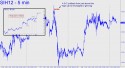

March Silver appears to be building thrust for a shot at 35.535, the ‘D’ target of the pattern shown in the thumbnail mini-inset. The 34.235 midpoint resistance that would need to be surpassed first is above Tuesday’s spike high, so we’ll need to make our move below that level, camouflage-style, if we’re going to get aboard with a minimum of stress. For that purpose, I suggest leveraging a B-C pullback from just above the obscure, look-to-the-left peak at 34.030 shown in the larger chart. The ‘X’ entry trigger could come up quickly, so a state of nimble alertness may be the key to getting executed. _______ UPDATE (11:30 a.m. EST): An enticing camouflage setup did indeed form on the pullback from just above 34.030. Since a chat-roomer has reported a fill based on my numbers, I’m establishing a tracking position herewith. Referencing the 3-minute chart, there was a picture-perfect B-C retracement from just above the 34.030 ‘external’ peak I’d flagged. Here are the coordinates: A=33.770 at 10:09 a.m. EST, B=34.085 at 10:24, and C= 33.950 at 10:33. All three are single-bar, yielding an X entry trigger at 34.030. P=34.110, and D=34.265 ( a pivot that held bulls back for about 20 minutes, but which has bullishly given way). Since ‘D’ of the camo pattern has been reached, you should be holding 25% of the original position, half of it having been exited at 34.110 (P), and another 25% at 34.265 (D). Assuming a single contract remains, and imputing to it paper profits so far, its effective cost basis would be 33.635. For now, use a fixed stop-loss predicated on the futures creating a bearish impulse leg on the 3-minute chart. As of this moment, that would imply an unpaused down-leg exceeding an external low at 33.950 recorded this morning at 10:33 a.m. _______ FURTHER UPDATE (11:50 a.m.): The position was stopped out on a swoon to exactly 33.950, yielding a theoretical profit of $3150 for 72 minutes of work. I was in the process of recommending that the stop be lowered to 33.655, allowing us to swing for the fence, but I couldn’t get this advice to you before the original stop was triggered. Regarding March Silver, my hunch is that it’s spent for the day. The 33.950 swoon low breached some spiky highs from yesterday that should have contained the pullback if the futures were about to get second wind.

March Silver appears to be building thrust for a shot at 35.535, the ‘D’ target of the pattern shown in the thumbnail mini-inset. The 34.235 midpoint resistance that would need to be surpassed first is above Tuesday’s spike high, so we’ll need to make our move below that level, camouflage-style, if we’re going to get aboard with a minimum of stress. For that purpose, I suggest leveraging a B-C pullback from just above the obscure, look-to-the-left peak at 34.030 shown in the larger chart. The ‘X’ entry trigger could come up quickly, so a state of nimble alertness may be the key to getting executed. _______ UPDATE (11:30 a.m. EST): An enticing camouflage setup did indeed form on the pullback from just above 34.030. Since a chat-roomer has reported a fill based on my numbers, I’m establishing a tracking position herewith. Referencing the 3-minute chart, there was a picture-perfect B-C retracement from just above the 34.030 ‘external’ peak I’d flagged. Here are the coordinates: A=33.770 at 10:09 a.m. EST, B=34.085 at 10:24, and C= 33.950 at 10:33. All three are single-bar, yielding an X entry trigger at 34.030. P=34.110, and D=34.265 ( a pivot that held bulls back for about 20 minutes, but which has bullishly given way). Since ‘D’ of the camo pattern has been reached, you should be holding 25% of the original position, half of it having been exited at 34.110 (P), and another 25% at 34.265 (D). Assuming a single contract remains, and imputing to it paper profits so far, its effective cost basis would be 33.635. For now, use a fixed stop-loss predicated on the futures creating a bearish impulse leg on the 3-minute chart. As of this moment, that would imply an unpaused down-leg exceeding an external low at 33.950 recorded this morning at 10:33 a.m. _______ FURTHER UPDATE (11:50 a.m.): The position was stopped out on a swoon to exactly 33.950, yielding a theoretical profit of $3150 for 72 minutes of work. I was in the process of recommending that the stop be lowered to 33.655, allowing us to swing for the fence, but I couldn’t get this advice to you before the original stop was triggered. Regarding March Silver, my hunch is that it’s spent for the day. The 33.950 swoon low breached some spiky highs from yesterday that should have contained the pullback if the futures were about to get second wind.