Gold did everything we’d asked of it yesterday, but Silver still has some work to do if precious-metal bulls are going to go back on the offensive. Comex December Gold need only have achieved 1659.10 yesterday to generate some positive signs on the hourly chart. In fact, it was trading well about that threshold early Monday evening, hovering round 1668 after having gotten as high as 1674. This suggests that the next upthrust could go as high as 1729.20, a “Hidden Pivot” target that comes from our proprietary Hidden Pivot Method. (Click here to find out more about this method and the “camouflage” trading technique we use to reduce risk.) However, Silver was relatively timid, and although the December contract finished slightly higher on the day, the 31.430 peak of yesterday’s rally fell 48 cents shy of our bullish trigger threshold at 31.905. By our lights, that number is a key “hidden” resistance, and if it is bettered on a closing basis or by more than a few cents intraday, we would expect Silver to launch sharply higher, reaching a minimum 34.715 over the next 6-10 days.

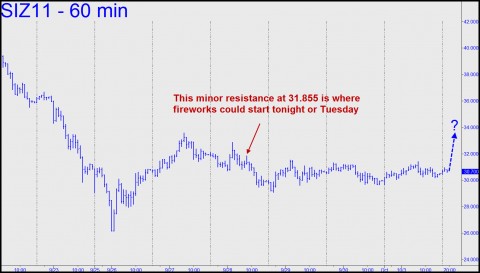

We never want to chisel these forecasts in stone, however, and we will therefore be looking closely Monday night and Tuesday for subtle signs of corroboration on the lesser charts. Meanwhile, there are two non-technical factors that strike us as bullish for gold and silver: 1) bullion quotes rose even though the U.S. dollar was also rallying; and 2) institutional sharks who typically let precious-metal prices waft higher on Sunday night did not slam them back down before the opening, as is their wont. What this suggests is that even though they generally like to fade the trend – in this instance by going short — buyers were too eager Sunday night to let it happen. Whatever the case, if you’re a night owl who tracks precious metals closely, set a screen alert at 31.860 Monday night for Comex December Silver, since that’s where the fireworks could start. Incidentally, we took a bullish stand opposite March Corn’s steep downtrend of the last four weeks, establishing a “tracking position” with a theoretical cost basis of $5.87 per bushel. Subscribers were advised to buy-stop their way aboard on the first rally from below $5.89. If you want to see this recommendation and others in full detail but don’t subscribe, try taking a free seven-day trial by clicking here. Incidentally, we are looking to do some similar bottom-fishing in December Crude, based on a target in the mid-$60s where we think the futures are likely to make a temporary bottom.

Jp morgan has had a short position in silver for years.

I have read they have 121 million oz short and that they sold 6 million oz more earlier this year.

and on top of that the Federal Reserve recently had its first audit ever and it was revealed that they had loaned some 16 trillion dollars to various banks, including JP Morgan.

Don’t know how much the JP Morgan loan was for but I am guessing the used some of it to build another short position at a much higher price, maybe buying back some of there lower short position fueled the rally in Silver last year and earlier this year.

My conclusion is that the Silver market is highly manipulated, its price depressed by big banks and funded by unlimited supply of money. The big banks don’t want gold or silver used as money in the future so I conclude that they will use whatever means they can to suppress it price.

Michael