Although our bullish outlook for stocks remains unchanged, the 900-point Dow rally we projected in late May hasn’t been the quite romp we were expecting. In fact, springtime’s tiresome ups and downs appear to be continuing into summer, and it now seems possible this behavior could persist well into August. If so, the risk of financial loss will be lower in the coming weeks than the risk of being bored half to death. Yesterday’s price action underscored the stock market’s reluctance to do much of anything, even when conditions seem right. Such as Sunday night. For a rare change, it looked like the slimeballs who control stocks in the off-hours were on the ropes. Usually, they take shares down as far as possible Sunday evening in order to exhaust sellers just ahead of Monday’s opening. This allows Them to short-squeeze stocks ahead of the bell, catalyzed by virtually any crumb of news that could be construed as even remotely positive. This time, however, with index futures getting pounded overnight, the familiar stage-managed rebound was nowhere in sight. Stocks in fact continued their fall for the first few hours of Monday’s session, with the Dow down by almost 200 points at the lows. Then, just when it looked as though DaBoyz might get trampled, shares suddenly reversed and headed north, recouping half the day’s losses by the final bell.

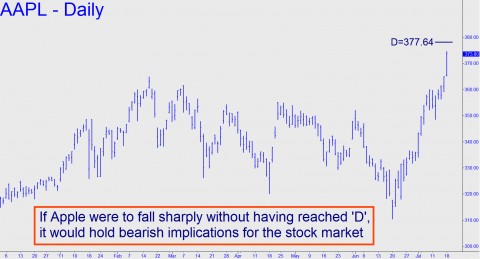

So how might the markets continue to bore us in the weeks ahead? For starters, we expect yesterday’s weakness to resume, bringing the September E-Mini S&P down to at least 1280.50 today or tomorrow. With the futures trading for around 1301.00 as of this moment, the implied 20-point drop would spell a relapse of about 160 points for the Dow Industrials. We’d be cautious buyers at that level, using the Hidden Pivot Method to find a “camouflage” entry opportunity with – in theory – a bare minimum of risk. (Click here for further details about this method. Or here, if you’d like a free trial subscription that would enable you to ask subscribers about it yourself in our 24/7 chat room.) If stocks were to fall even harder than that, we’d still be looking for the strong rally needed to push three widely followed bellwethers to intermediate-term rally targets yet to be achieved. Specifically, we expect Apple shares, for one, to hit a minimum 377.64 before the stock takes a breather; yesterday, they achieved 374.65 in a rampage that bucked the broad averages. Also, there is IBM, which has implied business at 183.35, a longstanding Hidden Pivot target; so far, Big Blue has gotten as high as 177.77. Finally, there is Google, which achieved a short-term target at 603.16 yesterday but which would presumably be primed for a thrust to as high as 668.83 if it closes above 603.16 for two consecutive days. Most bearish of all for the stock market, looking at the intermediate- to long-term trend, would be a sharp drop in AAPL and IBM without their having achieved the targets noted above.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

okay we won’t pick on GS as a market directional. how about this one? BAC lets say at $8 it gets difficult to believe dow goes to 13,000+ http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=BAC&insttype=Stock&freq=2&show=&time=20