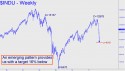

The weekly chart shows how yesterday’s plunge created a bearish impulse leg by exceeding the required internal and external lows. The price bar itself doesn’t look like much in the context of this very big picture, but it is ominous nonetheless that it has followed a bull cycle that failed to surpass the 13187 peak from May 2008. By definition, that means the entire Mother of All Bear Rallies from the 2009 low is merely corrective relative to that peak. The resulting, bearish ABCD pattern gives us a Hidden Pivot midpoint to use for a minimum downside target: 9542, representing a further fall of about 16 percent. To be sure, there are lesser uptrends yet to play out against the larger, bearish tableau; however, we now have an especially compelling reason to look for ways to get short at their respective midpoints and ‘d’ targets. Camouflage, anyone?

The weekly chart shows how yesterday’s plunge created a bearish impulse leg by exceeding the required internal and external lows. The price bar itself doesn’t look like much in the context of this very big picture, but it is ominous nonetheless that it has followed a bull cycle that failed to surpass the 13187 peak from May 2008. By definition, that means the entire Mother of All Bear Rallies from the 2009 low is merely corrective relative to that peak. The resulting, bearish ABCD pattern gives us a Hidden Pivot midpoint to use for a minimum downside target: 9542, representing a further fall of about 16 percent. To be sure, there are lesser uptrends yet to play out against the larger, bearish tableau; however, we now have an especially compelling reason to look for ways to get short at their respective midpoints and ‘d’ targets. Camouflage, anyone?