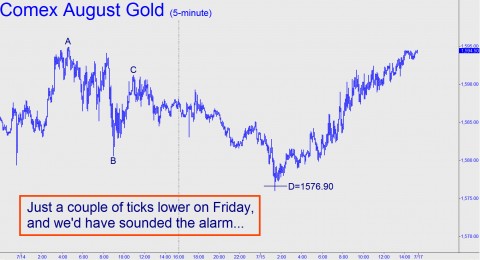

As gold ascends higher and higher into thin air, it continues to test every crag, jib, flake, crevice and runout on the rock face, much to the consternation of traders, investors and speculators. At these unaccustomed heights, it is perhaps only the long-term bull who acquired physical gold a decade ago who has the reserves of patience and calm needed to take corrective swoons and trendless tedium in stride. From a technical standpoint, we find that pullbacks both major and minor have gone to absolute extremes in order to prey on our individual and collective fears and doubts. For instance, when Gold and Silver futures prices plummeted from their May 2 highs, the seeming kamikaze dive brought them to within mere ticks of an extreme “danger zone” we’d identified using Hidden Pivot analysis. Then, just as suddenly, quotes rocketed skyward, recouping nearly half of the losses in just a few short days. And last week, a selloff that took two days to exhaust the nervous Nellies tested bulls yet again, with August Gold reversing sharply from within less than a single point of a 1576.90 Hidden Pivot support. However, even knowing where, exactly, to expect the turn offered no easy path to profits, since gold’s trampoline bounce came in the dead of night, starting at around 3:25 a.m. Eastern.

Of course, it is increasingly bullish expectations that have made bullion’s evasive moves more and more challenging. Were it otherwise, anyone could get rich simply by betting on the favorite. And talk about favorites! What could be more inevitable and obvious than gold’s continued rise? Amidst a paper-money blowout the likes of which the world has never before witnessed, and the looming revelation that hundreds of trillions of dollars of global debt can never be repaid in hard cash, we can only assume gold will continue higher, right? Indeed. But no matter how obvious all of this may seem, gold and silver will continue to challenge our expectations. And our nerves. Fortunately, there are a few precious-metals bulls out there who are fearless in reiterating their seemingly insane bull-market targets every time bullion quotes get smashed. Cherish these guys and trust what they say. But always verify. Even though we are pretty confident ourselves that they’re going to be right, their nonchalance in the face of harrowing and sometimes hellacious downdrafts does not come naturally to us. We’d prefer to forecast this bull market one Hidden Pivot target at a time. Speaking of which, the next benchmark for August Gold – a target we feel completely comfortable with and confident in — lies at precisely 1652.00. Want to know what out target is for September Silver? Try a free week’s subscription to Rick’s Picks by clicking here. You’ll get not only up-to-the-hour forecasts for some of the most popular trading vehicles, but also access to a 24/7 chat room that draws experienced traders from all over the world.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Depending on exactly which quote one uses, the above sentiment about humans and history can be attributed to either Hegel or Santayana. The reason we don’t appear to “move on” from experience, to incorporate it in such a way that we avoid repeating certain harmful outcomes, has to do with Homo Sapiens being prone to repetition compulsion both individually and collectively. Another issue connected with our inability to learn from history is that the human lifespan is such that there is always a new group coming along who know nothing of the past.