Sincerely,

An Amateur, A Day Trader, A Dreamer