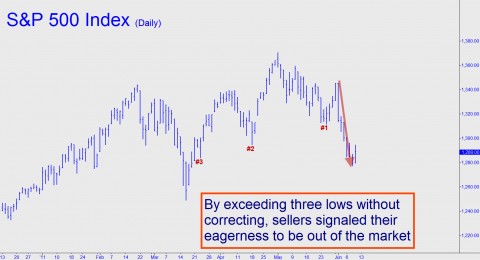

Because the stock market has just received the kiss of death technically speaking, traders who are looking to get short should view rallies like yesterday’s as a gift. Notice in the chart below how the S&P 500 exceeded three prior lows without an upward correction. It would have been bearish enough if the selloff had breached only two prior lows, since that is all our proprietary Hidden Pivot Method requires to signal a trend change. But by exceeding a third low for good measure, sellers revealed their eagerness to be out of shares before summer begins. In the meantime, let’s hope the bullish hubris continues for another day or two, since it could set up the fattest trading opportunity bears might see for a while. (Want to learn how to predict swing highs and lows yourself — with amazing accuracy? Click here for information about the upcoming Hidden Pivot webinar. Or here for a free trial subscription to Rick’s Picks, including access to a 24/7 chat room that draws veteran traders from around the world.)

According to the Wall Street Journal, stocks rallied yesterday because the economic news was moderately encouraging. We know better, though. It was more a case of the day’s flatulent economic news seeming moderately encouraging because stocks were rallying. The news item of the day — not counting the salacious one about Rep. Anthony Weiner’s formerly private life (and private parts) — concerned an unexpected contraction in the trade deficit in April. That’s good news, right? In fact, the trade deficit declined a whopping 6.7% because Americans are buying a lot less oil. And while that may be good news for the global-warming crowd, it is ominous news for the economy, since it suggests that soaring prices for an essential commodity are beginning to severely impact household budgets.

‘Just a Soft Patch’…Not!

Even so, eager as ever to see the glass as half-full, the Journal soft-pedaled the stock market’s ongoing correction from the April 29 high as relatively mild. “The Dow is now only off 5.4% from its April 29 high, making the six-week correction a relatively restrained one,” noted Wall Street’s newspaper of record. If yesterday’s rally turns out to be the beginning of a major upthrust, they’ll be right, the correction will have been mild. We doubt that that will prove to be the case, however, given the strength of the bearish “impulse leg” shown in the chart above. We’ll give Charles Plosser, president of Philadelphia’s Federal Reserve bank, the final word nevertheless. Plosser called recent weakness in the economy just a “temporary soft patch,” and opined that growth should resume and strengthen going forward. Considering the source, that sounds pretty scary to us.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Rick, you may know this guy. Chris Martenson’s The Crash Course: 45 Minute Version. Very interesting take on the future. Maybe sooner then we think? http://www.chrismartenson.com/page/crash-course-one-year-anniversary