Is the worst of the economic crisis behind us? We’d have thought answering that question with a resounding “No!” was a no-brainer, especially considering that the Federal Government’s multitrillion dollar attempt at stimulus has barely slowed the collapse of the real estate market, let alone lifted home prices as intended. And yet, when we asked the question at a recent panel discussion on “The Financial System of the Next Decades,” all but a handful of those in the audience raised their hands in assent, apparently in the belief that the U.S. is emerging from, or has emerged from, the Great Recession. We tried a different approach just to make sure: “How many of you think we are still in a financial bubble?” Three people in the audience of about 300 raised their hands. What’s going on here? We thought only the nation’s newsrooms were oblivious to economic reality, but apparently not. Was this perhaps a roomful of die-hard CNBC-watchers? That, too, seemed unlikely, since the audience was comprised mainly of University of Virginia graduates and alumni, not the sort of stock market yobs who can stomach the likes of Jim Cramer.

And the panel itself was not exactly a bunch of wild-eyed optimists either. More like a bunch of staid academicians. It included University president and professor of sociology Teresa A. Sullivan; Prof. William Wilhelm Jr. from UVa.’s McIntire School of Commerce; and Lawrence E. Kochard, chief executive of the school’s Investment Management Company. In his excellent post-mortem of Lehman’s collapse, Prof. Wilhelm noted that, at the time the investment firm went down in flames, it was financing more than 40 percent of its portfolio with debt maturing in two weeks or less. We pointed out that the Federal Reserve is currently far more leveraged than Lehman Brothers ever was, but neither the panel nor the audience seemed impressed.

Nor did we change any minds by citing one particularly alarming trend that could hasten the housing market’s final collapse, and with it the collapse of the U.S. economy. Specifically, we noted that homeowners faced with foreclosure have won nearly every court decision in which they’ve challenged lenders to prove ownership. Of course, it should surprise no one to learn that clear title to property would have been a casualty of the global mortgage-securitization mania that fed the housing boom. Now the banks will face the consequences, since lawsuits are springing up like topsy as more and more underwater homeowners take advantage of a legal loophole that promises to let them off the hook scot-free.

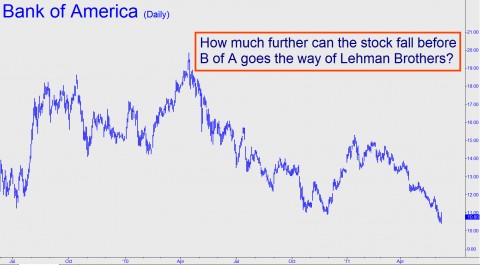

Panelist Kochard asserted that “everyone” was looking to short “something” to leverage the economy’s intractable weakness. We suggest that he study the method used by John Paulson a few years ago to capitalize on the mortgage market’s collapse . The scheme required such sophistication that only Paulson and a handful of others were able to make big money on it. We’ve long asserted that debt deflations such as the one occurring globally right now would challenge even the savviest investors to hold onto a mere fraction of their peak net worth. This is not a time of opportunity, but of defensive play, and although there are certain to be some incredible bargains after the financial system has imploded, the challenge until then will be to preserve one’s capital. Incidentally, even Paulson is not infallible. Reportedly, he bought a ton of Bank of America stock in expectations that its price would double. By our runes, B of A’s chart looks like that of a company that is headed for bankruptcy.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Back from daughter’s graduation in SoCal where the women are beautiful and the men rich, while they drive 85 mph with a 65 mph speed limit in $200 K Cars and surf all day and make love all night.

Woke up to notice 300% ISE Opening C/P ratio on Equity Options at 9:50 NYC. Many still buying the dips.

This may not end well when it ends…