The markets have opened lethargically Sunday night, although the S&P index futures are threatening to break out of a tiresome four-point range that has contained them for nearly five hours. It’s eerily quiet, like the noiseless moment in a slasher film just before the chain-saw wielding psychopath leaps from the shadows. Even the headlines are pregnantly subdued, a 7.2-magnitude earthquake in Turkey overshadowing all else. Other top stories-of-the-hour include the celebration in Libya of Qaddafi’s bloody, ignominious end; the latest non-developments in the global Occupy movement; an unexpectedly kind word for Facebook founder Mark Zuckerberg from the late Steve Jobs; and — this just in! — a Rangers victory in game four of the World Series. If you could chart the mood of the moment, it would feature Bollinger bands so tightly constricted they almost touch. Technicians use this tool to predict explosive moves when things seem a little too calm, as they do right now.

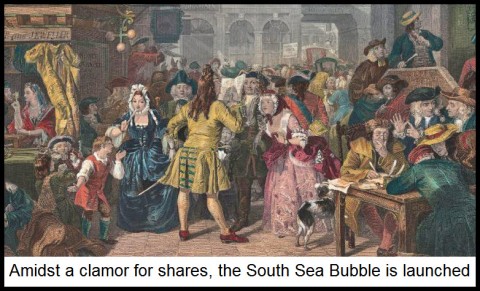

The biggest story due out sometime this week or early next will divulge the actual details of the Merkel-Sarkozy plan to save Greece — and therefore, presumably, all of Europe. We marveled here last week at how the two leaders have brazenly sought to milk yet a few more weeks of agitated calm from a troubled world by merely drum-rolling the latest bailout scheme without providing any inkling of its design. This reminded our colleague Bill Buckler, editor of the Oz-based Privateer, of the South Sea Bubble, wherein shares were floated in “a [British] company for carrying on an undertaking of great advantage, but nobody to know what it is.” Indeed. A similar fraud, later known as the Mississippi Bubble, had been perpetrated a year earlier on French investors evidently as gullible as they were greedy. You’d think the Brits might have had second thoughts. Then as now, however, dangle the prospect of quick gains in front of investors, and who cares about the details? This time around, Europe’s ongoing bailout scam lacks even the deception of the payout that Ponzi operators use to gain investors’ trust. Actually, the only thing Europe’s would-be rescuers have going for them at this point is that the consequences of failure are too grave to think about.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

“…the celebration in Libya of Qaddafi’s bloody, ignominious end…”

For probably the most nuanced and informed commentary on that, see:

http://www.ericmargolis.com/political_commentaries/the-gadaffi-i-knew.aspx