Jitters over Greece’s increasingly dire financial plight are waxing yet again, taking Wall Street traders by surprise if no one else. The Dow Industrial Average dove 303 points Friday on speculation that Greece would fall into default when the new week began. As of late Sunday night, however, there was barely a word about Greece on Google’s news page – only a story about rioting in the streets following enactment of a new, $2.7 billion property tax in the name of austerity. That’s the relatively good news. The bad news is that France, of all countries, was generating scary headlines of its own: Woes at French Banks Signal a Broader Crisis, declared the Wall Street Journal. “France’s largest private-sector banks will likely suffer further credit-rating downgrades this week, the latest sign that the debt crisis on the euro zone’s periphery is slowly infecting the core of the region’s financial system,” noted the article. Just when we thought the panic was about to engulf Spain and Italy, the spinmeisters insert France into the picture as a buffer, a default risk calculated to be at least somewhat less thinkable than the one threatening to inundate France’s two large neighbors to the south.

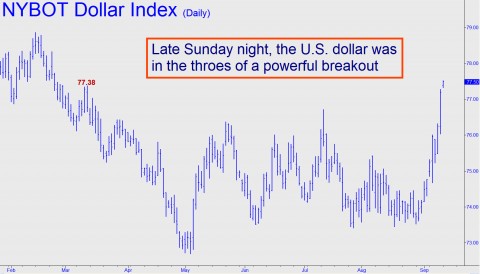

We doubt the diversion, if that’s what it is, will last for long, however, since, as everyone but the Powers That Be seems to understand by now, we’re all in this together — Europe, the U.S., China, Japan, South America, Russia et al. That fact hasn’t stopped U.S. banks from choking off lending to their European counterparts in recent weeks in a delusional attempt to distance themselves from the coming euro-implosion. Do Citibank, J.P. Morgan, Chase, Bank of America and their ilk actually believe their timid, eleventh-hour avoidance maneuvers will keep the blood-dimmed tide at bay when market forces ultimately overwhelm the central banks, as seems inevitable? The bankers might as well be piling sandbags against a nuclear blast. Note the steep trajectory of the dollar’s rally in the chart above. We told subscribers last week that if it pierced the 77.38 peak labeled in red, a major breakout was in the offing. As of Sunday night, the peak had been exceeded by a decisive 0.14 points, implying the upthrust is just getting started. If so, from a financial standpoint it is August 1914 in Europe, with bleak implications for the rest of the economic world.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

One more possible short term rally is in the cards. Looks like the dollar has broken out of its consolidation. Not exactly good for Gold, but I have been wrong before. Deflation is now a given since the 10 year broke below 2 percent.

The macro view I had eons ago seems to finally be coming together. Non-recoverable debt, deflation and depression on a world wide level. I still say the dollar will benifit as real estate, equities, and commodities fall out of favor.

I also have a long standing fibonacci number that should place the SPX at or above 1255. This should happen this week or the chances of it ever happening are dwindling fast.

I do love this fast action.