If a millennial tide of Fed funny-money can push the broad stock averages higher no matter what the economic climate, just imagine what it can do for the shares of companies with strong earnings growth in these recessionary times. In particular, Google, IBM and Apple have soared in recent days on stellar Q2 reports and giddy rumors. Yesterday it was Big Blue that took flight, gapping up five percent on news of exceptional top-line growth. Even better for investors was that the company expects this growth to continue for at least the rest of 2011 in all of its lines: hardware, software and business services. We wrote here a long while back that IBM bonds were probably a safer and better bet than U.S. Treasurys, and we still think this is so. There were a few other blue chip companies on our short list that one could imagine will do pretty well even if economic activity in the U.S. sinks to depressionary levels. Johnson & Johnson, Disney, Caterpillar, 3M and Safeway come to mind, as well as Apple, which, despite its pricey merchandise, stands to rake in tens of billions of dollars over the years from nickel-and-dime sales of iTunes to an imponderably large number of music lovers.

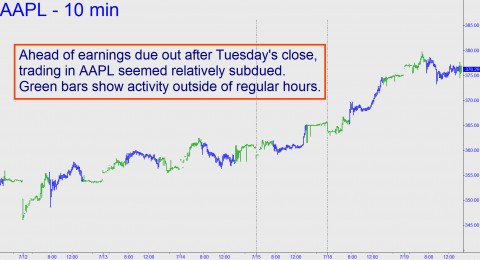

Google’s explosive short-squeeze came earlier in the week, when the stock gapped from 529 to 598 overnight – that’s nearly 14%! — on the sensational earnings report that nearly everyone must have expected. Apple’s numbers were to have been reported after the close on Tuesday, but the stock seemed uncharacteristically subdued ahead of the announcement. This is probably because AAPL, even more than GOOG or IBM, has spent the last few weeks discounting the best news anyone could imagine. Apple shares that traded as low as 310 on June 20 have since risen to an all-time high yesterday of 379, an increase of a little more than 22 percent. If the stock were to gap Tuesday evening on top of such an amazing run-up, it would rank as one of the most spectacular rallies in history by a large-cap firm. [Late-breaking note: Apple leaped to 405 moments after earnings were released around 5 p.m. EDT. This put into play a Hidden Pivot target at exactly 407.01, but any higher would suggest there is plenty of buying power remaining to be spent.]

Short in IBM

Relative to our forecasts, yesterday’s highs in Google and IBM slightly exceeded longstanding targets. We expect those targets to hold, at least for a while, and that is why we told subscribers a couple of weeks ago to buy IBM August 175 puts if the stock hit 183.35, a Hidden Pivot target. The order filled yesterday for around $1.20 per put when Big Blue leaped to an intraday high of 185.21. The fact that the stock was able to exceed the target at all is bullish as far as we’re concerned, but we still think IBM will need to retrace and consolidate the rally before mustering the seemingly inevitable push to $200. If so, our strategy on any temporary weakness in the stock will be to short-sell puts of a lower strike against the two we bought yesterday. The goal is to reduce risk to zero if we are wrong while preserving an opportunity to profit if the stock has indeed topped. Incidentally, if risk-averse trades in put and call sounds like your cup of tea, click here for a free trial subscription to Rick’s Picks.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Thanks for a great article Rick. It confirms many of my beliefs.