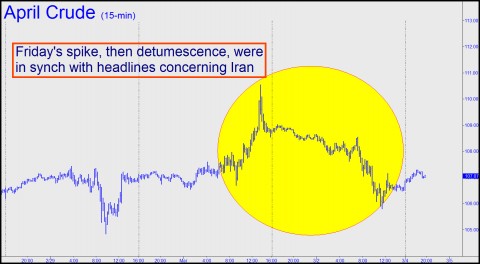

After spiking above $110, the price of a barrel of crude oil receded sharply on Friday, suggesting that the winds of war had abated, if perhaps only temporarily. Oils ups and downs seemed to track Obama’s rhetoric concerning Iran over the weekend. It began with the President saying, in an interview with Atlantic Monthly magazine released late in the week, that he would never allow Iran to develop a nuclear weapon and that it was no bluff to say that the U.S. was prepared to use force to prevent this. But by Sunday, the President had somewhat changed his tune. In a speech before AIPAC, the pro-Israel lobby group, he said there was still time to give negotiations and sanctions time to work. This line landed with a thud at the AIPAC conference, although Obama drew cheers for insisting, in the same speech, that “I do not have a policy of containment; I have a policy to prevent Iran from obtaining a nuclear weapon.” He further noted, to much applause, that “I will not hesitate to use force when it is necessary to defend the United States and its interests.”

We had suggested here a while back that readers tune out the speeches and headlines in order to gauge the odds of war with Iran. If a pre-emptive strike against the country’s nuclear facilities is coming, we reasoned, it seems certain to be reflected by a rise in the price of oil, much as occurred in the months leading up to the U.S invasion of Iraq in March of 2003. Unfortunately, our current forecast for NYMEX April Crude suggests a run-up to at least $120.18 over the near term — about 12% above Sunday night’s levels near $107. Although Iran’s threats to shut down the Strait of Hormuz have presumably helped to push prices above $100, it’s difficult to imagine they could continue rising to as high as $120 without the catalyst of an attack that is thought to be certain.

‘Peaceful Intentions’ Doubted

Meanwhile, few outside of Iran seem to be insisting any longer that the country’s intentions are peaceful. The mullahs flatly rejected the request of U.N. observers to inspect certain nuclear facilities, and Iran itself has already admitted to producing quite a bit more enriched uranium than they could possibly need for medical purposes. These facts do not by themselves justify going to war with Iran, especially since the consequences are unpredictable and could prove fatal to the fragile global economy. Moreover, while Iran’s puny military capability is no threat to the world, or even to Israel, the country’s ability to seriously disrupt oil supplies and global business through terrorism is not in doubt.

Would Iran’s clout increase if it had a nuclear bomb to back up threats such as it has made in the past, particularly against Israel? Presumably yes, and that is why, no matter what Obama says, we should be prepared for Israel to go it alone. If Israel attacks, they would likely do so before the U.S. elections, since they would not want to have to put their trust in a re-elected Obama. Another arguable incentive for Israel to make war sooner rather than later is that Syria is currently too busy with its own civil war to be of much help to Hezbollah’s war machine in Lebanon. The terrorist organization has a reported 50,000 missiles pointed at Israel, but that in itself gives Israel reason to strike Lebanon with such force that Hezbollah may think twice about starting something. Egypt is the only other military power that could conceivably do Israel harm, but that’s unthinkable because, in accordance with the treaty that binds Israel and Egypt, the U.S. would have to come to Israel’s defense.

The situation is certain to grow more tense unless Iran gives in. If they don’t, however, expect crude oil prices – and the price of gold and silver – to rise sharply in the weeks ahead.

(If you’d like to have these commentaries delivered free each day to your e-mail box, click here.)

I wanted to write the enemy of Iran but I rectify and rather the enemies of humanity must take seriously this warning from Iran, Iranian are believers in the one true God, and there is no army that can fight and win such a brave people like Iranians. Now we all know that these shaytanic people are pig headed, so just get ready and let them come. May Allah swt destroy wickedness and restore the truth and justice to this planet, ameen!